- United States

- /

- Pharma

- /

- NYSE:LLY

Is Eli Lilly’s Recent Obesity Drug Breakthrough Driving a Fair Stock Price in 2025?

Reviewed by Bailey Pemberton

If you're holding Eli Lilly stock or eyeing it for your portfolio, you likely know it's been on quite a ride lately. There’s a lot of chatter about whether now is the right time to buy, sell, or simply watch from the sidelines. After a massive 132.8% gain over three years and an incredible 554.4% return over the past five years, last year saw the stock dip by 9.4%, which certainly turned some heads. However, the longer-term story remains one of powerful growth, as seen in this month's 7.6% climb despite a slight 1.7% drop over the last week.

Recent developments have been fueling both excitement and debate. The chatter largely centers on Eli Lilly’s breakthroughs in obesity and diabetes treatments. These innovations, especially around drugs like tirzepatide, have reshaped investor sentiment and sparked talk of a new growth phase for the company. While these headlines have played a big role in shaping how analysts and investors value Eli Lilly, there are questions about whether future cash flows justify the premium price tag investors are willing to pay today.

If we look at the numbers, Eli Lilly’s value score comes in at 2 out of 6 using commonly used valuation checks, indicating the stock may not be a strong bargain by traditional metrics. Still, valuation is only part of the puzzle. Let us break down how these different valuation approaches compare and consider if there might be an even better way to value a company as dynamic as Eli Lilly.

Eli Lilly scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

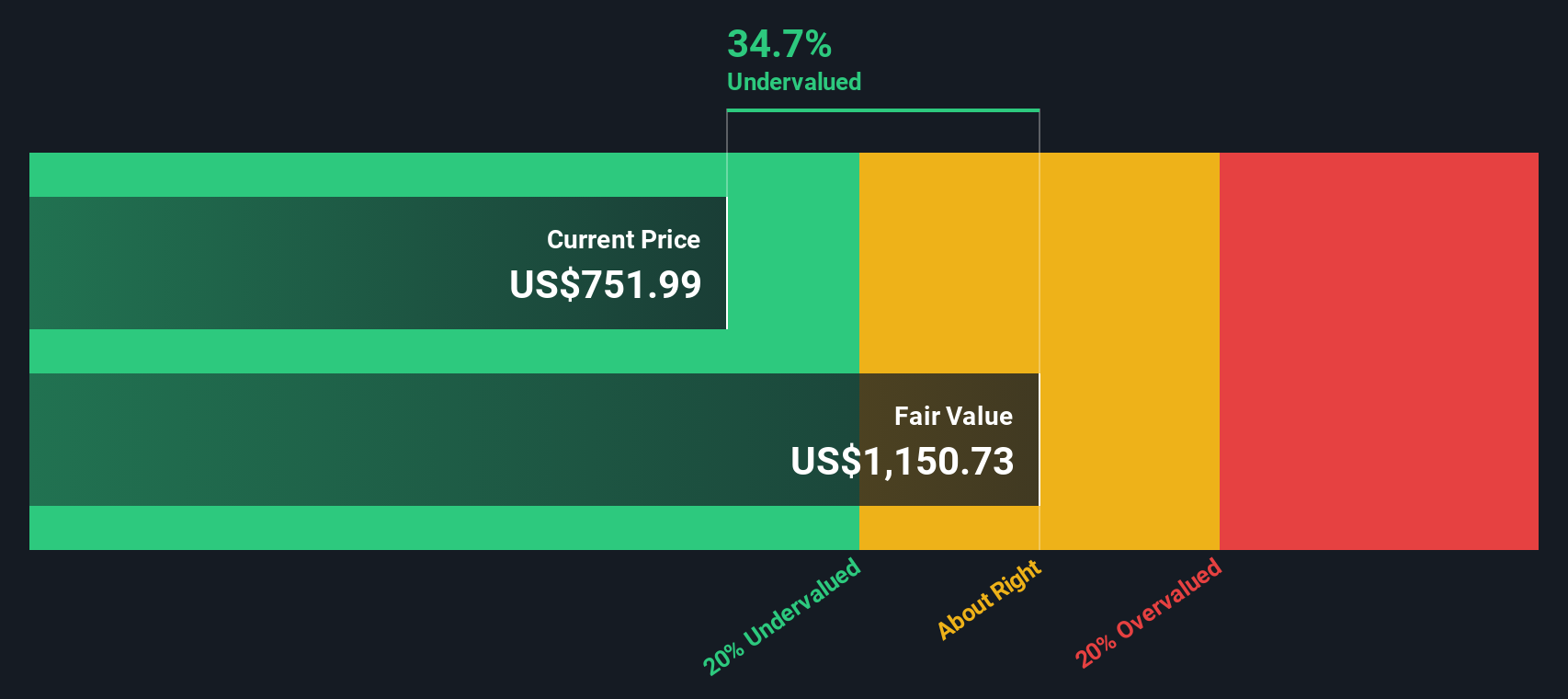

Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This approach is especially useful for companies like Eli Lilly, as its potential lies in the capacity to generate rising cash flows over time.

For Eli Lilly, the latest reported Free Cash Flow is $2.25 billion. According to current forecasts, this figure is projected to grow dramatically and reach over $34.09 billion by 2029. These estimates are based on analyst projections for the next five years. Further years are extrapolated by Simply Wall St using reasonable growth assumptions.

Using this model, the estimated fair value for Eli Lilly stock is $1,169.31. Compared to its current market price, the DCF analysis indicates the stock is trading at a 30.5% discount to its intrinsic value. This suggests that, based on anticipated future cash flows, Eli Lilly appears significantly undervalued at today's price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eli Lilly is undervalued by 30.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

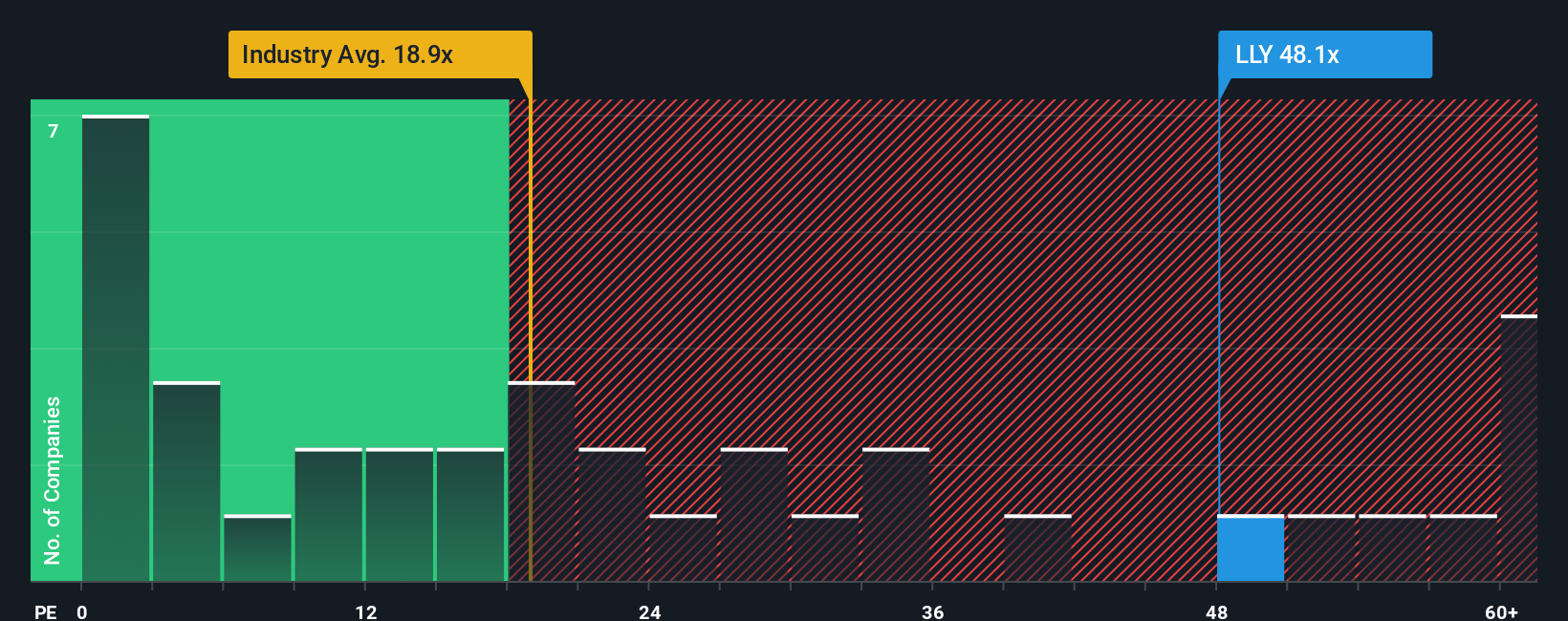

Approach 2: Eli Lilly Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Eli Lilly, as it directly compares a company’s current share price to its earnings per share. This makes it useful for assessing how the market values Eli Lilly’s profit-generating ability against other businesses in the sector.

It is important to note that a "normal" or fair PE ratio depends on factors such as expected future earnings growth and the risks involved in the business. Higher growth companies generally trade at higher PE ratios because investors are willing to pay more today for the expectation of stronger future profits. Conversely, higher risks can lower the fair value investors place on a company’s current earnings.

Eli Lilly’s current PE ratio is a lofty 52.9x, which is substantially higher than the pharmaceutical industry average of 18.4x and also well above the 15.7x peer average. At face value, this suggests the stock is trading at a significant premium to both its peers and its sector. However, relying solely on these benchmarks can overlook company-specific characteristics that influence true value.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric is designed to account for Eli Lilly’s earnings growth outlook, risk profile, profitability, market cap and industry characteristics. The Fair Ratio, calculated at 39.7x for Eli Lilly, reflects a more nuanced estimate of what investors should pay based on its specific strengths and risks, rather than simply comparing it to others.

Comparing the company’s actual PE ratio (52.9x) with its Fair Ratio (39.7x) suggests Eli Lilly’s shares are trading above what Simply Wall St considers fair given its fundamentals and growth profile. This points to an overvalued stock on this metric, but also highlights that Eli Lilly’s growth and profitability justify a much higher multiple than sector or peer averages alone would suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

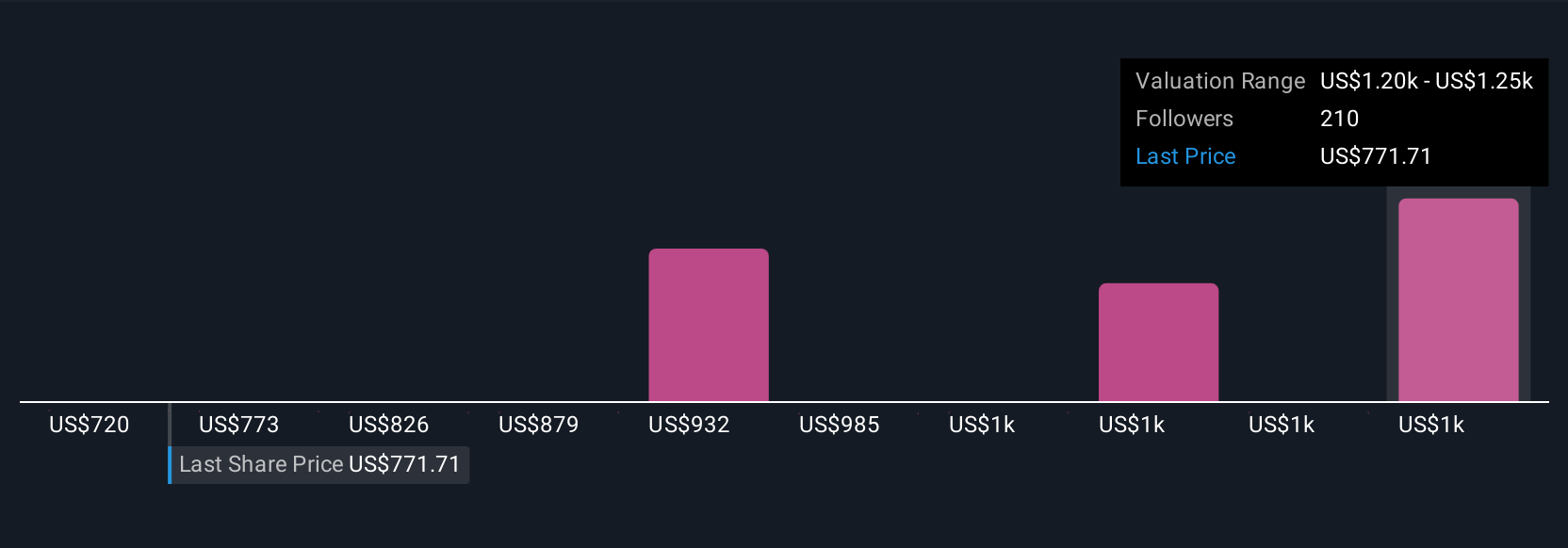

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

Earlier, we touched on the idea that understanding a company's value goes beyond just reading the numbers. This is where Narratives come in. A Narrative is your story, or point of view, on a company's future: connecting what you believe (about the business, its opportunities, and its risks) to your assumptions for future revenue, profit margins, and ultimately, a fair value estimate. Simply Wall St makes this approach easy: on their Community page, millions of investors create and share Narratives, so you can see how others connect Eli Lilly’s innovations, market realities, and industry shifts into clear forecasts and valuations.

This means you are no longer limited by generic valuation tools. With Narratives, you can compare a company’s fair value to its current price, making personalized buy or sell decisions rooted in your research and up-to-date information. Narratives aren’t static, either; they update as soon as new news or earnings are released, helping you react dynamically to change. For example, some believe Eli Lilly's fair value could be as high as $1,190 if obesity drugs dominate and margins expand, while others see $650 if competitive and reimbursement risks materialize. You get to decide which story and valuation match your outlook.

Do you think there's more to the story for Eli Lilly? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives