- United States

- /

- Pharma

- /

- NYSE:ELAN

A Fresh Look at Elanco Animal Health (ELAN) Valuation Ahead of Investor Day and Rising Analyst Optimism

Reviewed by Kshitija Bhandaru

Elanco Animal Health (NYSE:ELAN) is preparing for its Investor Day on December 9, 2025. Senior leaders are scheduled to discuss the company’s strategy, innovation plans, and financial outlook. Investors are watching closely for new insights.

See our latest analysis for Elanco Animal Health.

Momentum has picked up in a big way for Elanco this year, with the share price racing ahead for a 77.8% year-to-date return that far outpaces the broader sector. While some of this surge reflects renewed optimism around management’s roadmap and innovation ambitions, the company’s 1-year total shareholder return of 65.2% stands in stark contrast to its longer-term five-year total return, which remains down 31.7%. In short, Elanco’s turnaround story is gaining steam, but investors are weighing fresh confidence against the memory of deep past declines.

If you’re interested in uncovering other animal health or biopharma names showing similar momentum, consider using our screener to discover See the full list for free.

The question now is whether Elanco’s powerful rebound leaves room for further gains, or if the recent surge means the company’s expected turnaround and growth are already reflected in the current price.

Most Popular Narrative: 4.3% Overvalued

Elanco’s most widely followed narrative sees fair value a shade below the latest $21.42 closing price, reflecting modest overvaluation at current levels. The momentum behind new product launches and increased profitability sets the tone for what could come next.

“The successful launch of six potential blockbuster products and exceeding innovation revenue targets for 2024 positions Elanco for strong innovation contributions in 2025. This is expected to increase innovation revenue and positively influence earnings. Operational focus on strategic product launches and divesting non-core businesses such as the Aqua division has enabled debt reduction and increased investment capacity, which should improve net margins and financial stability.”

Want the inside track on how aggressive innovation and deep restructuring are shaping Elanco’s value narrative? The real story links impressive product pipelines and stretched market multiples to ambitious future earnings assumptions. Dive into the details to find out which numbers justify this optimism and which might raise eyebrows.

Result: Fair Value of $20.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, caution remains, as foreign exchange headwinds and higher operating costs could dampen earnings even though the company has demonstrated recent innovation momentum.

Find out about the key risks to this Elanco Animal Health narrative.

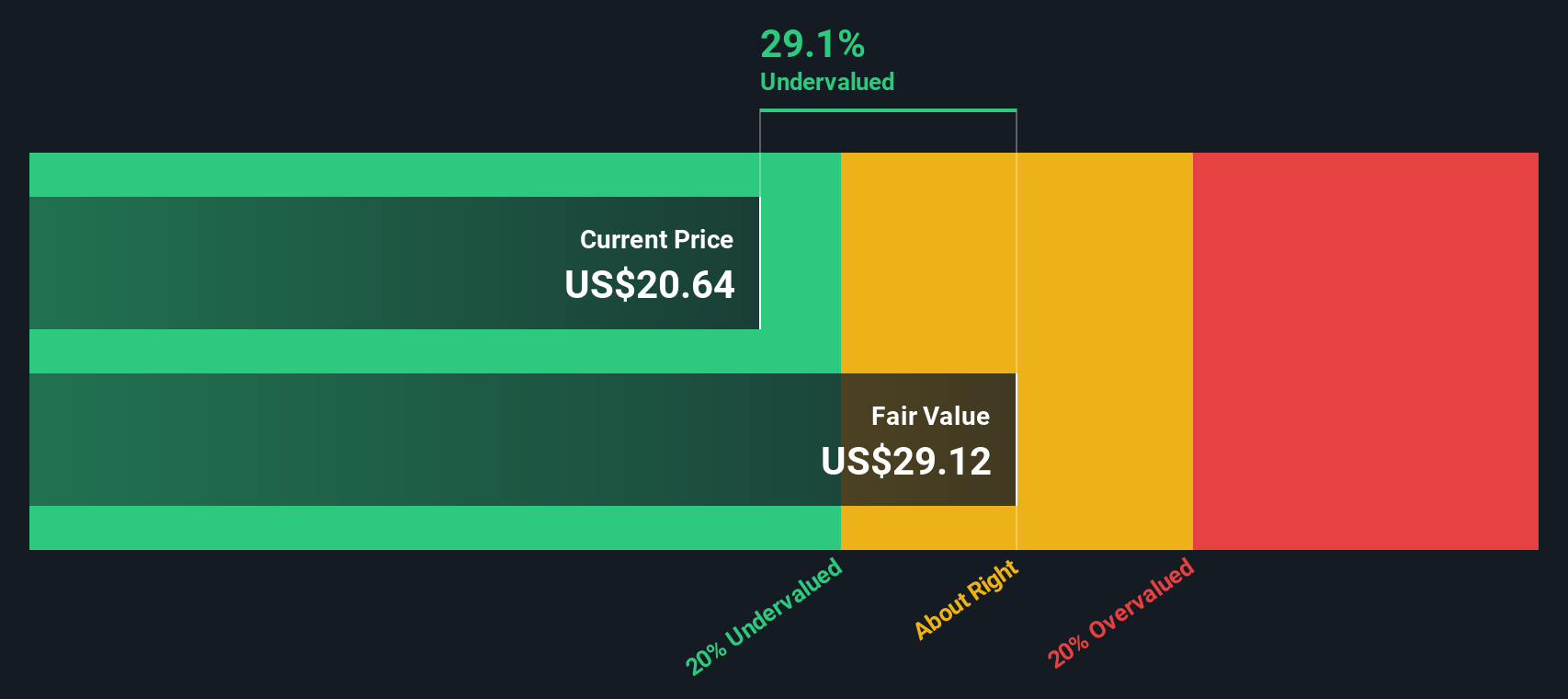

Another View: Discounted Cash Flow Points to Undervaluation

While market multiples suggest Elanco’s shares trade at a premium compared to industry averages and the fair ratio, our SWS DCF model presents a different perspective. The DCF outcome estimates fair value at $31.40, which is significantly higher than today’s share price. Could DCF optimism indicate hidden potential, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elanco Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elanco Animal Health Narrative

If you want to take a closer look or chart your own course, you can explore the numbers for yourself and develop a narrative in just a few minutes. Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while opportunities pass by. Use the Simply Wall Street Screener to pinpoint stocks that could elevate your investing strategy.

- Boost your portfolio with stocks offering strong yields by checking out these 18 dividend stocks with yields > 3% with yields above 3% and a history of reliable payouts.

- Catch the momentum of innovation by scanning these 24 AI penny stocks shaping the future with real artificial intelligence breakthroughs, not just hype.

- Uncover hidden gems with potential upside using these 878 undervalued stocks based on cash flows based on cash flows. The numbers may show value others are missing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives