- United States

- /

- Biotech

- /

- NYSE:RCUS

Arcus Biosciences (RCUS) Is Up 11.6% After Promising Renal Cancer Data and Pipeline Expansion Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- On October 6, 2025, Arcus Biosciences presented updated results from its ARC-20 Phase 1/1b study, showing that casdatifan as a monotherapy achieved a 31% confirmed overall response rate and a median progression-free survival of 12.2 months in heavily pretreated metastatic clear cell renal cell carcinoma patients, with a manageable safety profile.

- Alongside these results, the company announced five new research programs in autoimmune and inflammatory diseases, reflecting an expansion of its focus beyond oncology that could broaden future revenue streams.

- We'll examine how the positive efficacy and pipeline expansion highlighted in this update may influence Arcus Biosciences' investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Arcus Biosciences Investment Narrative Recap

The core investment idea with Arcus Biosciences centers on casdatifan's ability to establish a meaningful clinical and commercial foothold in late-line metastatic renal cell carcinoma, and how pipeline expansion efforts may drive growth into new therapeutic areas. The latest ARC-20 data further supports casdatifan’s efficacy and manageable safety profile, but the top short-term catalyst remains regulatory progress on pivotal late-stage studies, progress which this readout reinforces, while the biggest business risk continues to be regulatory delays that could postpone revenue and affect cash runway assumptions.

Among recent announcements, the August launch of the PEAK-1 Phase 3 study for casdatifan in combination with cabozantinib stands out, as it directly relates to the advancement of Arcus’s leading asset and underpins expectations for major upcoming efficacy results. These clinical milestones, if successful, would be key to shifting Arcus’s narrative from promising data to meaningful market position.

However, in contrast to the latest clinical excitement, investors should be aware that regulatory uncertainties could still threaten...

Read the full narrative on Arcus Biosciences (it's free!)

Arcus Biosciences' narrative projects $327.1 million revenue and $52.5 million earnings by 2028. This requires 7.7% yearly revenue growth and an increase in earnings of $350.5 million from the current -$298.0 million.

Uncover how Arcus Biosciences' forecasts yield a $29.91 fair value, a 99% upside to its current price.

Exploring Other Perspectives

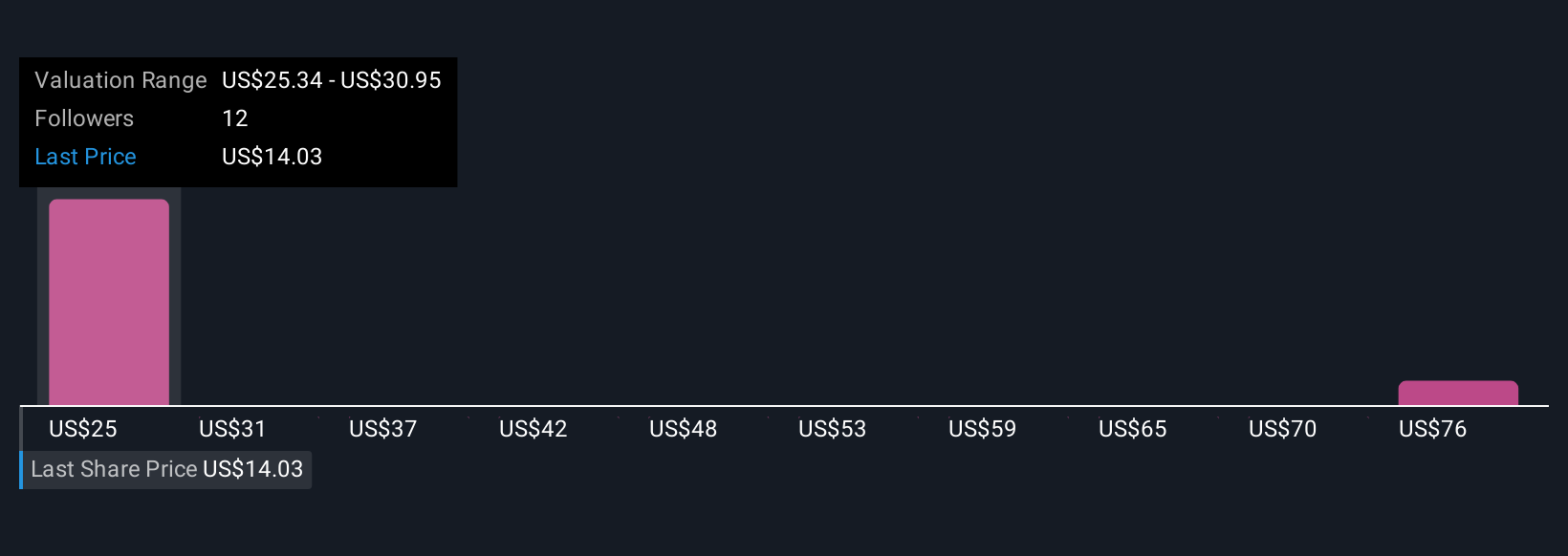

Simply Wall St Community members place fair value for Arcus Biosciences stock between US$25.34 and US$81.45, based on three independent forecasts. While optimism around the casdatifan pipeline is growing, regulatory concerns continue to shape near-term expectations for the business and its potential market access.

Explore 3 other fair value estimates on Arcus Biosciences - why the stock might be worth just $25.34!

Build Your Own Arcus Biosciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcus Biosciences research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arcus Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcus Biosciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCUS

Arcus Biosciences

A clinical-stage biopharmaceutical company, develops and commercializes cancer therapies in the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives