- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR) Valuation Check After Analyst Upgrade and 2026 Earnings Recovery Narrative

Reviewed by Simply Wall St

Morgan Stanley’s upgrade of Danaher (DHR) has put the stock back on many watchlists, as the firm leans into a 2026 recovery story built on core revenue growth and earnings leverage.

See our latest analysis for Danaher.

That optimism has helped the stock regain some momentum, with a 30 day share price return of 6.73 percent and a 90 day share price return of 14.79 percent, even though the 1 year total shareholder return is still slightly negative.

If Danaher’s recovery story has your attention, it could be a good moment to scan other healthcare names and see which look resilient using healthcare stocks.

With shares still below analysts’ targets but no longer obviously cheap after the recent rally, is Danaher quietly trading at a discount to its long term recovery potential, or is the market already pricing in that 2026 rebound?

Most Popular Narrative: 10.1% Undervalued

With Danaher last closing at $228.46 against a narrative fair value of $254.20, the story leans toward upside built on improving profitability and cash generation.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

Want to see what kind of revenue runway, margin lift, and earnings power this vision assumes? The full narrative lays out a bold profitability and valuation roadmap that may surprise you.

Result: Fair Value of $254.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around China policy shifts and prolonged biotech funding weakness could delay Danaher’s recovery trajectory and challenge those long term margin assumptions.

Find out about the key risks to this Danaher narrative.

Another View: Multiples Tell a Tougher Story

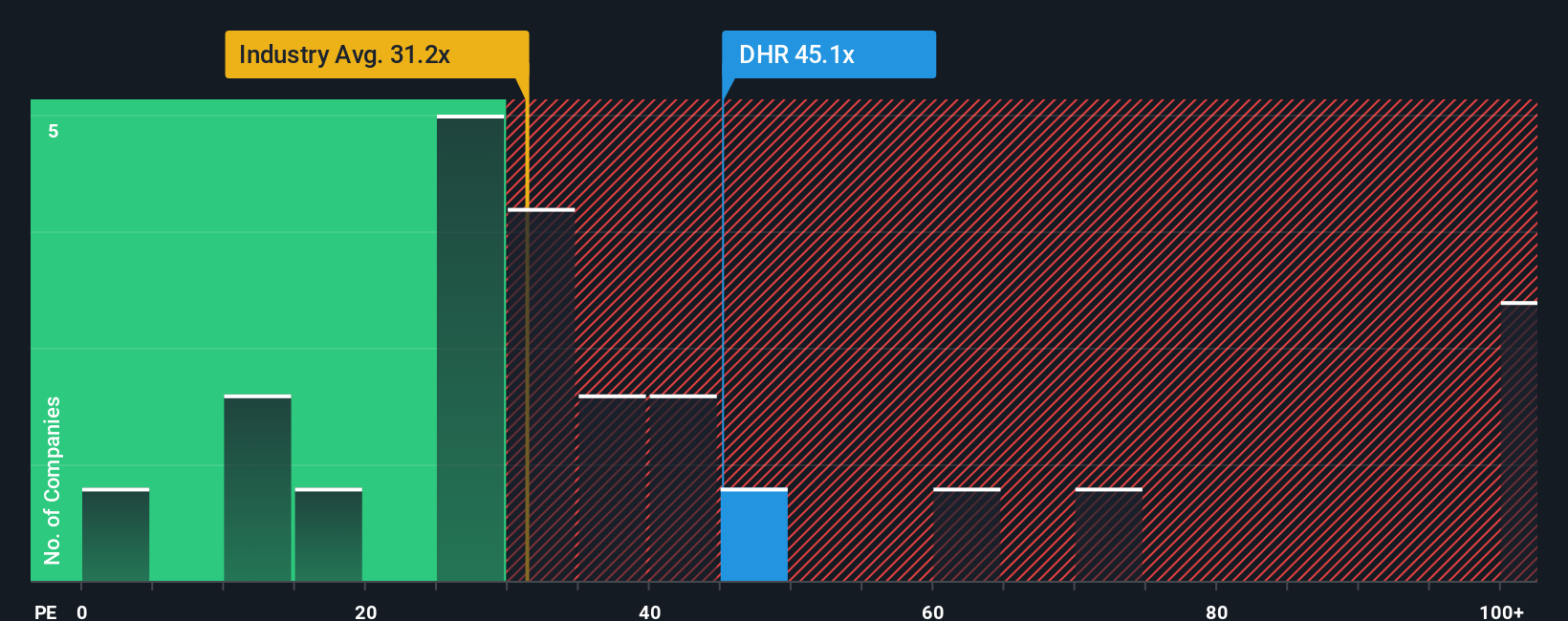

On earnings, Danaher looks far less forgiving. The stock trades at about 46.1 times earnings versus 37 times for the wider life sciences group and a 32.7 times peer average, while its fair ratio sits nearer 32.2 times, suggesting valuation risk if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Danaher research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more investing opportunities?

Before you move on, lock in your next smart idea by scanning targeted stock lists that spotlight growth, income, and innovation you will not want to overlook.

- Target undervalued potential by zeroing in on companies flagged as mispriced using these 915 undervalued stocks based on cash flows so you can act before the market catches up.

- Focus on innovators reshaping industries through AI with these 25 AI penny stocks to keep your portfolio aligned with emerging leaders.

- Strengthen your income stream by pinpointing reliable payers via these 14 dividend stocks with yields > 3%, and avoid leaving attractive yields to others.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026