- United States

- /

- Pharma

- /

- NYSE:PFE

How the Drug-Pricing Deal and a 10.8% Surge Are Shaping Pfizer's 2025 Outlook

Reviewed by Bailey Pemberton

If you have been weighing whether to buy, hold, or sell Pfizer right now, you are not alone. The company’s shares have seen some ups and downs that can leave even experienced investors second-guessing their moves. Over the past week, Pfizer jumped an impressive 10.8%. This bounce comes after months of cautious sentiment, with the stock still down 0.7% for the year and off 25.4% from where it stood three years ago. News of the finalized drug-pricing deal and ongoing policy discussions in Washington seem to have shifted the market’s mood, as investors reassess the risks and the rewards of owning such a major pharmaceutical name.

With a recent close at $26.43, Pfizer is certainly grabbing attention from value-conscious investors. The company comes through five out of six key undervaluation tests with flying colors, giving it a strong value score of 5. That makes it worth a closer look: Is the stock a genuine bargain, or are there deeper issues at play that the usual metrics might miss?

Let’s dig into the various valuation methods and see how Pfizer stacks up. Plus, stick around for an even smarter way to think about what this company is really worth.

Why Pfizer is lagging behind its peers

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation method that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's dollars. This approach helps investors see what a business might be worth based on its ability to generate cash well into the future.

For Pfizer, analysts estimate that the company generated $12.03 billion in Free Cash Flow (FCF) over the last twelve months. Looking ahead, consensus projections see FCF steadily growing, reaching approximately $16.85 billion annually by 2029. While analyst forecasts typically extend only five years, Simply Wall St extrapolates these further out to create a full ten-year roadmap for the company's cash generation in dollars.

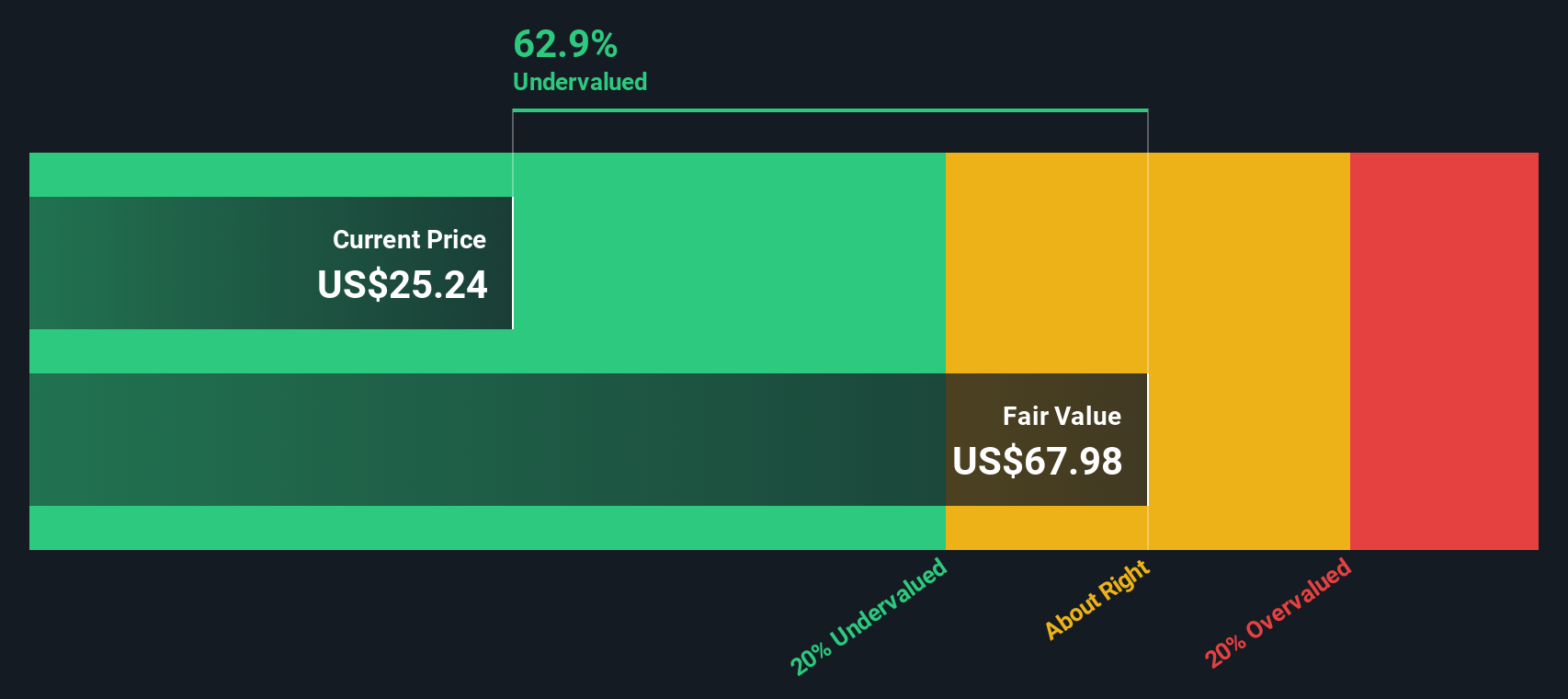

Based on these projections, the DCF model calculates an estimated intrinsic value for Pfizer shares at $67.98. With shares recently closing at $26.43, this analysis suggests the stock is trading at a 61.1% discount to its fair value. In other words, the market price implies a far more pessimistic outlook for Pfizer than the projections suggest.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 61.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pfizer Price vs Earnings

