- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (NYSE:PFE) Gets CDC Recommendation to Expand ABRYSVO Vaccine Use for RSV Prevention

Reviewed by Simply Wall St

Pfizer (NYSE:PFE) recently received a CDC recommendation for wider use of its RSV vaccine, ABRYSVO, in adults aged 50-59 at increased risk. Despite this positive development, Pfizer's shares saw a 2% decline over the past week. This move is in line with broader market trends, as the market dropped by 3% during the same period. The company's decision to halt development of Danuglipron, an oral weight loss drug, due to safety concerns, may have also added weight to the downward pressure on its shares, amid wider concerns impacting the healthcare sector and investor sentiment surrounding safety in drug development.

Pfizer has 3 possible red flags (and 2 which shouldn't be ignored) we think you should know about.

The recent CDC recommendation for Pfizer's RSV vaccine, ABRYSVO, is a promising development that could positively impact the company's revenue and earnings forecasts; however, the decision to halt development of the Danuglipron weight loss drug amplifies concerns over safety in drug development. This mix of news, coupled with Pfizer's shift towards enhancing R&D productivity, could moderate future growth expectations as ongoing savings measures aim to boost margins. Investors might anticipate a measured but cautious optimism as outcomes of these initiatives unfold.

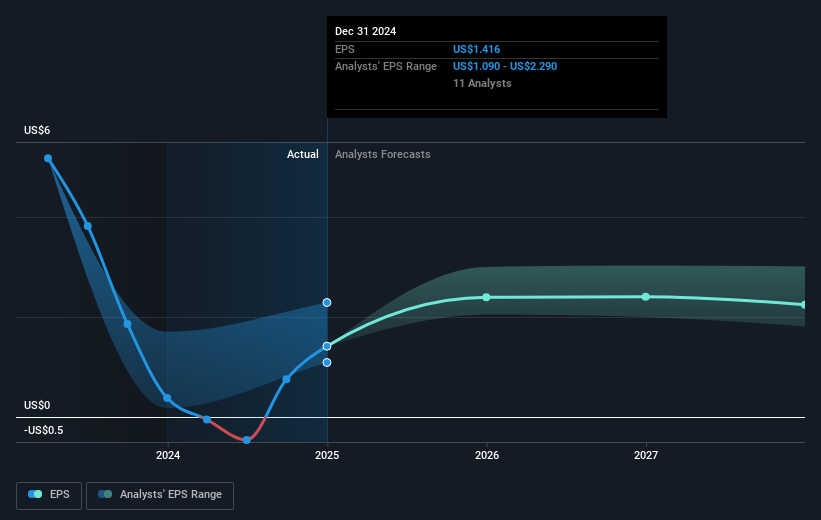

Over the past year, Pfizer's total shareholder return stands at a 7.86% decline, underperforming the broader US market, which posted a 4.6% gain. Compared to the US Pharmaceuticals industry, which experienced an 8% decrease, Pfizer also lagged slightly. The price movement aligns somewhat with the bears' price target of $25.56, which remains 13.8% above the current share price of $22.04, indicating some market skepticism about reaching consensus targets of $30.45. As Pfizer faces pressures from legislative changes impacting revenue, careful monitoring of pipeline developments and cost strategies will be crucial to adapting earnings forecasts going forward.

Our valuation report here indicates Pfizer may be undervalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pfizer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives