- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (NYSE:LLY) Declares US$1.50 Second Quarter Dividend For 2025

Reviewed by Simply Wall St

Eli Lilly (NYSE:LLY) experienced an 11% share price increase over the past month, largely influenced by the affirmation of a $1.50 per share dividend declared for the second quarter. The announcement of Q1 earnings, showing significant revenue growth to $12,729 million, and promising results from the SURPASS-3 trial for tirzepatide, contributed to investor optimism. Despite the broader market's marginal fluctuations amid concerns over tariffs and Fed decisions, Eli Lilly's strong earnings guidance and product development announcements provided a counterbalance, driving the stock's notable outperformance compared to the broader market's 2% rise.

Eli Lilly has 2 weaknesses (and 1 which shouldn't be ignored) we think you should know about.

The recent news surrounding Eli Lilly, including the affirmation of a $1.50 per share dividend and the promising outcomes from the SURPASS-3 trial, has boosted short-term investor sentiment. This optimism aligns well with the company's narrative of manufacturing expansion and strategic partnerships, such as the one with OpenAI, which are poised to bolster future revenue opportunities. The company's robust five-year total shareholder return, which surged by a very large percentage, showcases its impressive long-term performance. Over the past year, however, Eli Lilly's shares underperformed the US market's return of 8.2% but outpaced the US Pharmaceuticals industry's 3.4% decline.

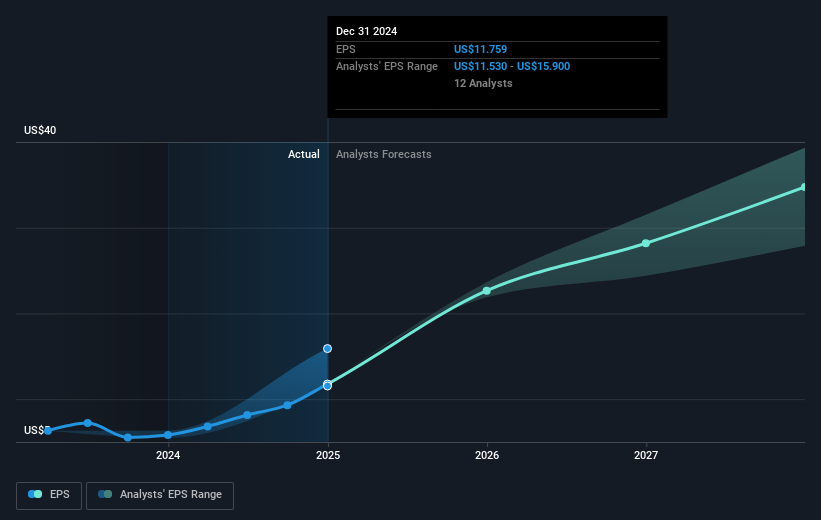

Increased manufacturing capabilities and successful trial results support the positive revenue and earnings growth forecasts. These developments may fuel Eli Lilly's projected annual revenue growth of 22.7% and possibly improve its profit margins despite potential challenges like pricing pressures and rising R&D costs. With a current share price of US$885.20 and a consensus analyst price target of approximately US$991.97, the stock has room to potentially close the 10.8% gap, reflecting broader analyst expectations. This positive sentiment suggests confidence in the firm's long-term growth prospects, despite short-term market variabilities.

Evaluate Eli Lilly's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Eli Lilly, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives