- United States

- /

- Life Sciences

- /

- NYSE:IQV

Could IQVIA's (IQV) Expanded GSK Partnership Signal a Shift in Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- On October 2, 2025, GSK and IQVIA announced a significant expansion of their Vaccine Track data tool, now covering 387 U.S. metro areas with a full decade of adult immunization insights.

- This enhancement highlights IQVIA's growing influence in healthcare analytics and the role of advanced data tools in supporting public health organizations to close vaccine coverage gaps.

- We’ll explore how IQVIA’s deepened healthcare analytics partnership with GSK could influence the company’s long-term market positioning.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

IQVIA Holdings Investment Narrative Recap

Owning shares of IQVIA means believing in the long-term demand for healthcare data and analytics, as well as the company’s ability to secure meaningful partnerships that deepen its value to clients such as governments and large pharma companies. The GSK partnership expansion underscores IQVIA’s continued relevance, but in the near term, the major risk remains pricing pressure in the competitive CRO market, which could weigh on earnings even if headline deals attract attention. The news does not appear to materially change this risk or shift the short-term catalyst of accelerated AI-driven analytics adoption, but it reinforces IQVIA’s role at the center of real-world data solutions.

Of the latest announcements, the strategic AI collaboration with NVIDIA is especially relevant when considering the rising importance of advanced analytics and automation in IQVIA’s offerings, including the Vaccine Track tool. This partnership positions IQVIA to respond quickly to growing client demand for AI-enhanced solutions, a factor crucial to maintaining margin stability and competitive advantage as industry pricing and adoption trends evolve.

On the flip side, investors should still be aware of how persistent margin pressures from CRO market competition can impact...

Read the full narrative on IQVIA Holdings (it's free!)

IQVIA Holdings' narrative projects $18.4 billion revenue and $1.8 billion earnings by 2028. This requires 5.4% yearly revenue growth and a $0.6 billion earnings increase from $1.2 billion.

Uncover how IQVIA Holdings' forecasts yield a $215.89 fair value, a 4% upside to its current price.

Exploring Other Perspectives

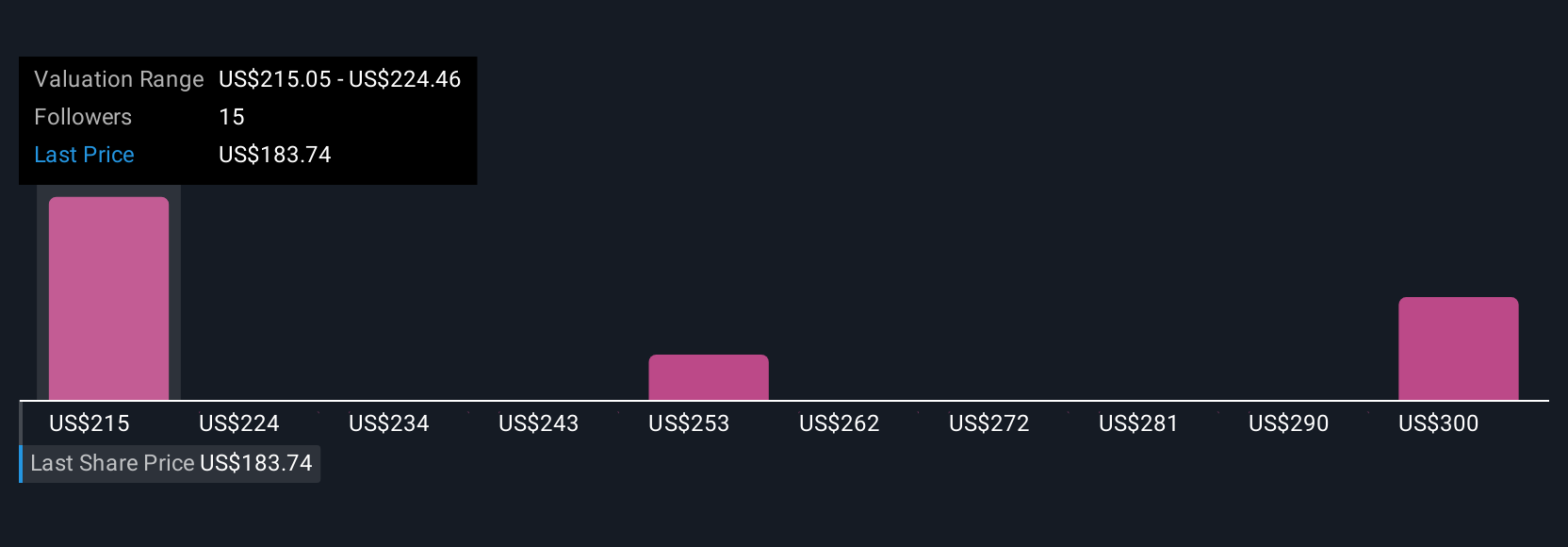

The Simply Wall St Community's fair value estimates for IQVIA range from US$215.89 to US$307.77 based on four different perspectives. Given ongoing pricing pressure in clinical research services, these opinions highlight the need to weigh margin risks when considering your own outlook.

Explore 4 other fair value estimates on IQVIA Holdings - why the stock might be worth as much as 49% more than the current price!

Build Your Own IQVIA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IQVIA Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IQVIA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IQVIA Holdings' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IQV

IQVIA Holdings

Provides clinical research services, commercial insights, and healthcare intelligence to the life sciences and healthcare industries in the Americas, Europe, Africa, and the Asia-Pacific.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives