- United States

- /

- Pharma

- /

- NYSE:OGN

Organon (NYSE:OGN) Reports Decreased Earnings Affecting Investor Sentiment

Reviewed by Simply Wall St

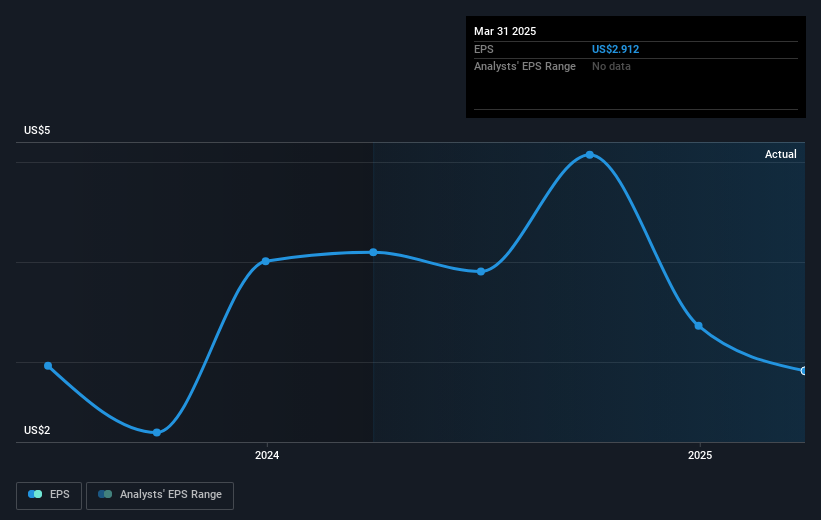

Organon (NYSE:OGN) saw significant volatility last month with a 30% decline in its share price, coinciding with the company's announcement of decreased earnings and a reduction in its dividend payout. The first-quarter earnings report revealed a drop in sales and net income compared to the previous year, potentially contributing to negative investor sentiment. The appointment of Ramona A. Sequeira to the board provides strategic industry expertise, but recent financial results may have outweighed this positive development. Amidst a mixed market performance influenced by external economic factors and earnings reports from other major companies, Organon’s unfavorable financial disclosures might have intensified the substantial price drop.

Amid Organon's recent financial struggles, the company's share price fell dramatically by 52.31% over the past year, highlighting significant challenges within the business. These declines coincide with a 30% drop in share value last month due to disappointing earnings and a dividend reduction. This recent turbulence sheds light on the underlying pressures faced by Organon, further intensified by pricing pressures and loss of exclusivity in key products. These issues compound risks to revenue and earnings forecasts, as documented in the recent narrative analysis.

While Organon's share price decline far exceeds the general market downturn, where the broader US market saw a modest increase of 7.2% over the past year, it also underperformed the US Pharmaceuticals industry's return of -8.1% for the same period. This underperformance may reflect specific challenges in Organon's growth strategy, such as the expected margin dilution from the Dermavant acquisition and the potential headwinds from VTAMA's integration into revenue streams. Despite these hurdles, the acquisition presents a long-term growth opportunity, potentially boosting revenues and net margins by 2026.

With a current share price of US$16.06, significantly discounting from the consensus price target of US$21.00, there is notable analyst optimism. However, this price target assumes future earnings growth and profitability improvements alongside a trading multiple of 7.6x future earnings, which currently sits well below the industry average. Investors are urged to scrutinize these assumptions alongside potential risks such as competitive pressures and LOE impacts on revenue trajectories.

Examine Organon's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Organon, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Good value slight.

Similar Companies

Market Insights

Community Narratives