- United States

- /

- Pharma

- /

- NYSE:PFE

Even with Vaccine Success, Pfizer (NYSE:PFE) Returns are Lagging the Broad Market

There are but few corners of the Earth that the brand power of Pfizer Inc. (NYSE: PFE) didn't reach in recent times, as a pharmaceutical giant made the best out of one of the more peculiar moments in recent history.

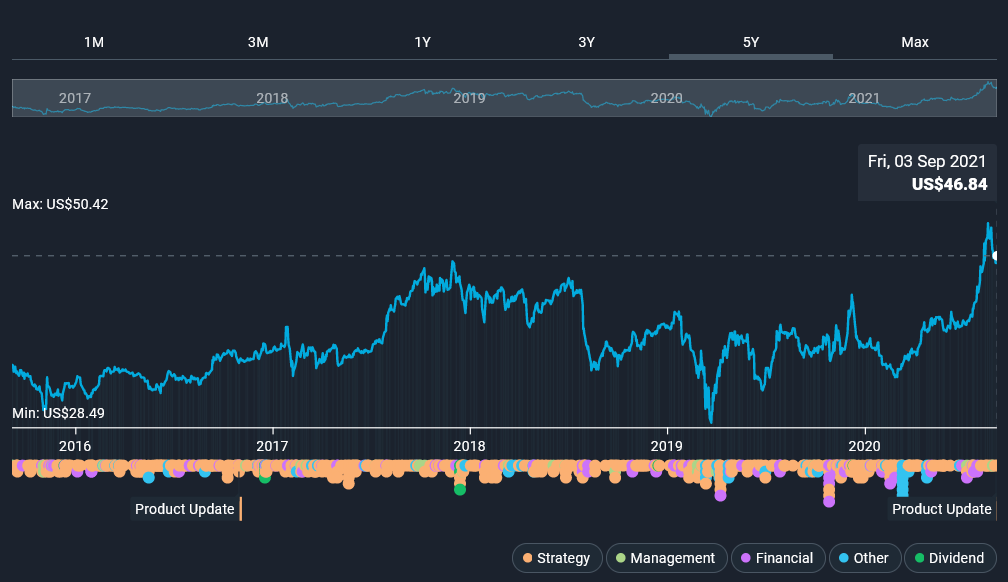

This article will examine the latest developments and look at the total shareholder returns stretching back the last 5 years.

The origin of quarantine

In October 1347, the bubonic plague arrived in Sicily, but it took 4 more months to make landfall in continental Europe, starting one of the worst pandemics in known history that wiped out one-third of Europe.

Trading centers, like Venice, were particularly vulnerable, so the Venetian government took advantage of their archipelago, setting the 2 outer islands as a transition zone. This is where the ships coming from places experiencing the plague or those with sick or suspected sick crew members had to anchor. The government set this at 40 (quaranta) days, thus creating the word quarantine.

Latest Developments

FDA fully approved the vaccine developed by Pfizer and Biotech. This outcome doesn't surprise after their vaccine was the first to receive the emergency use authorization back in December 2020.

Meanwhile, the company proceeds with Phase 2/3 of the clinical trial for PF-07321332, an oral drug for the treatment of non-hospitalized symptomatic patients. The drug aims to become a second drug with the FDA approval as the antiviral treatment, after remdesivir from Gilead Sciences (NASDAQ: GILD).

Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases (NIAID), said that he expects the full treatment by Pfizer/BioNTech and Moderna (NASDAQ: MRNA) to become 3 doses, instead of 2. FDA advisory board will discuss booster vaccinations in a meeting scheduled for September 17.

See our latest analysis for Pfizer.

Examining the Return

While share price is up 37% in the last five years, that's less than the market return. However, more recent buyers have seen an increase of 29% over the last year.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long-term performance or if there are some discrepancies.

One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price. Pfizer achieved compound earnings per share (EPS) growth of 14% per year during five years of share price growth. The EPS growth is more impressive than the yearly share price gain of 7% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

The company's earnings per share (over time) are depicted in the image below (click to see the exact numbers).

We know that Pfizer has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you determine if the EPS growth can be sustained.

The Dividend

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a complete picture for stocks that pay a dividend.

For Pfizer, the TSR over the last 5 years was 75%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

Party Like it is 1347

It's good to see that Pfizer has rewarded shareholders with a total shareholder return of 42% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 12%.

Thus, bringing us to the largest problem, if we examine the stock chart, we can see that it was quite uneventful and range-bound until the vaccine news catalyst propelled it upwards. With the forward guidance estimating vaccine revenues to be 42%, the odds of repeating the medium-term outperformance are not great - especially if the COVID-19 pandemic doesn't drag on or competitors do not roll out their solutions.

To understand Pfizer better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Pfizer (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

For those who like to find winning investments this free list of growing companies with recent insider purchasing could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion