- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Revvity (RVTY): A Fresh Look at Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Revvity.

While Revvity’s 1-month share price return of nearly 10% stands out as a positive shift, momentum follows a difficult year with a total shareholder return down almost 20%. Overall, short-term gains are encouraging but still play catch-up given recent underperformance.

If this recent uptick has you curious about broader opportunities, now is the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares boasting a nearly 30% discount to intrinsic value estimates and analysts remaining upbeat, the question for investors is clear: does Revvity represent a genuine buying opportunity, or is the market already factoring in future growth?

Most Popular Narrative: 15.4% Undervalued

With Revvity’s last close at $95.31 and the most-followed narrative assigning a fair value that's notably higher, the stage is set for an intriguing valuation debate. Investors are weighing significant future growth potential against risks and shifting expectations.

Ongoing shift in product mix toward higher-margin, software-enabled and consumables-driven offerings (e.g., SaaS Signals, reagents, new IDS i20 platform), along with structural cost actions, are expected to materially expand operating and net margins. The 2026 outlook anticipates a higher 28% operating margin baseline.

Want the full growth playbook that underpins this compelling price target? Discover which ambitious margin projections and major business pivots are factored into the narrative’s fair value. There’s more beneath the surface than you might expect.

Result: Fair Value of $112.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes in China and slower-than-expected recovery across key end markets could quickly challenge these optimistic assumptions.

Find out about the key risks to this Revvity narrative.

Another View: Multiples Tell a Different Story

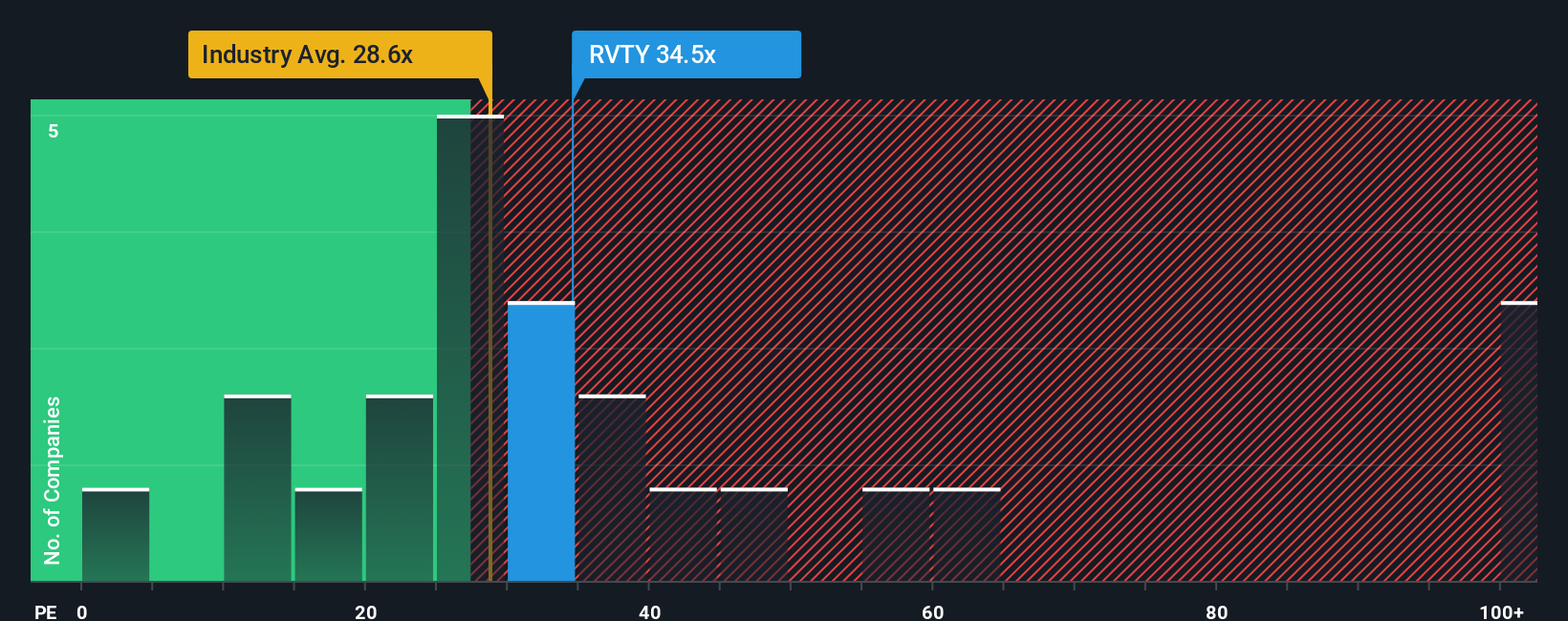

While discounted cash flow points to Revvity as undervalued, its current price-to-earnings ratio of 39.7 is quite high relative to the industry average of 33 and well above the market-implied fair ratio of 22.3. This premium suggests investors are willing to pay up, but does it increase valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revvity Narrative

If you have a different perspective or want to dig deeper into Revvity's fundamentals, you can build your own investment narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Revvity.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Don’t miss your chance to uncover winning stocks tailored to your interests and financial goals using these powerful tools:

- Unlock fresh profit potential by tapping into these 873 undervalued stocks based on cash flows that are priced below their true worth, before the market catches up.

- Get ahead of massive growth trends by targeting future leaders among these 24 AI penny stocks revolutionizing industries with artificial intelligence.

- Boost income from your portfolio by selecting these 17 dividend stocks with yields > 3% delivering high yields and strong fundamentals for lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVTY

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives