- United States

- /

- Pharma

- /

- NYSE:TEVA

Teva Pharmaceutical Industries Limited (NYSE:TEVA) Stock Catapults 27% Though Its Price And Business Still Lag The Industry

The Teva Pharmaceutical Industries Limited (NYSE:TEVA) share price has done very well over the last month, posting an excellent gain of 27%. The last month tops off a massive increase of 109% in the last year.

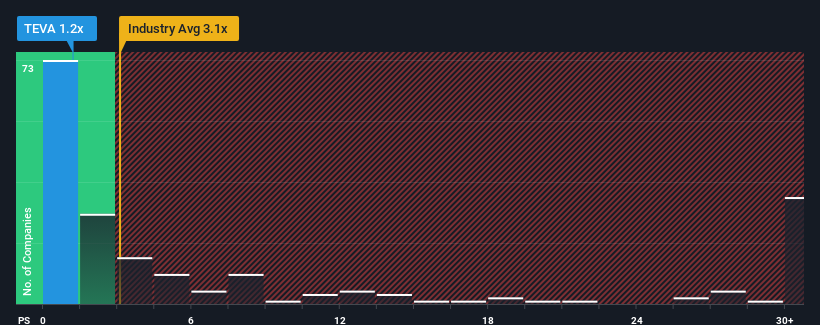

Although its price has surged higher, Teva Pharmaceutical Industries' price-to-sales (or "P/S") ratio of 1.2x might still make it look like a buy right now compared to the Pharmaceuticals industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 13x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Teva Pharmaceutical Industries

How Teva Pharmaceutical Industries Has Been Performing

With revenue growth that's inferior to most other companies of late, Teva Pharmaceutical Industries has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Teva Pharmaceutical Industries.How Is Teva Pharmaceutical Industries' Revenue Growth Trending?

Teva Pharmaceutical Industries' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 1.7% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.0% each year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 19% each year, which is noticeably more attractive.

In light of this, it's understandable that Teva Pharmaceutical Industries' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

The latest share price surge wasn't enough to lift Teva Pharmaceutical Industries' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Teva Pharmaceutical Industries' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Teva Pharmaceutical Industries with six simple checks.

If you're unsure about the strength of Teva Pharmaceutical Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives