- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) Partners With Gates Foundation For HIV PrEP Trials In 16 Countries

Reviewed by Simply Wall St

Merck (NYSE:MRK) recently announced the initiation of its Phase 3 EXPrESSIVE clinical trials for MK-8527, a new HIV prevention drug, reflecting its commitment to addressing global health challenges. Over the past quarter, the company’s stock saw a price increase of 6%. Despite a flat broader market largely unaffected by geopolitical trade uncertainties, Merck's progress in clinical trials and the partnership with the Gates Foundation might have provided additional optimism among investors. This advancement aligns with Merck's ongoing efforts to innovate within the pharmaceutical sector, counterbalancing the external market stability.

Be aware that Merck is showing 1 weakness in our investment analysis.

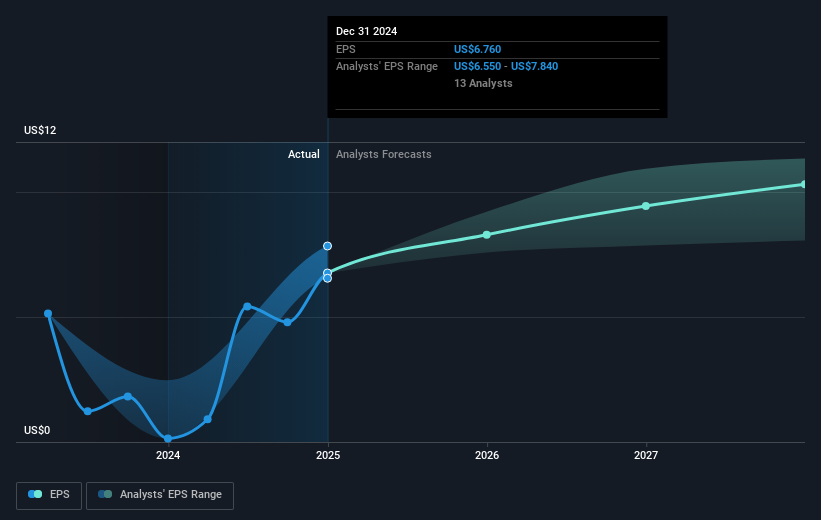

Merck's recent initiation of its Phase 3 EXPrESSIVE clinical trials for MK-8527 potentially contributes positively to its narrative of growth through robust R&D and new product launches. With the aim of maintaining leadership in oncology and other areas, these clinical advancements could enhance future revenue and earnings prospects, aligning with analyst forecasts of reaching US$24.6 billion in earnings by 2028. The trials add momentum to the company's pipeline, bolstering investor optimism regarding Merck's ability to sustain long-term margins despite challenges such as KEYTRUDA's exclusivity loss and GARDASIL sales declines.

Over the past five years, Merck's total shareholder return, including share price and dividends, was 28.61%. Despite this positive longer-term performance, the company underperformed the broader US market's return of 11.4% in the past year, showing a complex narrative of consistent growth juxtaposed with recent challenges. Relative to the US Pharmaceuticals industry, Merck edged out the sector's decline over the year.

In terms of share valuation, Merck's current price of US$79.04 is trading at a 22.1% discount to the analysts' consensus price target of US$101.79. This current valuation reflects potential investor skepticism concerning short-term risks, despite the projected earnings and revenue growth from new product launches and strategic investments. The ongoing developments in Merck's product line, supported by the recent clinical trials, indicate a potential for positive long-term impacts on revenue and earnings, reinforcing confidence as articulated by the consensus price targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives