- United States

- /

- Pharma

- /

- NYSE:JNJ

Where can Investors Find Value in a Well-Rounded Company like Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson (NYSE:JNJ) is thought of as a strong, mature company that has performed and will keep performing for shareholders. Novice investors may also run into the company as part of their potential initial investment palette. Today, we are going over the fundamentals for J&J, and see what that might mean for the future value of the company.

Income & Cash Flows

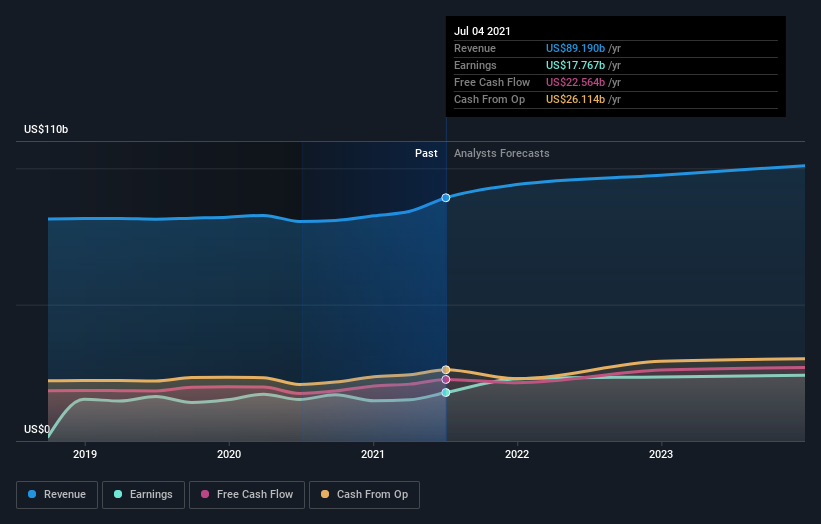

Analysts that follow J&J are optimistic on the fundamentals and are estimating an annual earnings growth of 7.8% and an annual revenue growth rate of 3.2%.

The company is forecasted to increase revenues to around US$101b by the end of 2023.

View our latest analysis for Johnson & Johnson

J&J has a profit margin of 19.9%, which shows that the company is well on the way of maximizing profits.

Finally, we consider the cash flows. For J&J the free cash flows are US$22.6b, standing above the earnings result of US$17.8b, which is great for investors. In fact, free cash flows have been mostly above earnings in previous years as well. This can sometimes be a great leading indicator into future improved performance, because when those two number converge, they usually converge on the cash flows, which means bringing profits up for J&J.

In the chart below, we will examine the income fundamentals of J&J, as well as what analysts estimate these numbers to be by the end of 2023.

The Balance Sheet

The image below, which you can click on for greater detail, shows that at July 2021 Johnson & Johnson had debt of US$33.5b, up from US$30.4b in one year.

However, it does have US$25.3b in cash offsetting this, leading to net debt of about US$8.18b.

Of course, Johnson & Johnson has a titanic market capitalization of US$420.1b, so the debt is quite manageable.

Johnson & Johnson has a low net debt to EBITDA ratio of only 0.27. And its EBIT covers its interest expense a whopping 127 times over. So we're pretty relaxed about its conservative use of debt. And we also note warmly that Johnson & Johnson grew its EBIT by 15% last year, making its debt load easier to handle.

Key Takeaways

Johnson & Johnson is a well-rounded company with an optimistic growth outlook. The earnings are estimated to grow, and the company is in control of debt.

For investors, the efficacy of J&J operations my present a value opportunity, since the market might not have fully caught up with the expected change in future profitability.

Our model shows that the company is slightly undervalued and as we examined today, the fundamentals are on the way to get better.

You can view our full valuation model for J&J Here.

If you're looking to trade Johnson & Johnson, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives