- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (NYSE:JNJ) Shares React as FDA Grants Multiple Designations to Nipocalimab

Reviewed by Simply Wall St

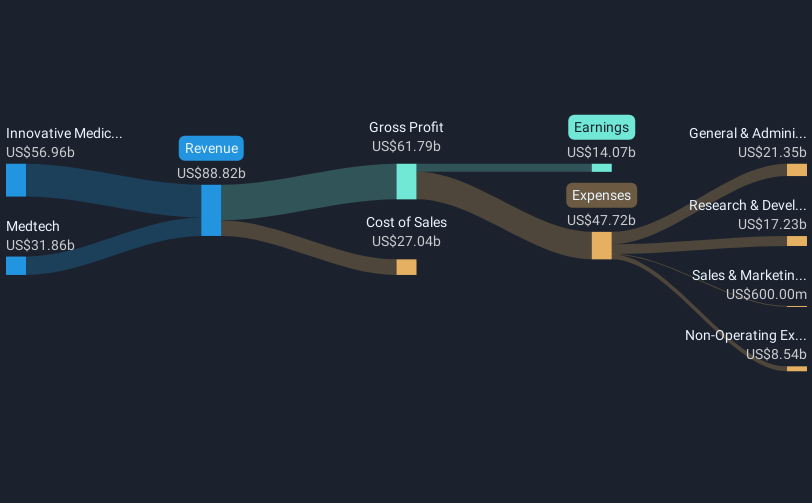

Johnson & Johnson (NYSE:JNJ) announced compelling results from its Phase 3 Vivacity-MG3 study on nipocalimab, showing promising efficacy and safety in treating generalized myasthenia gravis, which were significant events during the quarter. Additionally, the company's ongoing regulatory strides, including new designations for nipocalimab, offered a robust pipeline outlook. However, despite a 5% stock increase in the last quarter, JNJ's performance remained largely aligned with market movements, which experienced a volatile phase due to broad economic uncertainties and tariff concerns. These developments provided some support against a backdrop of overall market downturns.

We've spotted 1 possible red flag for Johnson & Johnson you should be aware of.

The compelling results from Johnson & Johnson's Phase 3 study on nipocalimab could significantly bolster its portfolio in treating generalized myasthenia gravis, potentially leading to increased market confidence and improved revenue streams. This progress aligns with their strategic focus on expanding treatment options, which may positively influence revenue and earnings forecasts. Over the past five years, JNJ's total return, including dividends, was 18.19%, indicating solid long-term growth. In the last year, JNJ surpassed the US Pharmaceuticals industry, which saw an 11.5% decline, demonstrating resilience against broader industry challenges.

Despite the promising data and a subsequent 5% stock increase last quarter, the stock remains priced below the consensus price target of $171.11, reflecting a 9.4% potential upside from its current US$153.25 level. These share price dynamics suggest investor caution amid macroeconomic pressures. As analysts project revenue to grow 2.9% annually with improved profit margins, any positive regulatory developments related to nipocalimab could further justify the stock moving towards its price target, potentially enhancing the company's market position and shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives