- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (TMO): Reassessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Thermo Fisher Scientific (TMO) has quietly edged higher over the past month, gaining about 3% and extending a roughly 18% climb in the past 3 months. This performance is prompting a fresh look at its valuation.

See our latest analysis for Thermo Fisher Scientific.

Zooming out, Thermo Fisher Scientific’s 11.08% year to date share price return and 11.83% total shareholder return over the past year suggest steady, rebuilding momentum as investors grow more comfortable with its growth and earnings trajectory around $580.45 per share.

If Thermo Fisher’s move has you thinking more broadly about healthcare and life sciences, this could be a good moment to explore other healthcare stocks that might fit your strategy.

With Thermo Fisher still trading below analyst targets yet already reflecting solid growth and margin gains, investors face a key question: is this a reasonable entry point, or is the market already pricing in the next leg of expansion?

Most Popular Narrative Narrative: 5.4% Undervalued

With Thermo Fisher closing at $580.45 against a most popular narrative fair value near the low $600s, the story leans modestly in favor of upside while hinging on specific growth and profitability assumptions.

Strong momentum in high impact innovation, evidenced by next generation analytical tools like the Orbitrap mass spectrometers and AI integration into drug development workflows, positions Thermo Fisher to capture incremental share as genomics and precision medicine proliferate, structurally boosting future revenues and margins.

Curious how steady mid single digit growth, rising profit margins and a richer future earnings multiple can still point to upside from here? The narrative leans on a detailed roadmap of expanding revenues, higher earnings power and a valuation profile usually reserved for sector leaders, but the exact mix of assumptions may surprise you. Want to see which long term projections actually drive that fair value gap?

Result: Fair Value of $613.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if China’s weakness persists or if academic and government funding pressures further dampen instrument and consumables demand.

Find out about the key risks to this Thermo Fisher Scientific narrative.

Another Angle on Valuation

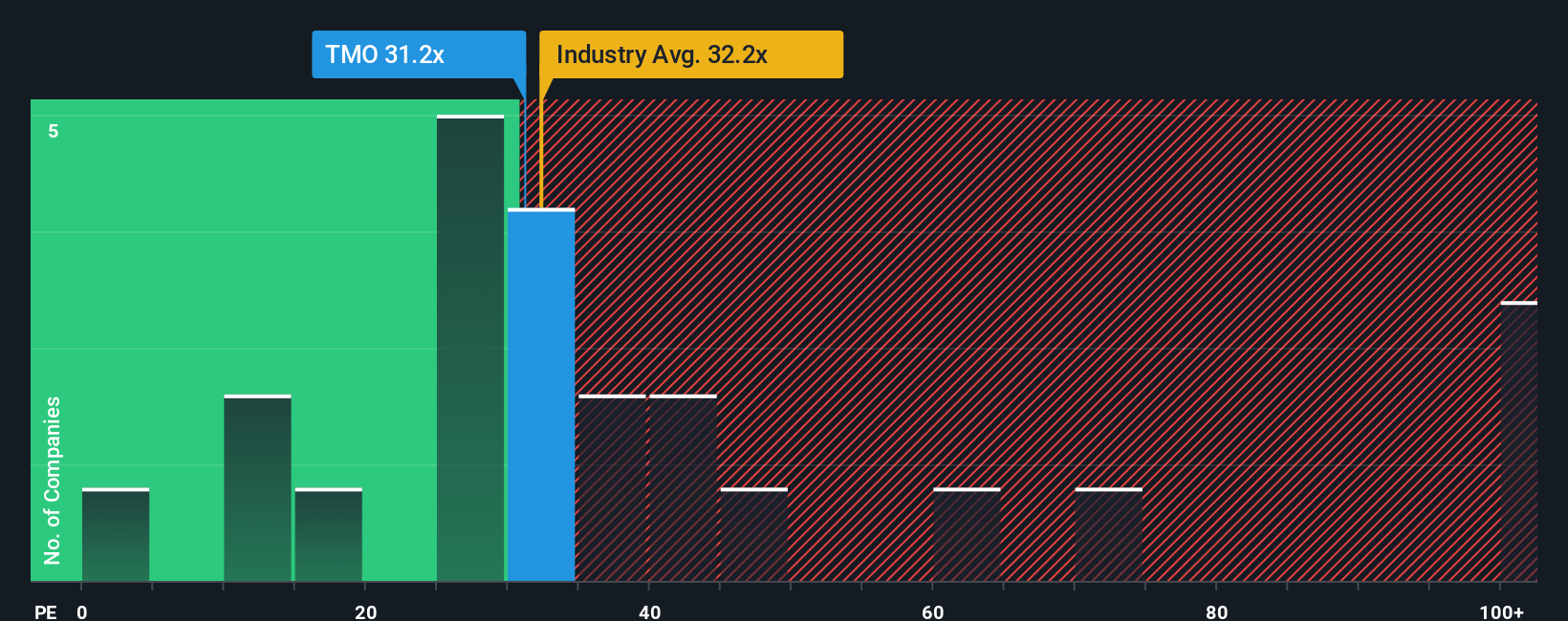

On earnings, Thermo Fisher looks a little rich, trading on a P E of 33.2 times versus a fair ratio of 30.9 times, even if it still sits below the Life Sciences industry at 37 times and peers at 35.9 times. Is that premium breathing room, or margin for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thermo Fisher Scientific Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, secure your next opportunity by using the Simply Wall St Screener to uncover high conviction stocks that could sharpen your portfolio’s edge.

- Capture potential mispricings by targeting companies trading below intrinsic value using these 915 undervalued stocks based on cash flows, and position yourself ahead of a possible rerating.

- Ride structural trends in automation and data by screening for next generation innovators with these 25 AI penny stocks, before the crowd fully catches on.

- Strengthen your income stream by focusing on reliable payers through these 14 dividend stocks with yields > 3%, and avoid missing out on compounding yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026