- United States

- /

- Pharma

- /

- NYSE:TEVA

The Possible Reason why Teva (NYSE:TEVA) is Still Trading Below Intrinsic Value

Teva Pharmaceutical Industries Limited (NYSE:TEVA) seems to be undervalued on a fundamental basis. However, sometimes stocks are trading below intrinsic value because there are factors external to the current money making capacity of the company. We will examine what can be the cause and the extent of the risk for investing in Teva. We will start our analysis with the balance sheet and long term debt.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet.

When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Teva Pharmaceutical Industries

What Is Teva Pharmaceutical Industries's Net Debt?

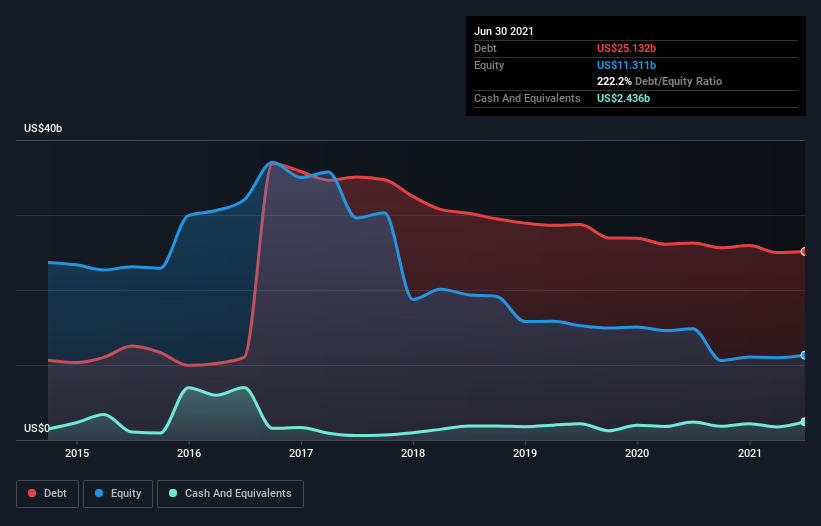

You can click the graphic below for the historical numbers, but it shows that Teva Pharmaceutical Industries had US$25.1b of debt in June 2021, down from US$26.3b, one year before. On the flip side, it has US$2.44b in cash leading to net debt of about US$22.7b.

We can also see that the debt level has been slowly declining over the past few years, this is in-line with the long term strategy of management to stabilize the company and bring down the cost of debt and equity financing.

How Healthy Is Teva Pharmaceutical Industries' Balance Sheet?

The latest balance sheet data shows that Teva Pharmaceutical Industries had liabilities of US$12.7b due within a year, and liabilities of US$25.2b falling due after that. Offsetting these obligations, it had cash of US$2.44b as well as receivables valued at US$4.49b due within 12 months. So, its liabilities total US$31.0b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$9.87b company. So we'd watch its balance sheet closely, without a doubt. After all, Teva Pharmaceutical Industries would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With a net debt to EBITDA ratio of 5.1, it's fair to say Teva Pharmaceutical Industries does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 3.1 times, suggesting it can responsibly service its obligations.

The balance sheet is clearly the area to focus on when you are analyzing debt. But ultimately the future profitability of the business will decide if Teva Pharmaceutical Industries can strengthen its balance sheet over time. So if you're focused on the future, you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Teva Pharmaceutical Industries created free cash flow amounting to 9.8% of its EBIT, an uninspiring performance. That low level of cash conversion undermines its ability to manage and pay down debt.

Risk Factors and Debt Pressures

Teva is involved in multiple court cases as a defendant, with a wide-ranging variety of allegations (page 25). Some allegations against Teva include: patent infringements, antitrust, product liability, price fixing, customer allocation, market share allocation, improper marketing and distribution of opioids, shareholder litigation, false Medicare claims, release of hazardous substances and natural resource damages.

When adding the possibility of additional financial distress caused by negative outcome of the pending cases, it becomes clearer why investors may be reluctant to invest in Teva.

These cases may drag on for some time, and even though the company is making efforts to arrange strategic settlements to some cases, the wide range of possible outcomes increases the risk for the company.

If these cases should result in negative outcomes, the company may need to further increase leverage in order to pay for damages. This can further increase their cost of equity and cost of debt. Currently, their cost of debt is impacted by their corporate bond rating of Ba2/BB-, which is below investment grade.

Key Takeaways

If we were to only consider the fundamentals and current level of debt, Teva is definitely trading below its fair value. However, we now see the possible risks which are driving institutional investors away from the company.

Teva's ongoing court cases leave a lot of room for uncertainty regarding the company's ability to generate cashflows in excess of the risks. That is why we should keep in mind that even though the fundamentals are good, a lack of certainty may be putting pressure on the stock price.

On the flip side, if the company secures favorable settlements and continues paying off debt, stockholders might be in for a large upside - barring, of course, any future risky litigation.

These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Teva Pharmaceutical Industries you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you're looking to trade Teva Pharmaceutical Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives