- United States

- /

- Life Sciences

- /

- NYSE:IQV

How Investors May Respond To IQVIA Holdings (IQV) Earnings Beat And Strong Organic Revenue Growth

Reviewed by Sasha Jovanovic

- In the recent quarter, IQVIA Holdings reported organic revenue growth and favorable currency effects that lifted total revenue to US$4.10 billion, with adjusted EPS rising to US$3.00 and both figures coming in ahead of analyst expectations.

- This earnings beat, alongside continued analyst optimism, highlights how IQVIA’s mix of data, analytics, and clinical services is still resonating strongly with life sciences customers.

- Next, we’ll examine how this earnings outperformance, especially the stronger organic growth, may influence IQVIA’s existing investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

IQVIA Holdings Investment Narrative Recap

To own IQVIA, you need to believe that its integrated data, analytics, and CRO platform will stay central to how drug makers run clinical and commercial decisions. The latest quarter’s organic growth and earnings beat support that view and modestly ease near term concerns around pricing pressure, though competition and mix shift still look like the biggest risks to margins.

Among recent developments, IQVIA’s reaffirmed full year 2025 revenue guidance of US$16,150 million to US$16,250 million is most relevant here, as it frames this quarter’s outperformance within a still measured growth outlook and helps investors judge whether current AI and RWE driven catalysts are flowing consistently into the top line.

Yet investors should be aware that growing client price sensitivity in CRO contracts could still...

Read the full narrative on IQVIA Holdings (it's free!)

IQVIA Holdings' narrative projects $18.4 billion revenue and $1.8 billion earnings by 2028.

Uncover how IQVIA Holdings' forecasts yield a $250.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

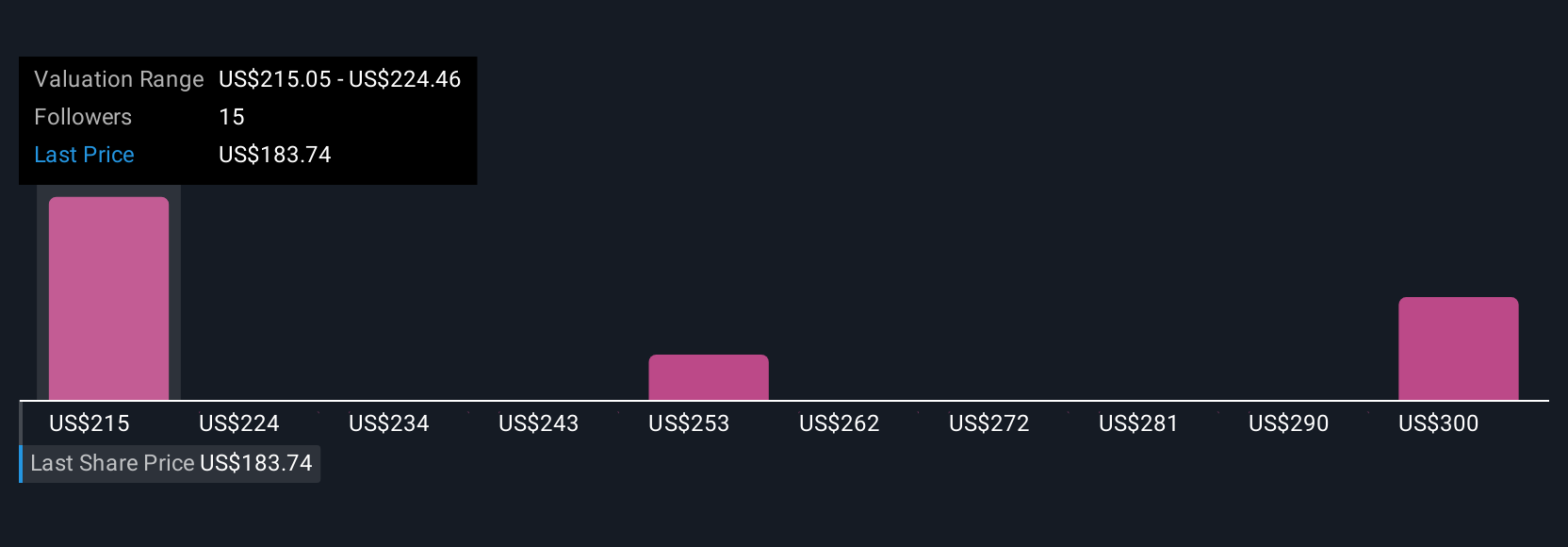

Four members of the Simply Wall St Community currently place IQVIA’s fair value between US$250 and about US$309 per share, reflecting a fairly tight cluster of views. You can weigh those against the recent earnings beat and still present concerns about CRO pricing pressure and mix driven margin headwinds, and decide how that balance might shape IQVIA’s future performance.

Explore 4 other fair value estimates on IQVIA Holdings - why the stock might be worth just $250.00!

Build Your Own IQVIA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IQVIA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IQVIA Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026