- United States

- /

- Life Sciences

- /

- NYSE:CRL

What Charles River Laboratories International (CRL)'s Improving Discovery and Safety Assessment Bookings Trend Means For Shareholders

Reviewed by Sasha Jovanovic

- In early December 2025, Charles River Laboratories International, Inc. shared an upbeat business update at the Evercore 8th Annual Healthcare Conference in Coral Gables, highlighting ongoing improvements in its Discovery and Safety Assessment net book-to-bill ratio since the third quarter.

- This steady month-by-month strengthening in orders since mid-2025 offers investors a clearer read-through on underlying demand recovery in one of the company’s core segments.

- With management pointing to improving Discovery and Safety Assessment bookings, we’ll now examine how this update may reshape Charles River’s investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Charles River Laboratories International Investment Narrative Recap

To own Charles River Laboratories, you need to believe that demand for outsourced preclinical research will gradually recover while the company adapts to new testing technologies. The recent disclosure of steadily improving Discovery and Safety Assessment book-to-bill trends supports the near term recovery catalyst, but does not remove key risks around cancellations, funding-sensitive biotech demand, and pressure on margins from global CRO competition.

Among recent announcements, the most relevant alongside the Evercore update is management’s November guidance that fourth quarter 2025 organic revenue will still decline year on year, with DSA revenue only stable to slightly below the third quarter. Together, these signals suggest improving order momentum but a still fragile backdrop in which any renewed softness in bookings or cancellations could delay a return to organic growth.

Yet even with improving DSA bookings, investors should be aware that rising cancellations and backlog reliance could still...

Read the full narrative on Charles River Laboratories International (it's free!)

Charles River Laboratories International's narrative projects $4.4 billion revenue and $483.2 million earnings by 2028. This requires 2.8% yearly revenue growth and a $552.4 million earnings increase from $-69.2 million today.

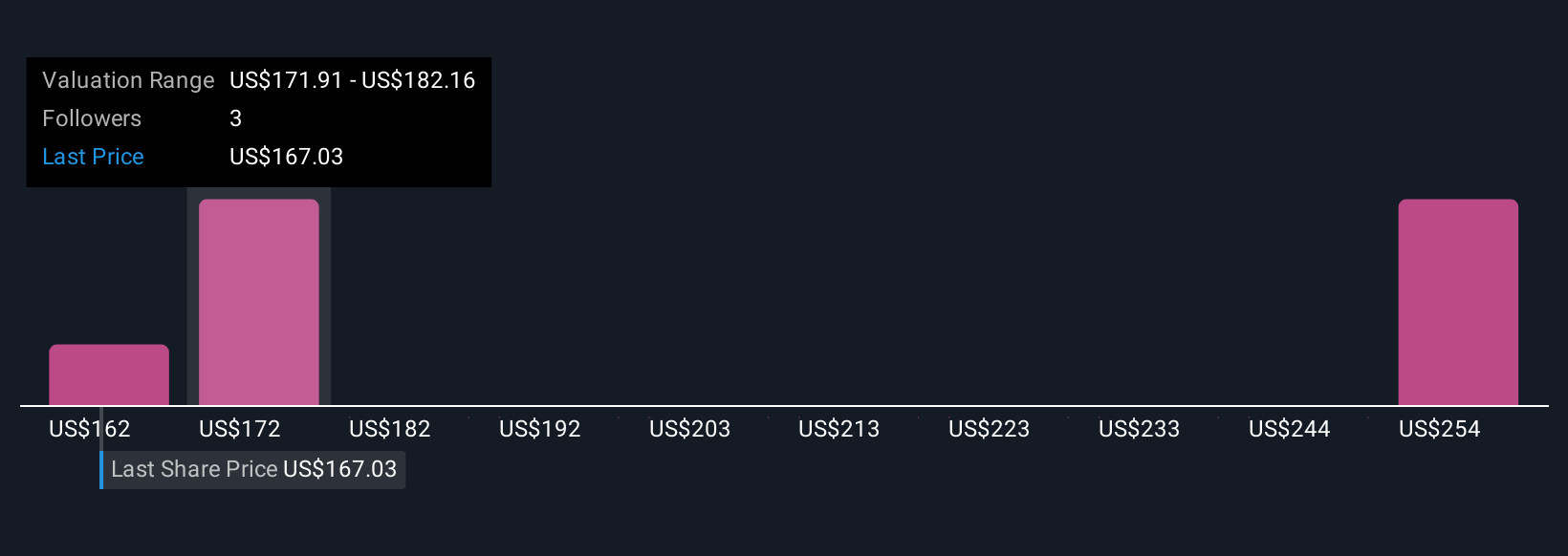

Uncover how Charles River Laboratories International's forecasts yield a $188.93 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Charles River span US$188.93 to US$254.80 across 2 independent views, underscoring how far opinions can diverge. Against that backdrop, the recent month by month strengthening in DSA bookings raises important questions about how durable any recovery in demand and earnings might prove to be over time.

Explore 2 other fair value estimates on Charles River Laboratories International - why the stock might be worth just $188.93!

Build Your Own Charles River Laboratories International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles River Laboratories International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles River Laboratories International's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026