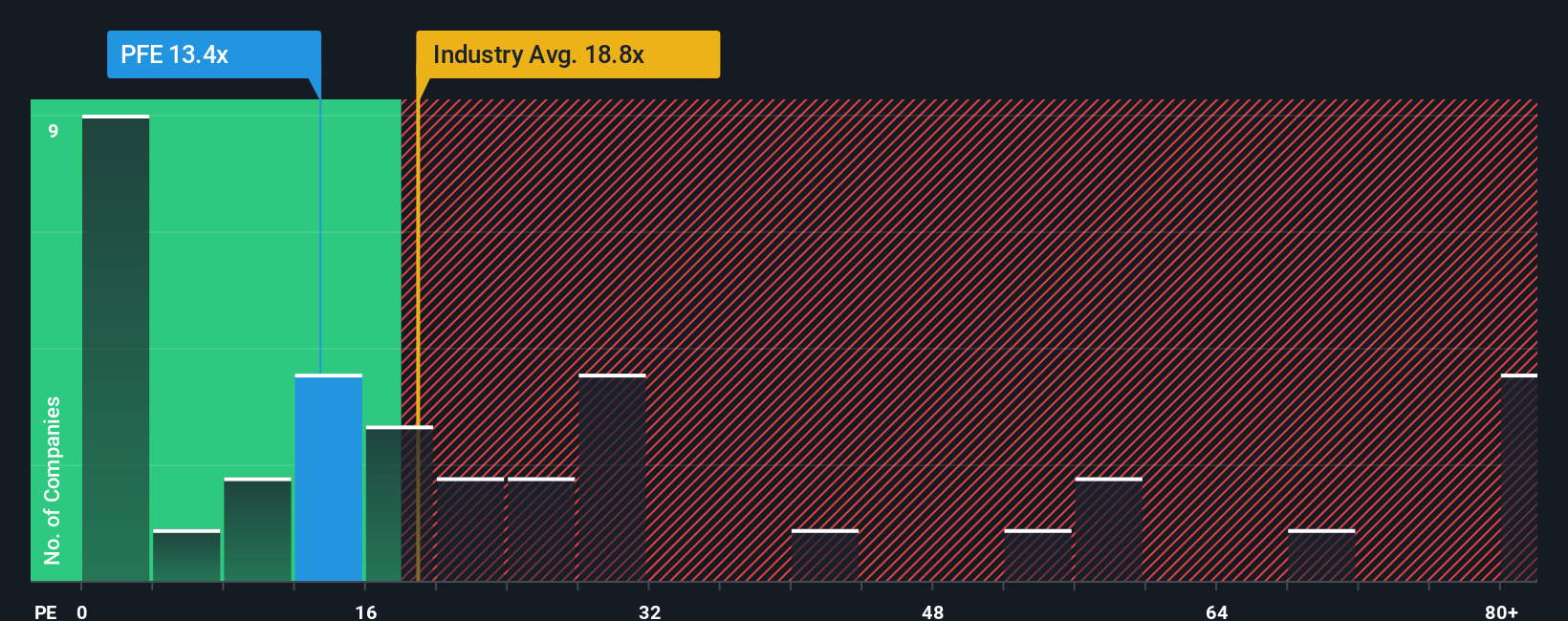

The Price-to-Earnings (PE) ratio is a popular way to assess whether a profitable company like Pfizer is fairly valued by the market. For established firms, the PE ratio answers the question, "How much are investors willing to pay today for a dollar of yesterday's earnings?" It is especially suitable for companies with consistent profits and clear earnings history, making it a go-to tool for quick comparison among peers.

What counts as a “normal” or “fair” PE ratio can shift quite a bit, depending on expected earnings growth and perceived risk. Fast-growing companies, or those seen as less risky, tend to warrant higher PE ratios. Stagnant or riskier firms often command lower multiples.

Pfizer's current PE sits at 14x, noticeably below both the industry average of 19.2x and the peer average of 19.1x. This might initially suggest undervaluation compared to other major pharmaceutical names. However, there is more nuance to consider. Simply Wall St’s “Fair Ratio” is a proprietary metric that estimates what a reasonable PE for Pfizer should be, based on company-specific factors such as earnings growth prospects, profit margins, industry trends, market capitalization, and unique risks. For Pfizer, the Fair Ratio is calculated at 22.5x.

Unlike simple peer or industry comparisons, the Fair Ratio approach provides a more holistic sense of valuation. It combines Pfizer’s own strengths and weaknesses with broader market dynamics, helping you decide whether the current price truly reflects its future earning power and risk profile.

With Pfizer trading at 14x against a Fair Ratio of 22.5x, the stock appears meaningfully undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just a number; it is your personal story about what you believe is happening at a company like Pfizer, woven together with your financial expectations for the future, such as your estimates of revenue growth, profit margins, and what those are worth today.

With Narratives, you connect the company's story (why Pfizer might outperform, face headwinds, or steadily deliver) directly to an explicit financial forecast. This allows you to determine a fair value you can actually compare to the current share price. Narratives are easy to use on Simply Wall St’s Community page, where millions of investors share perspectives and continually update their outlooks as new information arrives, whether that is a surprise earnings update, fresh regulation, or a scientific breakthrough.

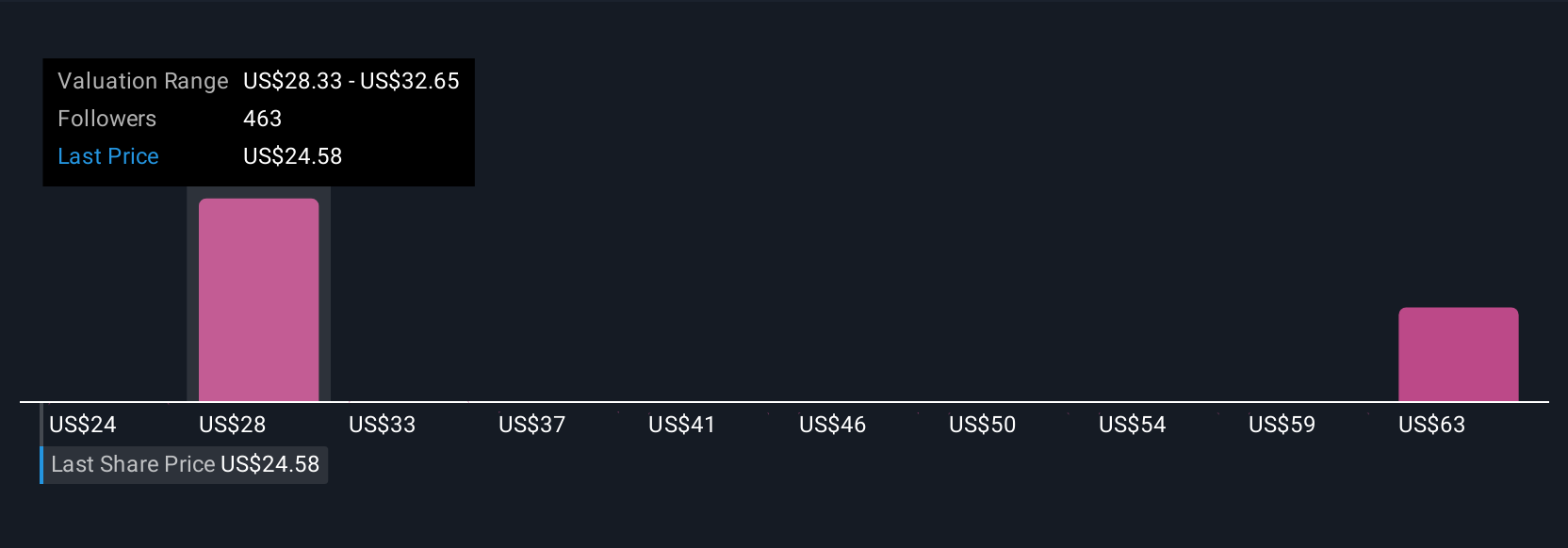

By building and following Narratives, you can decide when to buy or sell Pfizer by seeing how your Fair Value stacks up against the latest market price. For example, some investors set Pfizer's fair value as high as $35.77 by expecting breakthrough oncology growth and rapid margin expansion, while others see it closer to $24.00 based on tough industry regulation and slower revenue. Narratives let you test, refine, and visualize your unique perspective, connecting your view of the story directly to an actionable investment decision, all in real time.

For Pfizer, we'll make it really easy for you with previews of two leading Pfizer Narratives:

Fair Value: $28.86

The current price is 8.44% below this value.

Expected annual revenue growth: -2.25%

- Expansion in innovative therapies, a focus on biologics, and strategic business development are intended to deliver long-term growth and resilience despite patent expirations and industry pressures.

- Growth in emerging markets and operational improvements through digitalization are expected to broaden revenue opportunities and bolster margins, helping to offset headwinds in established markets.

- Analysts see a consensus price target of $28.86, which is 14.4% above the current share price, based on improving earnings and profit margins over the next three years.

Fair Value: $24.00

The current price is 10.13% above this value.

Expected annual revenue growth: -4.21%

- Intensifying drug pricing negotiations, regulatory reforms, and patent expirations threaten to constrain Pfizer’s revenue growth and compress margins, especially as exclusivity on key products expires.

- Heavy dependence on new R&D assets to offset a shrinking legacy portfolio presents risk, as innovation may not keep pace with revenue loss and increased competition from generics and biosimilars.

- The bearish price target of $24.00 is slightly below the current price, indicating that from a conservative standpoint, Pfizer may be fairly valued given anticipated revenue decline and regulatory hurdles.

Do you think there's more to the story for Pfizer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives