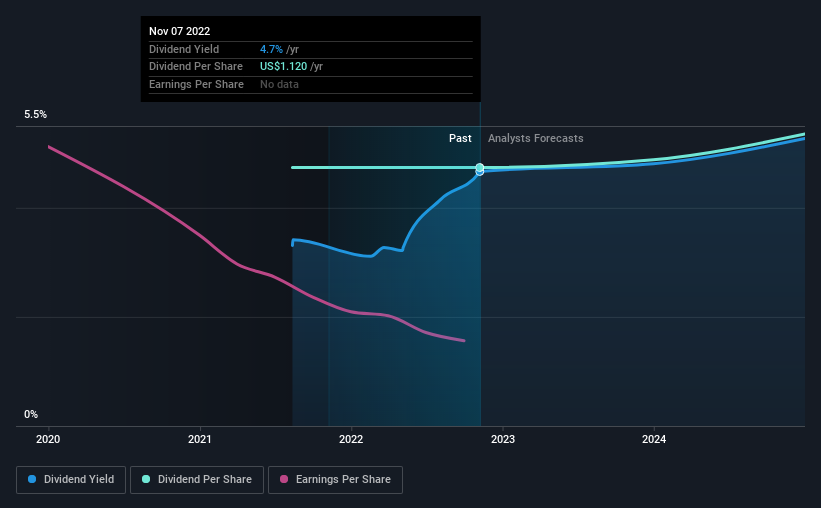

The board of Organon & Co. (NYSE:OGN) has announced that it will pay a dividend on the 15th of December, with investors receiving $0.28 per share. This means the annual payment is 4.7% of the current stock price, which is above the average for the industry.

View our latest analysis for Organon

Organon's Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Organon was paying a whopping 206% as a dividend, but this only made up 28% of its overall earnings. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

The next year is set to see EPS grow by 32.5%. If the dividend continues on this path, the payout ratio could be 21% by next year, which we think can be pretty sustainable going forward.

Organon Doesn't Have A Long Payment History

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Earnings per share has been sinking by 33% over the last three years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

Organon's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 4 warning signs for Organon you should be aware of, and 2 of them don't sit too well with us. Is Organon not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives