- United States

- /

- Life Sciences

- /

- NYSE:CRL

Former FDA Leader to Lead Scientific Advisory Board Could Be a Game Changer for Charles River (CRL)

Reviewed by Sasha Jovanovic

- Earlier this month, Charles River Laboratories International created a global Scientific Advisory Board led by former FDA official Dr. Namandjé N. Bumpus, aiming to advance New Approach Methodologies (NAMs) that reduce animal testing in therapeutic and chemical development.

- This emphasis on in vitro, in silico, and non-animal testing, coupled with a new partnership enabling clients access to innovative toxicity assays, highlights the company's growing commitment to scientific innovation and regulatory adaptation.

- We’ll explore how appointing a former FDA leader to champion NAMs could influence Charles River Laboratories' long-term growth trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

Charles River Laboratories International Investment Narrative Recap

To be a shareholder in Charles River Laboratories International, you need confidence that the push toward advanced therapeutics and non-animal testing methods will translate to long-term demand for specialized preclinical services. The recent creation of a Scientific Advisory Board led by a former FDA official underscores the company's commitment to innovation, but does not materially alter the most important short-term catalyst: stabilization in biopharma R&D demand, nor does it resolve the risk of a future regulatory pivot away from animal testing that could affect the core business.

Among recent announcements, the collaboration with Toxys to provide access to human stem cell–based assays for developmental toxicity stands out. This move aligns closely with Charles River's NAMs initiative, directly tying into investor hopes that the company can evolve its offerings as industry and regulatory preferences shift, and potentially buffering against longer-term risks to traditional revenue streams.

By contrast, investors should be aware that even with these new capabilities, Charles River’s heavy reliance on animal-based preclinical research means...

Read the full narrative on Charles River Laboratories International (it's free!)

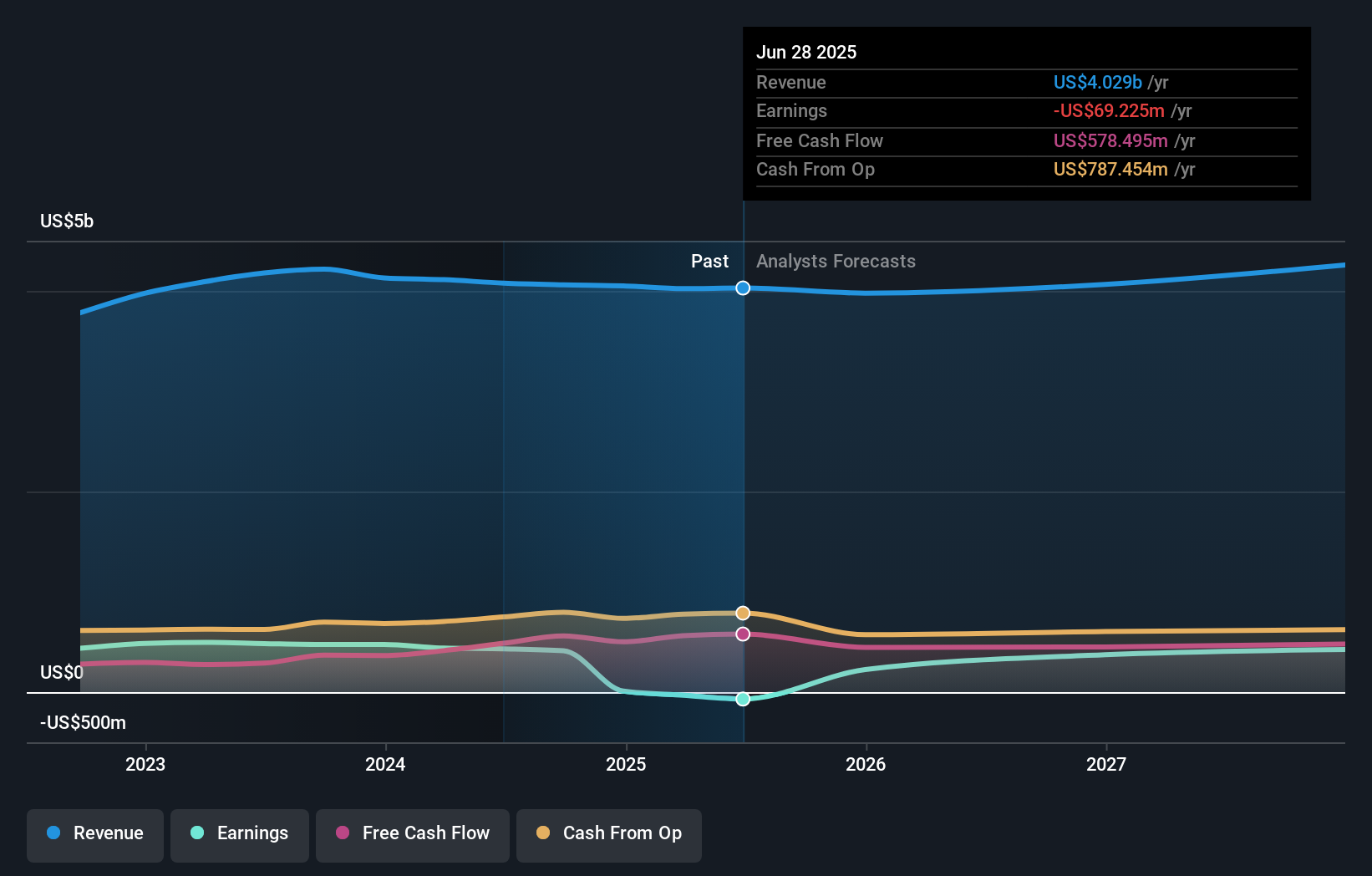

Charles River Laboratories International is projected to reach $4.4 billion in revenue and $483.2 million in earnings by 2028. This outlook assumes annual revenue growth of 2.8% and an earnings increase of $552.4 million from the current loss of $-69.2 million.

Uncover how Charles River Laboratories International's forecasts yield a $185.87 fair value, a 4% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community submitted 1 fair value estimate for Charles River Laboratories, all at US$185.87, reflecting consensus prior to this month's strategic changes. As investor views can vary significantly, keep in mind that the ongoing shift toward non-animal testing methods could reshape future growth prospects and warrants close monitoring.

Explore another fair value estimate on Charles River Laboratories International - why the stock might be worth as much as $185.87!

Build Your Own Charles River Laboratories International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles River Laboratories International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles River Laboratories International's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives