- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY): Does Its Recent Strength Signal More Valuation Upside for Investors?

Reviewed by Kshitija Bhandaru

See our latest analysis for Eli Lilly.

After an impressive run in recent years, Eli Lilly’s share price has continued to show upward momentum, with its solid fundamentals helping attract attention even as growth cools off slightly. While the 1-year total shareholder return is essentially flat, its three- and five-year total shareholder returns remain remarkably strong, reflecting the company’s staying power within healthcare despite shifts in sentiment and sector rotation.

If you’re keeping an eye on exceptional performers in healthcare, discover more opportunities with our curated list of industry leaders: See the full list for free.

With Eli Lilly’s share price hovering just below analyst targets and robust multi-year returns, the question for investors is clear: is there genuine value left to uncover here, or has the market already accounted for all the company’s future growth?

Most Popular Narrative: 8% Undervalued

Compared to Eli Lilly’s latest closing price of $819.85, the most popular narrative sets its fair value at $891.62, suggesting the market still trails consensus estimates. As analyst projections anchor valuations, investors are left wondering what’s truly driving such optimism for the stock's future growth.

Advancements in research and development, particularly in neurodegenerative diseases (for example, Alzheimer's with Kisunla and donanemab), and a deep clinical pipeline with multiple late-stage readouts, position Eli Lilly to capture future multi-billion dollar market opportunities and support long-term revenue and margin expansion.

What’s behind this ambitious target? The most widely followed narrative assumes major jumps in revenue and profit margins and relies on several bold forward-looking financial projections. Want to find out what numbers back up that valuation? The true drivers may surprise you.

Result: Fair Value of $891.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory pressures related to drug pricing and heavy reliance on blockbuster drugs could quickly challenge the bright outlook for Eli Lilly.

Find out about the key risks to this Eli Lilly narrative.

Another View: High Market Premium Points to Valuation Risk

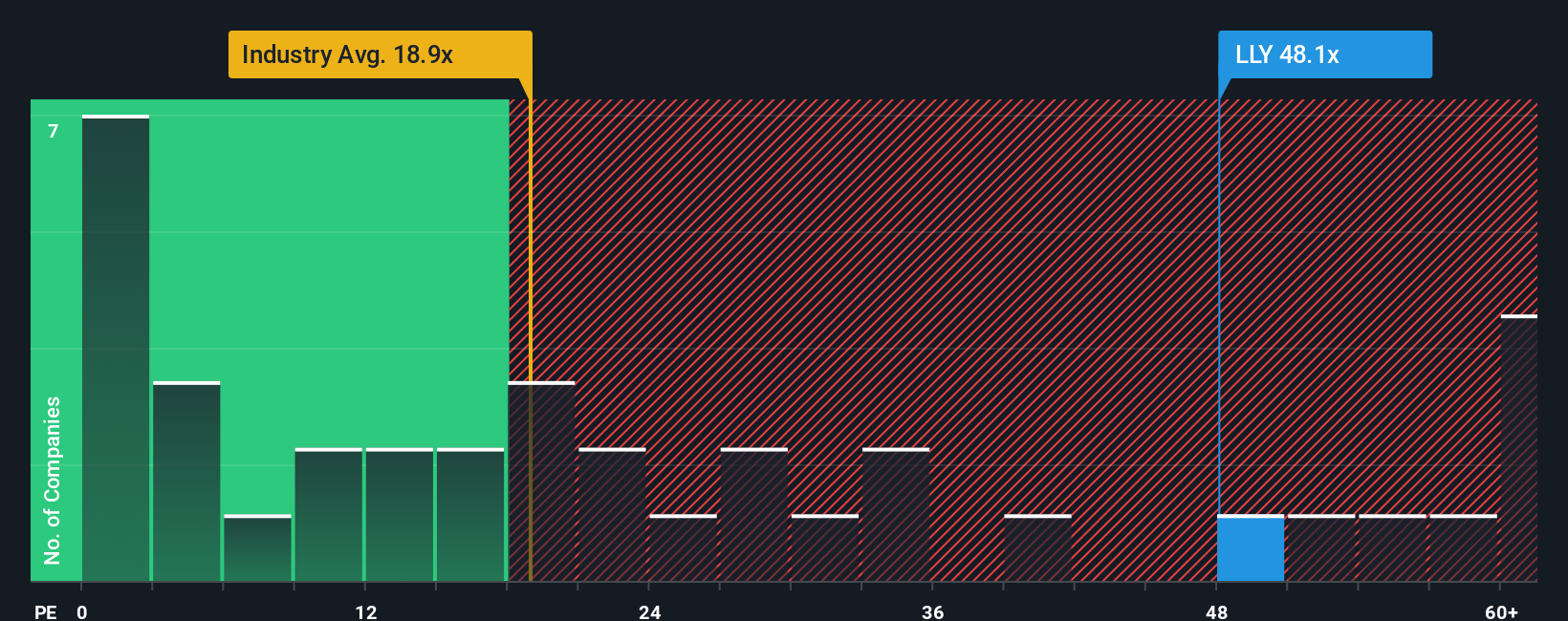

Looking through the lens of price-to-earnings, Eli Lilly’s share price trades at 53.3 times earnings, far ahead of the US pharmaceutical sector average (19.8x), its peers’ average (16.5x), and even the estimated fair ratio (39.9x). This substantial premium could signal over-optimism and raises the question, does Wall Street expect too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you have your own take or want to dig deeper into the data, crafting your personalized narrative takes just a few moments. Do it your way.

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

There’s never been a better moment to uncover your next portfolio win. Don’t sit on the sidelines while others grab new growth, income, and innovation potential. See what’s possible today.

- Kickstart your search for high potential with these 910 undervalued stocks based on cash flows that stand out for their strong fundamentals and attractive pricing.

- Tap into emerging technologies by checking out these 24 AI penny stocks making breakthroughs in artificial intelligence and automation.

- Secure consistent income by zeroing in on these 19 dividend stocks with yields > 3% offering yields above 3% and a track record of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives