- United States

- /

- Pharma

- /

- NYSE:LLY

Will Eli Lilly’s (LLY) New Investments Reveal a Shift in Its Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- In recent days, Eli Lilly announced a series of milestone events, including regulatory approvals for new breast cancer and Alzheimer's therapies, a US$6.5 billion investment in a Houston manufacturing facility, and the expansion of its innovation hub in San Diego. These moves reflect confidence in future demand, expansion of Lilly's product portfolio, and a strengthened presence in biotech and manufacturing ecosystems.

- The expansion of the Gateway Labs network highlights Lilly’s focus on supporting early-stage biotech innovation, positioning the company to accelerate drug discovery and access novel therapeutic approaches.

- We'll explore how the Houston facility investment signals Lilly's expectations for rising production needs and advancing its growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Eli Lilly Investment Narrative Recap

Owning Eli Lilly means believing in continued innovation, robust demand for its obesity, diabetes, and neurology drugs, and the company's ability to navigate pricing pressures and competition. The recent spate of approvals and manufacturing investments supports the growth catalysts at play, but does little to reduce the most immediate risk: pricing power erosion due to regulatory focus and payer actions in the US and Europe.

The FDA approval of Inluriyo for advanced breast cancer is especially relevant, reflecting Eli Lilly's pipeline diversification and efforts to grow beyond its heavy reliance on metabolic therapies. This addition may help mitigate near-term volatility arising from competitive and reimbursement headwinds in obesity but does not directly impact concerns around margin and payer negotiations.

Yet, investors should be aware that despite impressive expansion and product launches, the biggest risk may actually come from...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's narrative projects $89.1 billion in revenue and $34.2 billion in earnings by 2028. This requires 18.7% yearly revenue growth and a $20.4 billion increase in earnings from $13.8 billion today.

Uncover how Eli Lilly's forecasts yield a $891.62 fair value, a 6% upside to its current price.

Exploring Other Perspectives

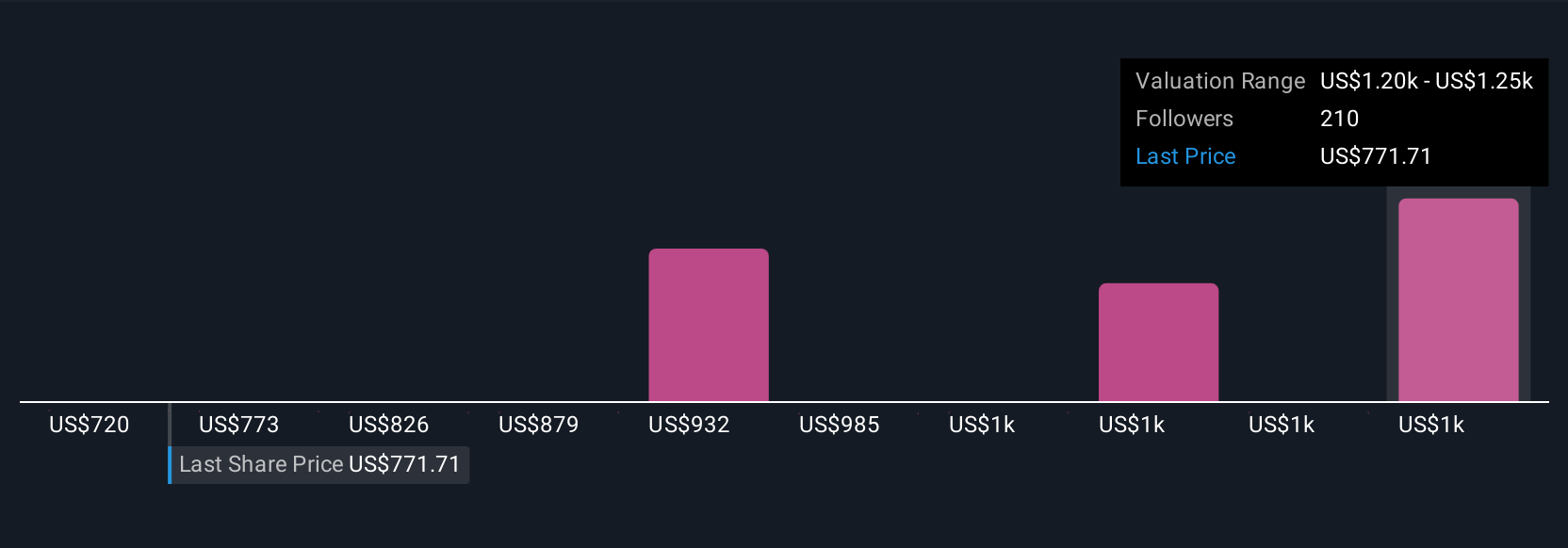

Thirty members of the Simply Wall St Community assessed Eli Lilly’s fair value from US$650 to US$1,189. While investor views vary widely, many are focused on expanding diabetes and obesity treatment volumes as a core growth driver. Consider how different perspectives about payer resistance or access might shape future returns and review several takes for a fuller picture.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth 23% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives