- United States

- /

- Life Sciences

- /

- NYSE:CRL

Charles River Laboratories (CRL): Do Analyst Upgrades Signal a Shift in Management Credibility or Market Perception?

Reviewed by Sasha Jovanovic

- In recent days, multiple prominent analysts, including Barclays, Jefferies, and Citigroup, have issued upgrades for Charles River Laboratories International, reflecting rising confidence in the company's business outlook. This wave of analyst optimism appears to have played a significant role in shifting investor sentiment toward the company.

- We'll examine how this surge in analyst upgrades could influence Charles River Laboratories International's investment narrative and future prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Charles River Laboratories International Investment Narrative Recap

Being a shareholder in Charles River Laboratories International means believing in the long-term need for specialized preclinical research services, particularly as the pharmaceutical industry advances with complex therapeutics and expanding R&D pipelines. While the recent surge in analyst upgrades has lifted investor sentiment, it does not materially change the near-term focus on backlog conversion and reduced cancellations, which remain the key catalyst and risk for the business. Among recent announcements, the reaffirmation of 2025 earnings guidance stands out, especially after the prior reduction in revenue expectations. This confirmation helps stabilize confidence despite recent CFO turnover and highlights management's commitment to operational execution, crucial for converting backlog and restoring higher-quality earnings. Yet, despite more positive analyst signals, a lingering concern for investors to keep in mind is the company’s exposure to volatile R&D funding and recent softness in client demand, particularly as...

Read the full narrative on Charles River Laboratories International (it's free!)

Charles River Laboratories International is projected to reach $4.4 billion in revenue and $483.2 million in earnings by 2028. This outlook is based on an annual revenue growth rate of 2.8% and a $552.4 million increase in earnings from the current -$69.2 million.

Uncover how Charles River Laboratories International's forecasts yield a $179.73 fair value, in line with its current price.

Exploring Other Perspectives

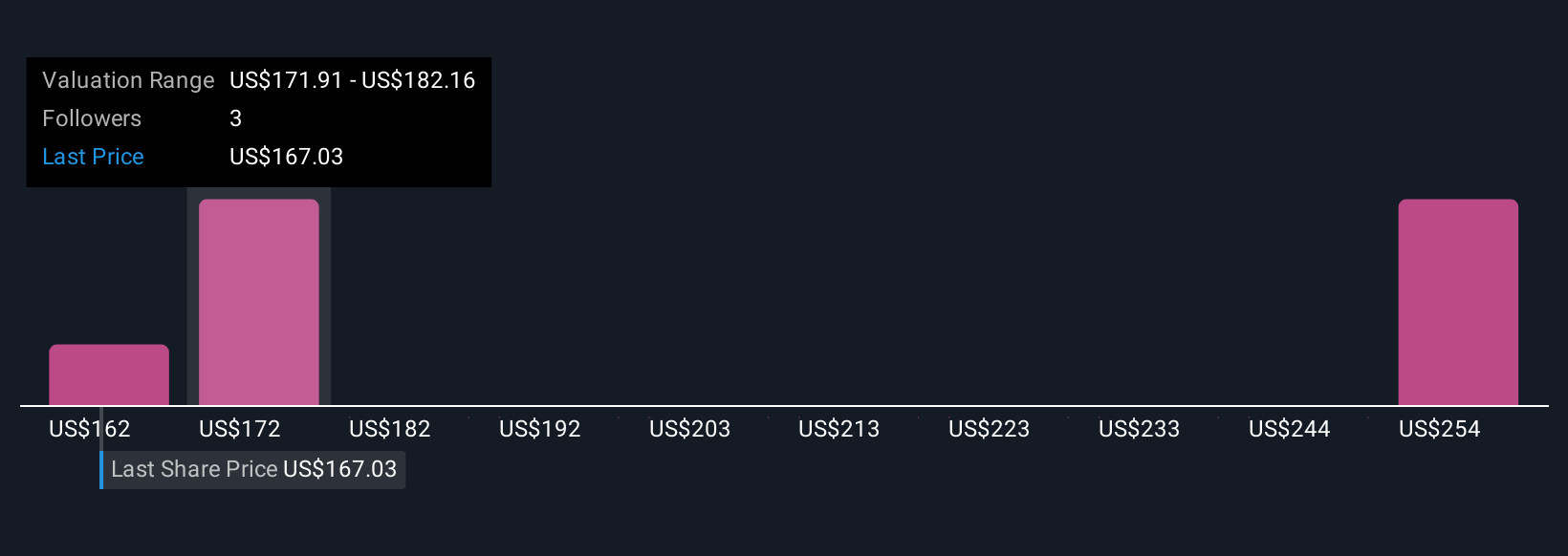

Fair value estimates from the Simply Wall St Community range widely, from US$161.65 to US$262.89, across three individual analyses. While investor opinions differ, persistent demand softness and ongoing revenue pressure could influence both short-term sentiment and longer-term performance, pointing to the importance of understanding all viewpoints.

Explore 3 other fair value estimates on Charles River Laboratories International - why the stock might be worth 8% less than the current price!

Build Your Own Charles River Laboratories International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Charles River Laboratories International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles River Laboratories International's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives