- United States

- /

- Life Sciences

- /

- NYSE:CRL

A Fresh Look at Charles River Laboratories (CRL) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Charles River Laboratories International (CRL) stock has shown steady gains over the past month, returning 21%. Investors are watching recent momentum as the company posts annual revenue and net income growth in its latest financial update.

See our latest analysis for Charles River Laboratories International.

The recent momentum in Charles River Laboratories International’s shares has grabbed attention, with a 1-month share price return of 21.2% and a solid 7-day gain that signals renewed confidence. While the current price sits at $188.26, the 1-year total shareholder return is just 1.3%, indicating that despite short-term enthusiasm, longer-term investors have seen only modest gains overall.

If you’re inspired by this recent move and want to broaden your perspective, consider exploring See the full list for free..

With share prices climbing and recent financial results showing growth, the key question for investors now is whether Charles River Laboratories International offers hidden value or if the market has already factored in all of its future potential.

Most Popular Narrative: Fairly Valued

With Charles River Laboratories International's fair value estimated at $185.87 and a last close of $188.26, the narrative suggests shares align closely with analyst forecasts. This reflects recent optimism but leaves little room for misplaced exuberance. The following quote sheds light on what underpins this consensus view.

Analysts are assuming Charles River Laboratories International's revenue will grow by 2.8% annually over the next 3 years. Analysts assume that profit margins will increase from -1.7% today to 11.0% in 3 years time.

Ever wondered what drives this strikingly precise valuation? One bold set of growth assumptions and a major turnaround in profitability anchor the entire narrative. Crack open the numbers predicting a multiyear transformation to see what’s fueling the story behind the target price.

Result: Fair Value of $185.87 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the company's reliance on animal-based research and ongoing price competition. Either of these factors could dampen future growth prospects.

Find out about the key risks to this Charles River Laboratories International narrative.

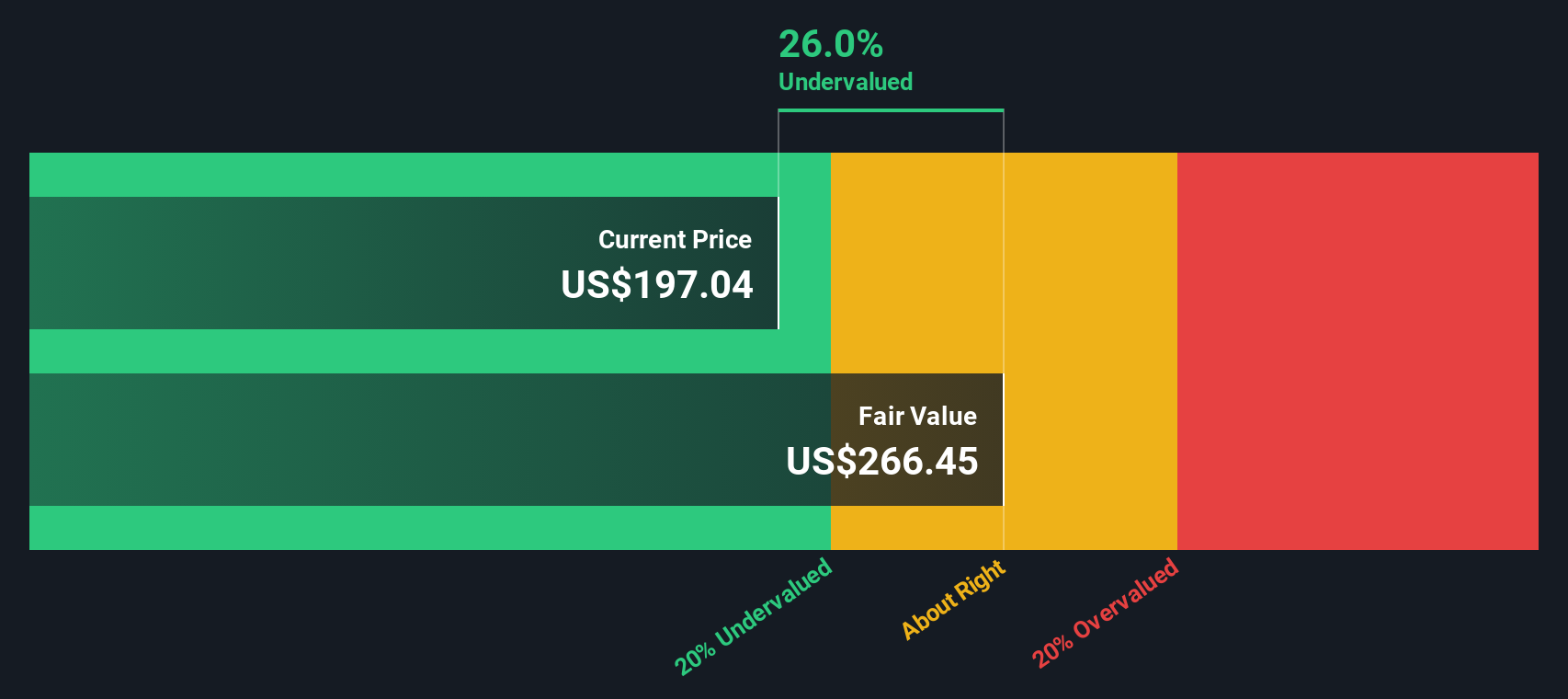

Another View: Discounted Cash Flow Suggests Undervaluation

Looking beyond price-to-sales and peer comparisons, the SWS DCF model offers an alternative perspective. According to this approach, Charles River Laboratories International could be trading around 29% below its fair value. This signals a potential opportunity that the market might be overlooking. Does the DCF view reflect hidden upside, or is the market right to be skeptical?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Charles River Laboratories International Narrative

If you have your own perspective or want to dig deeper into the numbers, it's easy to craft a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your strategy further and ensure you don’t overlook the next big winner. Use the Simply Wall Street Screener to uncover new opportunities you might have missed.

- Capture steady income with strong yields by reviewing these 17 dividend stocks with yields > 3%, which consistently reward shareholders and stand out for sustainable returns.

- Spot fast-growing companies leading artificial intelligence by tapping into these 24 AI penny stocks, featuring innovators driving advancements in automation and machine learning.

- Seize untapped value in the market with these 881 undervalued stocks based on cash flows, identified as trading below intrinsic worth and offering serious potential for future upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives