- United States

- /

- Life Sciences

- /

- NYSE:WST

We Think West Pharmaceutical Services (NYSE:WST) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that West Pharmaceutical Services, Inc. (NYSE:WST) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for West Pharmaceutical Services

What Is West Pharmaceutical Services's Net Debt?

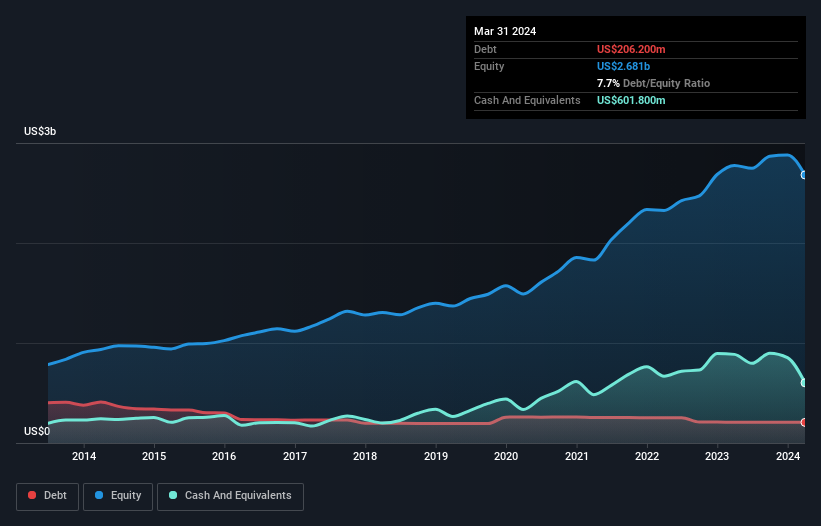

The chart below, which you can click on for greater detail, shows that West Pharmaceutical Services had US$206.2m in debt in March 2024; about the same as the year before. However, its balance sheet shows it holds US$601.8m in cash, so it actually has US$395.6m net cash.

How Strong Is West Pharmaceutical Services' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that West Pharmaceutical Services had liabilities of US$648.4m due within 12 months and liabilities of US$273.3m due beyond that. Offsetting this, it had US$601.8m in cash and US$543.9m in receivables that were due within 12 months. So it actually has US$224.0m more liquid assets than total liabilities.

This state of affairs indicates that West Pharmaceutical Services' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the US$23.6b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, West Pharmaceutical Services boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, West Pharmaceutical Services's EBIT dived 10%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine West Pharmaceutical Services's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While West Pharmaceutical Services has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, West Pharmaceutical Services produced sturdy free cash flow equating to 54% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that West Pharmaceutical Services has net cash of US$395.6m, as well as more liquid assets than liabilities. So we are not troubled with West Pharmaceutical Services's debt use. Over time, share prices tend to follow earnings per share, so if you're interested in West Pharmaceutical Services, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives