- United States

- /

- Life Sciences

- /

- NYSE:TMO

Is It Time To Reassess Thermo Fisher Scientific After Its Recent Share Price Pullback?

Reviewed by Bailey Pemberton

- If you are wondering whether Thermo Fisher Scientific is still a smart buy at around $563 a share, or if the easy gains are already behind it, this breakdown will help you evaluate what you might really be paying for.

- The stock is up 7.8% year to date and 5.7% over the last year, but that climb has cooled recently, with a 2.3% dip over the past month and a 3.0% slide in the last week, suggesting that market sentiment is in flux.

- Investors have been reacting to a mix of headlines around Thermo Fisher's expanding role in life sciences tools, new partnerships in biopharma services, and strategic investments in cutting edge lab technologies that position it as a long term enabler of drug discovery and diagnostics. At the same time, broader market worries about healthcare spending, regulation, and growth in research budgets have added some short term noise to the share price.

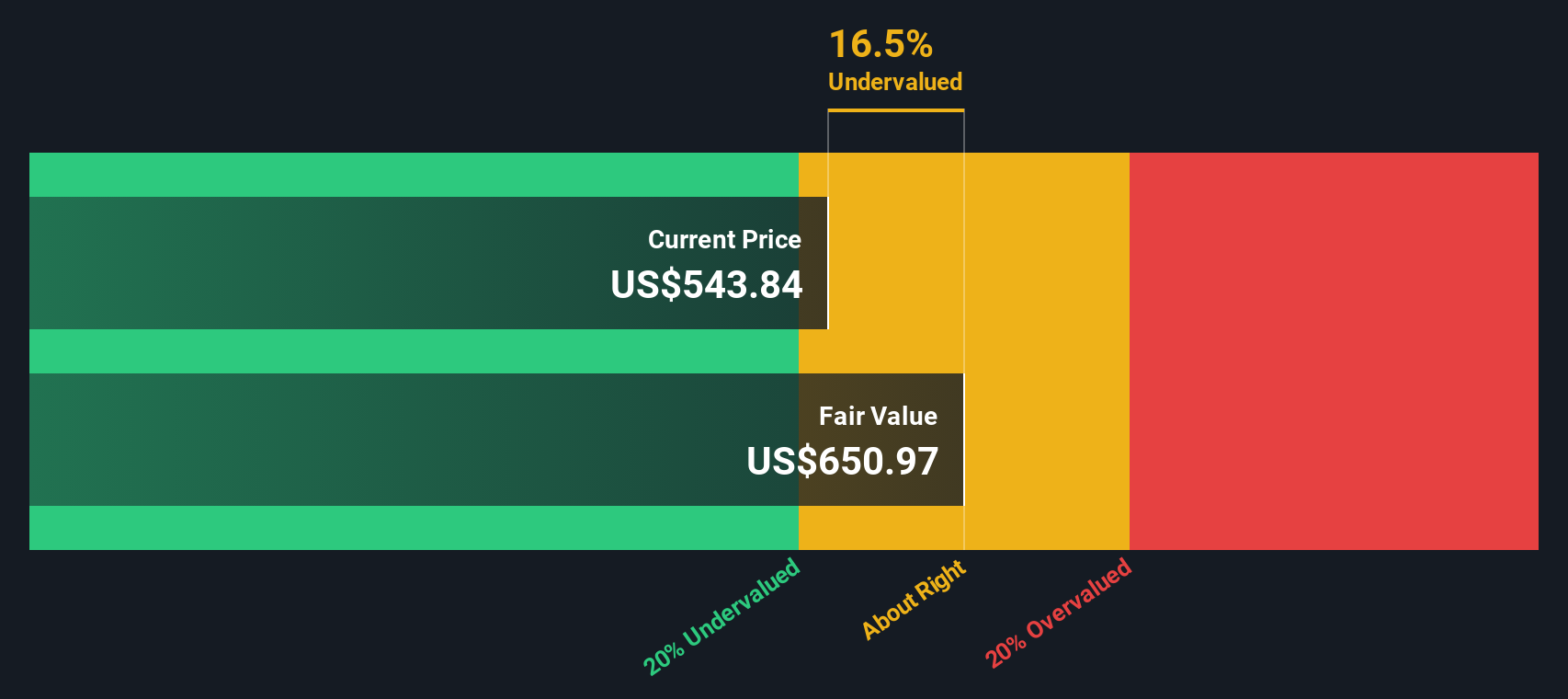

- On our framework, Thermo Fisher currently scores a 3/6 on valuation checks, reflecting that it appears undervalued on half of the six metrics we track. You can see the detailed breakdown in this valuation score. Next, we will walk through those traditional valuation approaches and, toward the end of the article, explore an additional way to understand what the stock might truly be worth.

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to a present value. For Thermo Fisher Scientific, the model is based on a 2 Stage Free Cash Flow to Equity approach, using cash flow projections in $.

The company generated roughly $6.1 billion in free cash flow over the last twelve months, and analyst estimates plus extrapolations suggest this could rise to around $15.3 billion by 2035. In the near term, projections reach about $8.6 billion in 2026 and $11.3 billion by 2029, with longer range growth tapering as the business matures.

When all those projected cash flows are discounted back to today, the DCF model arrives at an intrinsic value of about $606 per share, implying the stock is trading at roughly a 7.1% discount to fair value. That places Thermo Fisher in the slightly undervalued, rather than deeply mispriced, category.

Result: ABOUT RIGHT

Thermo Fisher Scientific is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Thermo Fisher Scientific Price vs Earnings

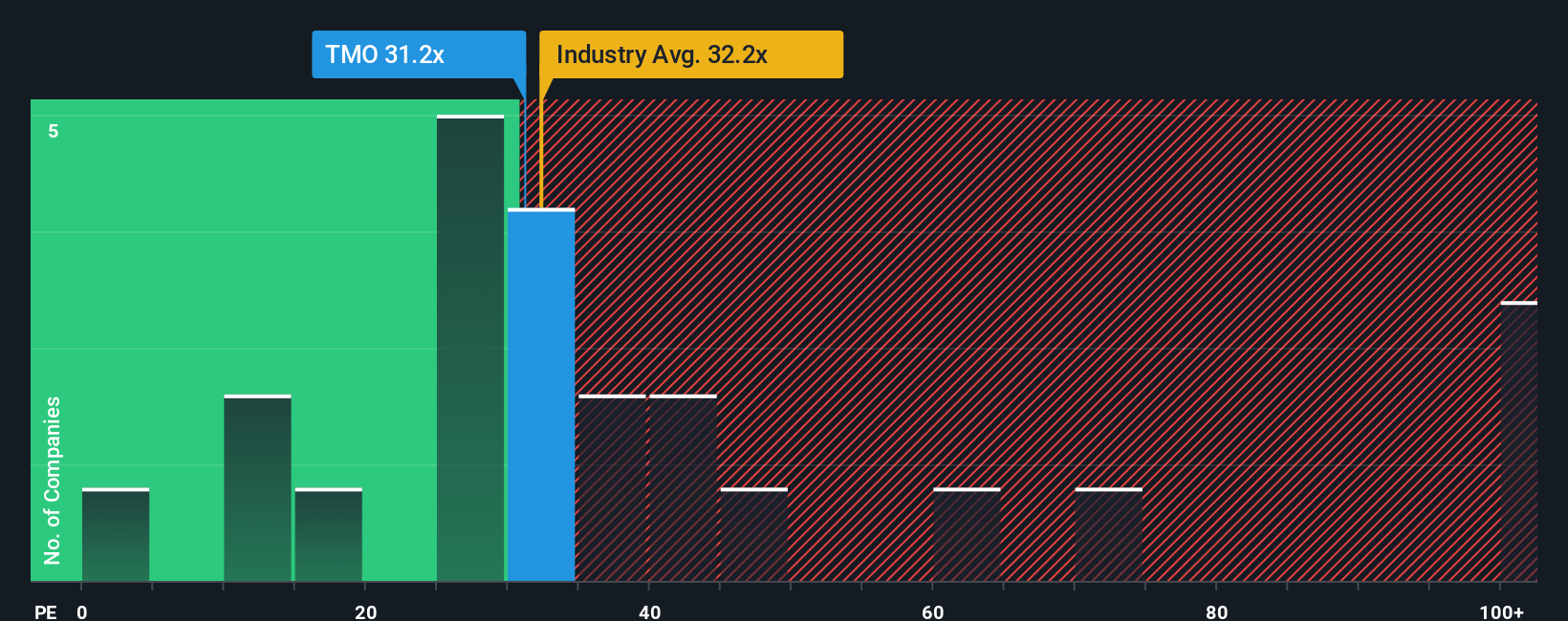

For profitable, established companies like Thermo Fisher Scientific, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current profits. A higher PE can be justified when a business is expected to grow faster or is seen as lower risk, while slower growth or higher uncertainty usually warrants a lower, more conservative multiple.

Thermo Fisher currently trades on about 32.2x earnings, slightly below both the Life Sciences industry average of roughly 34.1x and the broader peer group at around 34.5x. Simply Wall St also calculates a Fair Ratio of 30.8x for Thermo Fisher, which represents the PE level that would typically make sense given its earnings growth profile, margins, industry position, market cap and risk factors.

This Fair Ratio is more tailored than a simple peer or industry comparison, because it adjusts for company specific fundamentals rather than assuming all Life Sciences stocks deserve the same multiple. With Thermo Fisher’s actual PE of 32.2x sitting modestly above the 30.8x Fair Ratio, the shares look slightly expensive on this metric, but not dramatically so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you connect your view of Thermo Fisher Scientific’s story to concrete numbers. You do this by choosing assumptions for its future revenue, earnings and margins, turning those into a dynamic financial forecast and fair value that updates as new news or earnings arrive. You can then compare that fair value to today’s price to decide whether it looks like a buy or a sell. This is why some investors currently set a more cautious Narrative with fair value around $540 per share, while others, using more optimistic assumptions, land closer to $626, reflecting different but equally structured perspectives on the same company.

For Thermo Fisher Scientific however we will make it really easy for you with previews of two leading Thermo Fisher Scientific Narratives:

🐂 Thermo Fisher Scientific Bull Case

Fair value: $626 per share

Implied undervaluation vs current price: about 10.1%

Revenue growth assumption: 5.22%

- Sees Thermo Fisher as a life science leader, using innovation, AI enabled efficiency and strategic M&A to support steady earnings and margin expansion.

- Assumes resilient demand from pharma and biotech manufacturing, precision diagnostics and end to end lab services will compound revenue and returns over time.

- Flags risks from funding uncertainty, China exposure, margin headwinds and leadership transition, but still concludes fair value is above the current share price.

🐻 Thermo Fisher Scientific Bear Case

Fair value: $540 per share

Implied overvaluation vs current price: about 4.3%

Revenue growth assumption: 7.0%

- Recognizes strong structural demand for life science tools, diagnostics and CDMO services, supported by AI, automation and a growing R&D spend base.

- Expects 7 to 10% annual revenue growth and margin improvement to 16 to 18%, but sees that strength as largely reflected in the current valuation.

- Highlights downside risks from slower R&D funding, regulatory changes, M&A execution missteps and cyclicality in biotech funding that could cap returns from here.

Do you think there's more to the story for Thermo Fisher Scientific? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026