- United States

- /

- Pharma

- /

- NYSE:PFE

Does PADCEV Keytruda Bladder Cancer Win Reshape The Bull Case For Pfizer (PFE)?

Reviewed by Sasha Jovanovic

- Pfizer and Astellas previously announced that the FDA approved PADCEV (enfortumab vedotin-ejfv) plus Keytruda as a perioperative treatment for cisplatin-ineligible adults with muscle-invasive bladder cancer, based on Phase 3 EV-303 data showing strong gains in event-free and overall survival versus surgery alone.

- This decision strengthens Pfizer’s oncology franchise by moving an advanced antibody-drug conjugate and immunotherapy combination into an earlier, curative-intent setting for high-risk bladder cancer patients.

- We’ll now examine how this earlier-line PADCEV/Keytruda approval fits into Pfizer’s investment narrative built around oncology and innovative biologics.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Pfizer Investment Narrative Recap

To own Pfizer today, you need to believe its pivot toward oncology, complex biologics, and obesity treatments can offset patent expirations, pricing pressure, and high debt. The new perioperative PADCEV/Keytruda approval reinforces oncology as the key catalyst in the near term, while policy and pricing reform, plus the coming patent cliff, remain the biggest overhangs. This approval helps the story, but it does not remove execution or regulatory risk.

Among recent announcements, Citi’s “Neutral” rating and US$26 price target highlight how balanced expectations already are around Pfizer’s turnaround efforts. That external view frames the PADCEV/Keytruda news as one more proof point for the oncology thesis rather than a reset of the investment case, especially as investors also weigh the Metsera acquisition, cost-cutting plans, and elevated dividend against earnings dilution and leverage.

Yet while the oncology wins are encouraging, investors should also be aware of how aggressive global drug pricing reforms could...

Read the full narrative on Pfizer (it's free!)

Pfizer’s narrative projects $59.6 billion in revenue and $12.8 billion in earnings by 2028.

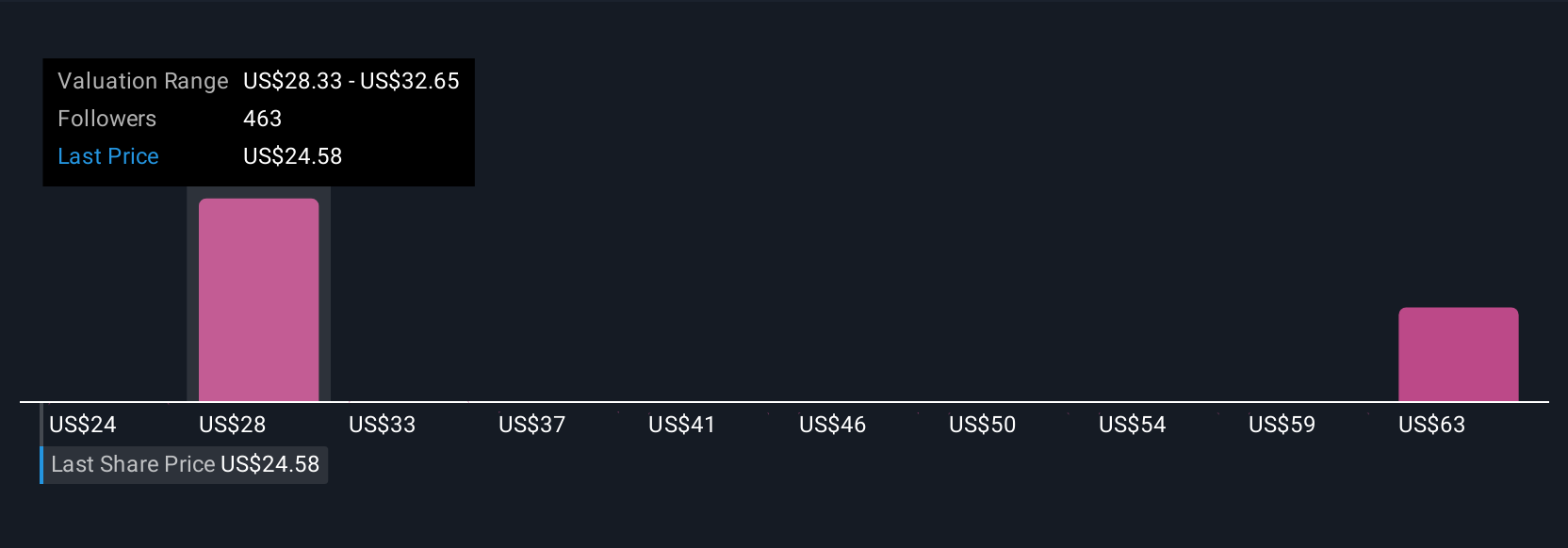

Uncover how Pfizer's forecasts yield a $29.08 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Some of the lowest estimate analysts were already modeling revenue slipping to about US$56.1 billion and earnings of roughly US$11.8 billion by 2028, so if you are worried that new R&D assets might not fully replace aging blockbusters, this PADCEV/Keytruda win could either soften that concern or simply be one bright spot in a tougher overall view.

Explore 34 other fair value estimates on Pfizer - why the stock might be worth over 2x more than the current price!

Build Your Own Pfizer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pfizer research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pfizer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pfizer's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026