- United States

- /

- Pharma

- /

- NYSE:LLY

What Eli Lilly (LLY)'s Drug Pricing Pressure Means for the Future of Its Obesity Franchise

Reviewed by Sasha Jovanovic

- In the past week, Eli Lilly faced increased political scrutiny after President Donald Trump and officials indicated intentions to substantially lower the prices of GLP-1 weight-loss and diabetes drugs, igniting concerns about possible government intervention and pricing pressures for key products like Zepbound and Mounjaro.

- This heightened focus on drug pricing underscores the potential vulnerability of the rapidly expanding market for obesity and diabetes treatments, which is a significant growth driver for the company.

- We'll examine how amplified political pressure on GLP-1 drug pricing may alter Eli Lilly's investment narrative and future market assumptions.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Eli Lilly Investment Narrative Recap

Eli Lilly shareholders generally need to believe in the company’s leadership in obesity and diabetes treatments and in its ability to grow earnings as demand rises. After President Trump’s recent push for sharply lower GLP-1 drug prices, the biggest short-term catalyst, volume growth in key products, now faces potential pricing pressure, making regulatory risk the most immediate threat to the business. The headline risk appears material and could influence revenue assumptions, but the fundamental growth narrative around innovative drugs remains in focus.

Among recent announcements, the positive Phase 3 trial results for orforglipron, in diabetes and obesity, stand out. While this bolsters Eli Lilly’s product pipeline in its highest growth category, it is directly relevant to concerns over future pricing and access for GLP-1 therapies, showing both the promise of the pipeline and the risks that regulatory actions could pose to new launches.

By contrast, investors should be aware that even robust product launches can be disrupted if policymakers…

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's outlook anticipates $89.1 billion in revenue and $34.2 billion in earnings by 2028. This projection relies on an 18.7% annual revenue growth rate and a $20.4 billion increase in earnings from the current $13.8 billion figure.

Uncover how Eli Lilly's forecasts yield a $891.62 fair value, a 10% upside to its current price.

Exploring Other Perspectives

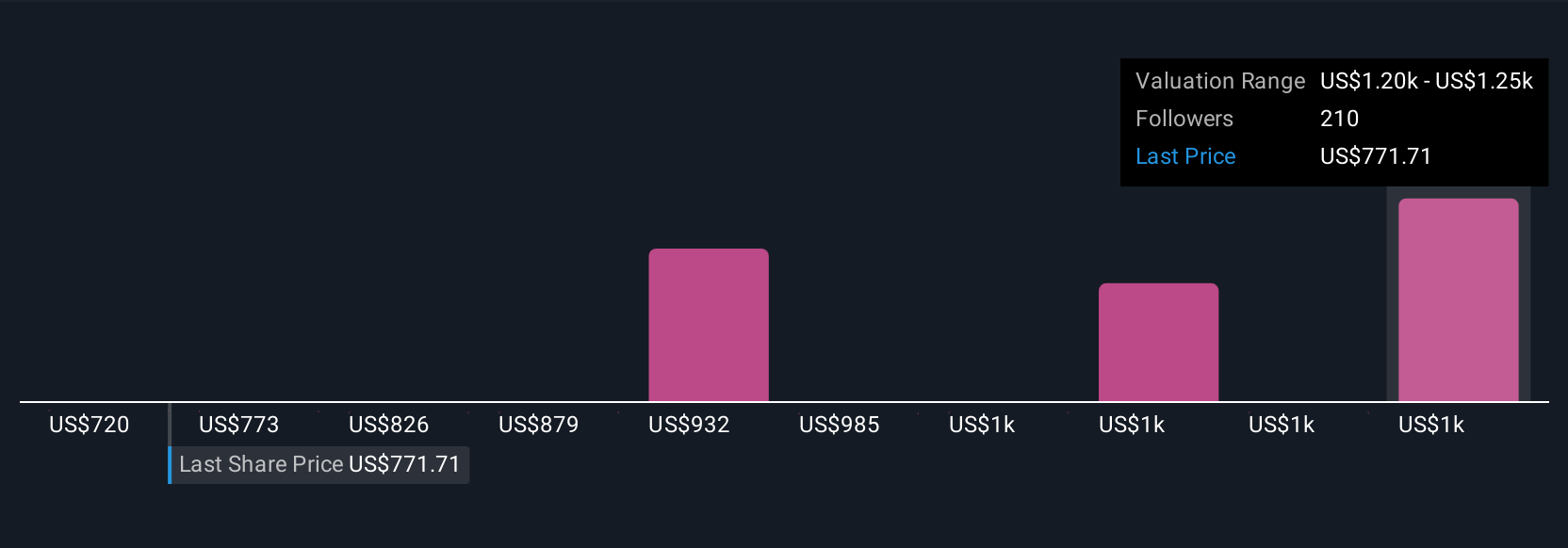

Thirty Simply Wall St Community fair value estimates for Eli Lilly span US$650 to US$1,189.18 per share, reflecting highly varied outlooks. As pricing risks gain attention, these differences illustrate why it pays to review multiple perspectives.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth 20% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives