- United States

- /

- Life Sciences

- /

- NYSE:CRL

Charles River Laboratories International (CRL) Expands Oncology Partnerships With PICI and CHLA

Reviewed by Simply Wall St

Charles River Laboratories International (CRL) recently announced strategic collaborations to advance oncology research. This news comes amid a 2.91% price increase over the past month. During this period, the broader market, including major indexes like the S&P 500, rose to record highs, bolstered by inflation data indicating potential interest rate cuts by the Federal Reserve. While these macroeconomic factors likely influenced CRL's share price positively, the company's efforts in oncology and cell therapy research, highlighted by its partnerships with the Parker Institute for Cancer Immunotherapy and Children's Hospital Los Angeles, likely complemented the broader market's positive momentum.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

The recent strategic collaborations announced by Charles River Laboratories International have the potential to enhance their positioning in the oncology research sector, thereby complementing the company's narrative of investing in advanced therapeutics and digitalization. Over the past year, the company's total shareholder return, factoring in share price and dividends, experienced a 20.83% decline, indicating challenges despite broader industry tailwinds. This performance contrasts with the US Life Sciences industry, which saw a decline of 21.6%, and the US market, which gained 20% over the same period.

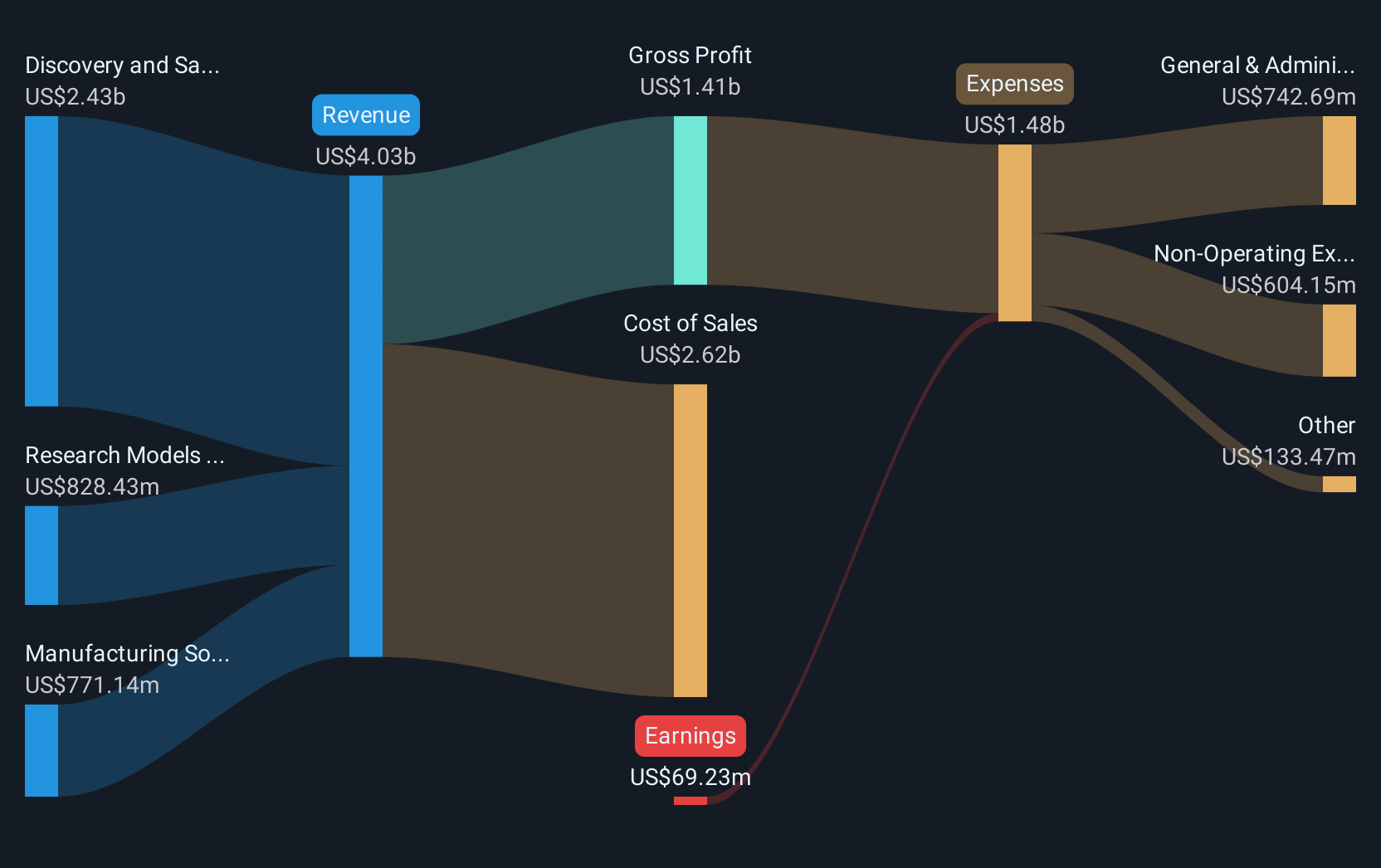

Looking ahead, partnerships such as those with the Parker Institute for Cancer Immunotherapy and Children's Hospital Los Angeles could positively influence Charles River's revenue and earnings forecasts. Analysts expect annual revenue growth of 2.8% and a significant turnaround in earnings from a loss to a gain of US$483.2 million by 2028. While the current share price of US$153.27 remains below the consensus target of US$177.07, reflecting a 15.53% potential increase, investor confidence will largely depend on the successful execution of these collaborative initiatives and the resolution of existing challenges within the company's operational landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives