- United States

- /

- Pharma

- /

- NYSE:OGN

Earnings Pressure and Demand Delays Could Be a Game Changer for Organon (OGN)

Reviewed by Sasha Jovanovic

- In recent days, Organon reported that persistent revenue declines over the past five years have been compounded by a sharper drop in earnings per share as customers delayed purchases.

- This ongoing operational challenge signals deep-rooted issues in demand and profitability, extending beyond temporary market disruptions or isolated quarters.

- With customer purchase delays amplifying already declining revenues, we’ll assess how this trend affects Organon’s investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Organon Investment Narrative Recap

To be an Organon shareholder today, you must believe the company's transition beyond its mature, off-patent drug portfolio is achievable, particularly by capitalizing on pipeline momentum and biosimilars. The recent update on falling revenues and sharper earnings declines raises near-term concerns, especially as delayed customer purchases weigh on performance. This development could materially affect the main catalyst of accelerating biosimilars growth and amplifies the structural risk around demand instability.

Among Organon's recent announcements, the FDA approval of two denosumab biosimilars stands out as directly relevant. These approvals could inject fresh momentum into top-line growth and lessen reliability on legacy products, but the positive impact may be offset if the revenue pressures from customer delays persist. Contrast this optimism, though, with the unresolved question of whether biosimilars can meaningfully buffer against ongoing pricing pressure and generic competition, a crucial factor that investors should be aware of if...

Read the full narrative on Organon (it's free!)

Organon's narrative projects $6.5 billion revenue and $990.3 million earnings by 2028. This requires 1.2% yearly revenue growth and a $290.3 million earnings increase from $700.0 million today.

Uncover how Organon's forecasts yield a $13.17 fair value, a 42% upside to its current price.

Exploring Other Perspectives

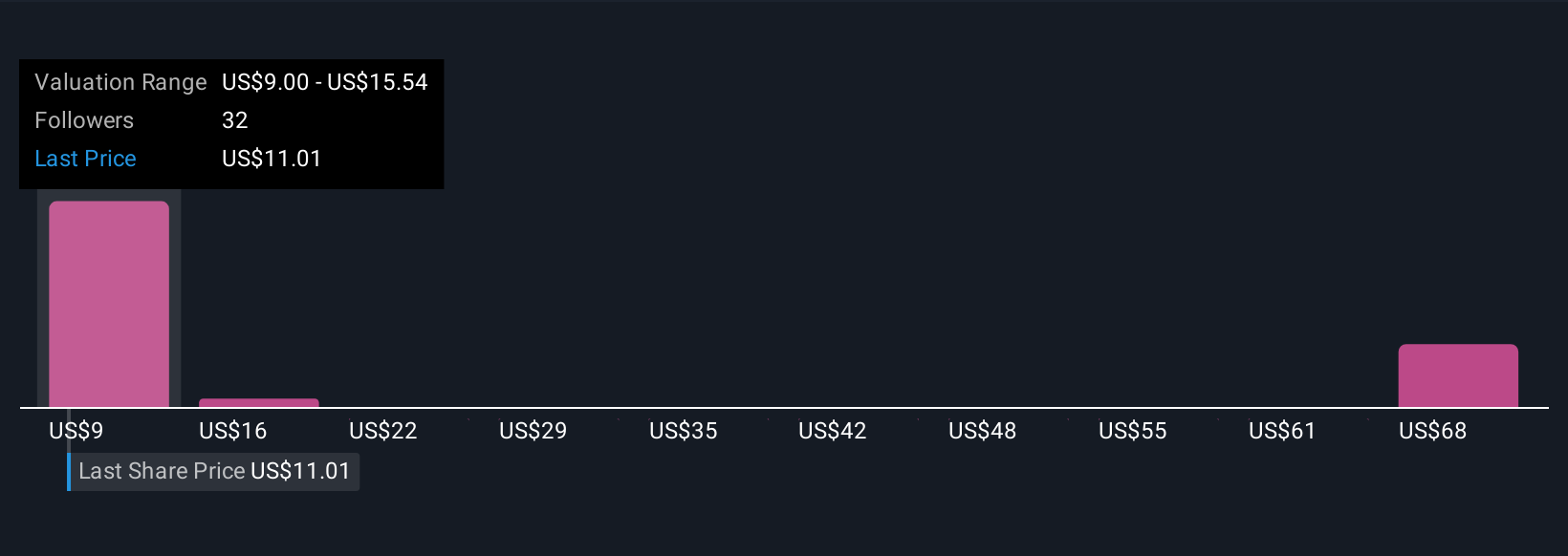

Simply Wall St Community members provided seven fair value estimates for Organon, ranging widely from US$9.00 to US$67.81 per share. Many emphasize potential for biosimilars growth but highlight persistent risk from generic competition, underscoring why performance expectations vary so much across different investors.

Explore 7 other fair value estimates on Organon - why the stock might be worth over 7x more than the current price!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with limited growth.

Similar Companies

Market Insights

Community Narratives