- United States

- /

- Real Estate

- /

- NasdaqCM:CHCI

Comstock Holding Companies, Inc. (NASDAQ:CHCI) Held Back By Insufficient Growth Even After Shares Climb 32%

Comstock Holding Companies, Inc. (NASDAQ:CHCI) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 36%.

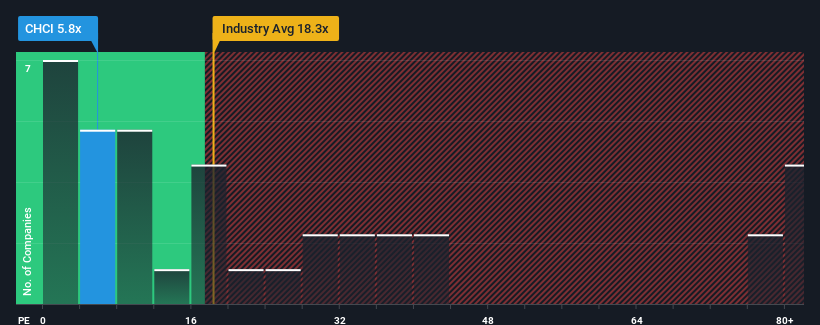

Although its price has surged higher, Comstock Holding Companies' price-to-earnings (or "P/E") ratio of 5.8x might still make it look like a strong buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 17x and even P/E's above 30x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Comstock Holding Companies certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Comstock Holding Companies

How Is Comstock Holding Companies' Growth Trending?

Comstock Holding Companies' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 83% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 26% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Comstock Holding Companies' P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Shares in Comstock Holding Companies are going to need a lot more upward momentum to get the company's P/E out of its slump. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Comstock Holding Companies revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Comstock Holding Companies (1 is potentially serious!) that you need to be mindful of.

If you're unsure about the strength of Comstock Holding Companies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CHCI

Comstock Holding Companies

Operates as a asset manager, developer, and operator of mixed-use and transit-oriented properties in the Washington, D.C.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.