- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) Launches Next-Gen Digital Ecosystem for Growth Disorders with Dawn Health

Reviewed by Simply Wall St

Merck (NYSE:MRK) recently announced the launch of a next-generation digital ecosystem for Growth Hormone Deficiency, a move that underscores its commitment to innovative patient care. This development adds a counterbalance to broader market trends, where mixed investor sentiment is influenced by anticipation of Federal Reserve interest rate decisions and ongoing trade discussions. While Merck's shares declined by 3% over the last month, this shift aligns with the flat market performance, where the Dow Jones and S&P 500 exhibited minimal overall changes. The investment landscape reflects a cautious curiosity about upcoming earnings seasons and tariff negotiations.

We've discovered 2 weaknesses for Merck that you should be aware of before investing here.

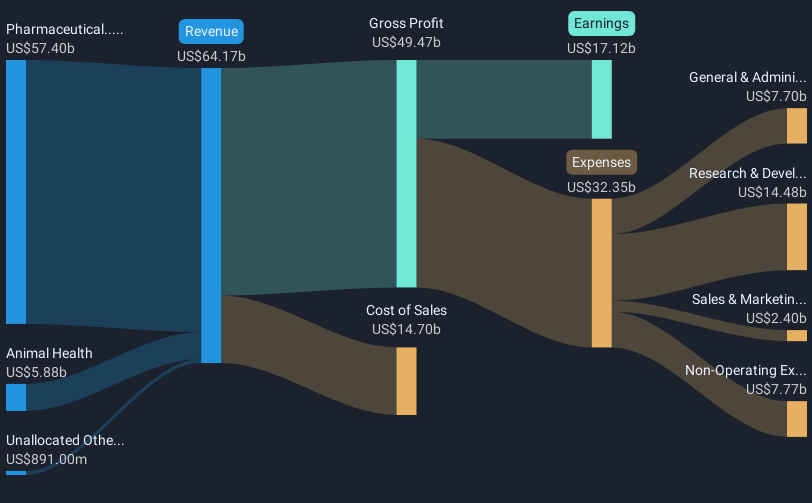

Merck's recent advancement in digital health solutions for Growth Hormone Deficiency could influence its long-term narrative by enhancing its innovative profile and potentially driving revenue upward. This move aligns with the broader emphasis on research and development, as Merck continues to focus on expanding its pipeline with high-potential products. Over the past five years, the company's total shareholder return was 25.20%, showcasing solid long-term performance despite shorter-term fluctuations. In contrast, over the past year, the company's shares underperformed relative to the US Pharmaceuticals industry, which saw a decline of 8.1% compared to the overall market's growth of 7.2%.

The company's announcement may also positively impact revenue and earnings forecasts, supporting the expectation of reaching US$24.6 billion in earnings by April 2028. Analysts have a consensus price target of US$107.54, 21.2% above the current share price of US$84.71, suggesting potential upside. Merck's strategic innovations could help bridge the discount to this target, provided the expected catalysts unfold effectively. As the company moves forward with its investments and product launches, there may be a renewed investor focus, especially in light of its proactive approach to overcoming challenges such as competition and pricing pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Very undervalued with outstanding track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives