- United States

- /

- Pharma

- /

- NYSE:OGN

Will Shifting Analyst Sentiment on Organon (OGN) Signal a New Phase for Its Investment Thesis?

Reviewed by Sasha Jovanovic

- In recent weeks, Organon has captured investor attention as the company prepares for its upcoming earnings release, which is projected to show year-over-year growth amid notable changes in analyst sentiment and valuation metrics.

- This heightened focus on Organon's earnings potential highlights the market's sensitivity to evolving analyst estimates and expectations for future financial performance.

- We'll examine how anticipation over Organon's upcoming earnings release and analyst estimate shifts may reshape its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Organon Investment Narrative Recap

To invest in Organon, a shareholder would need to believe in the company’s ability to translate its expanding portfolio in women’s health and biosimilars into sustainable growth, despite revenue pressure from legacy products. The recent uptick in share price and positive market reaction to anticipated year-over-year earnings growth may boost confidence in the upcoming earnings report as an immediate catalyst, though the company’s vulnerability to generic competition and mature product exposure remains a structural risk that is largely unaffected by this specific news event.

Organon’s recent FDA approval for BILDYOS® and BILPREVDA®, biosimilar versions of denosumab, stands out as a material development, given the rising interest in biosimilars as a potential revenue stream. This aligns with the current investment narrative, positioning Organon to offset the anticipated drag from legacy products and shifting market dynamics, which could play a role in future earnings results.

But with pressure on legacy brands and ongoing pricing challenges, one factor investors should not overlook is…

Read the full narrative on Organon (it's free!)

Organon's outlook anticipates $6.5 billion in revenue and $990.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 1.2% and an earnings increase of $290.3 million from current earnings of $700.0 million.

Uncover how Organon's forecasts yield a $13.17 fair value, a 20% upside to its current price.

Exploring Other Perspectives

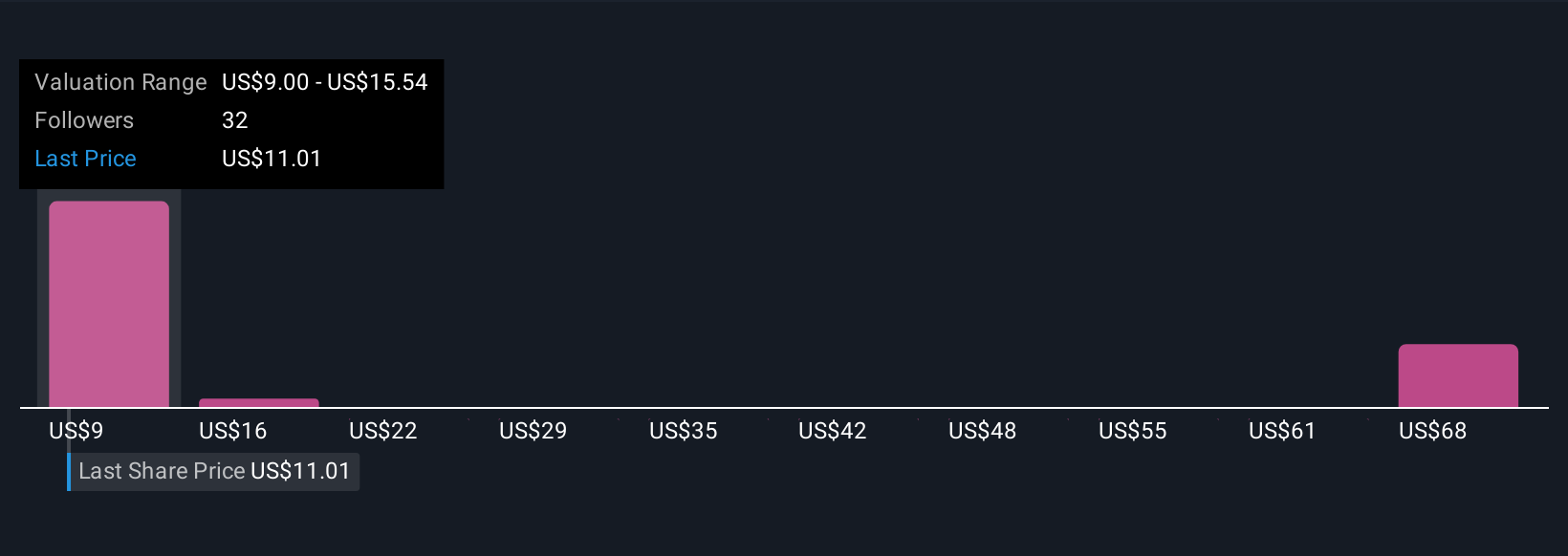

Seven contributors in the Simply Wall St Community estimate Organon’s fair value between US$9 and US$74.49 per share. Some focus on biosimilars growth, while others weigh ongoing generic competition, inviting you to consider several perspectives on future performance.

Explore 7 other fair value estimates on Organon - why the stock might be worth 18% less than the current price!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives