- United States

- /

- Pharma

- /

- NYSE:ELAN

Will Rising Analyst Optimism and Short Interest Shift Elanco Animal Health's (ELAN) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, analyst sentiment for Elanco Animal Health has shifted further positive, with key research firms maintaining bullish ratings and emphasizing the company's innovative portfolio and strong competitive position across pet and farm animal health markets.

- At the same time, Elanco’s short interest has risen above industry peers, signaling heightened attention from both bullish and bearish investors that could impact future trading activity.

- To better understand how this renewed analyst optimism and increased short interest influence Elanco Animal Health’s outlook, we’ll examine the investment narrative and future growth implications.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Elanco Animal Health Investment Narrative Recap

To own shares in Elanco Animal Health, you have to believe in the long-term growth potential of animal health innovation and the company's ability to leverage its broad product portfolio across pet and farm markets. The recent rise in analyst optimism, matched with increased short interest, highlights mixed sentiment but does not materially change the short-term catalyst, the rapid adoption of new products like Zenrelia and Credelio Quattro. The bigger near-term risk remains Elanco’s execution pace on new product launches and spending control.

Among recent developments, the Zenrelia label update stands out: with the FDA removing certain safety warnings, this advancement could remove a barrier for veterinary adoption and support early sales acceleration. This directly addresses the most critical near-term catalyst for Elanco, the successful launch and ramp of its blockbuster innovations, and suggests ongoing momentum in product execution that analysts are closely watching.

On the other hand, investors should not overlook the increased short interest as it may point to underlying concerns about...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's outlook projects $5.1 billion in revenue and $186.7 million in earnings by 2028. This requires a 4.5% annual revenue growth rate and a decrease in earnings of $247.3 million from the current $434.0 million.

Uncover how Elanco Animal Health's forecasts yield a $20.55 fair value, in line with its current price.

Exploring Other Perspectives

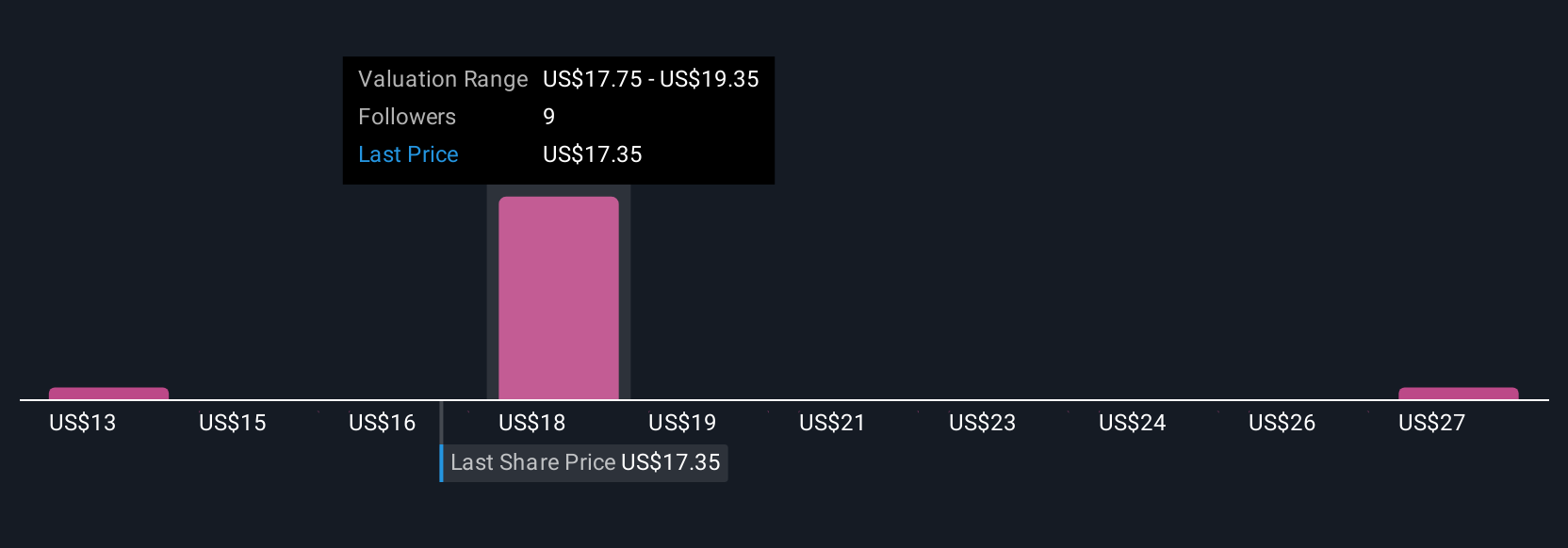

Simply Wall St Community members have set fair value estimates for Elanco Animal Health ranging from US$12.93 to US$31.40, covering three individual viewpoints. While these valuations span a wide range, the company’s ability to deliver strong product launches remains a key factor that could influence whether such optimistic targets are justified. Consider the different perspectives before making any decisions.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth 37% less than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives