- United States

- /

- Pharma

- /

- NYSE:BMY

Analyzing the Market Rotation into Pharmaceuticals and Why Bristol-Myers Squibb (NYSE:BMY) has Value and Dividend Potential

Healthcare stocks have posted positive returns this week, with Pharma companies trending at a 4.26% a 7-day return. Our Market analysis revealed that Bristol-Myers Squibb Company (NYSE:BMY) is both a growth and stable dividend stocks, and today we will explore the fundamentals behind the stock.

For a quick overview, here are the key takeaways from our analysis:

- BMY has stable earnings, low financial risk and is possibly undervalued.

- The stock may be a good dividend option on account of its 2.8% yield.

- Investors may become more interested in on-shore stocks that are not exposed to global supply chain risks.

You can explore the full financial potential of Bristol-Myers Squibb in our daily report.

Market Trends

It seems that investors are focused on reducing the risk of supply chain dependence on China, and part of them are turning to on-shore industries such as pharmaceuticals.

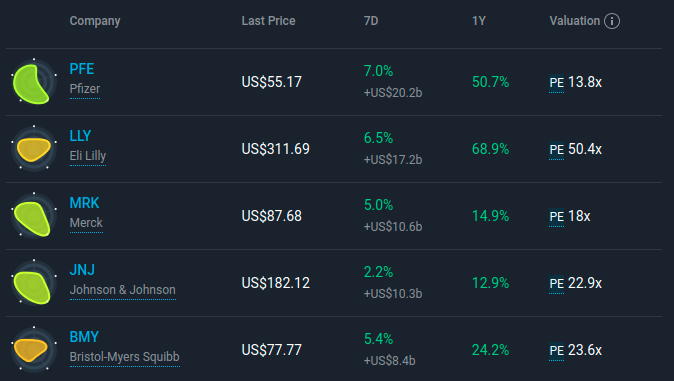

When filtering through returns for pharma stocks, we can see that BMY ranks in the top 5 gainers in the industry. The company also seems to have a decent return in the last 12 months and a 23x PE. Currently, the median PE ratio for the pharma industry is 22.4x, while it 3-Year Average is 20x. It looks like BMY is slightly above of these averages, which means that investors are expecting the stock earnings to grow slightly more than peers.

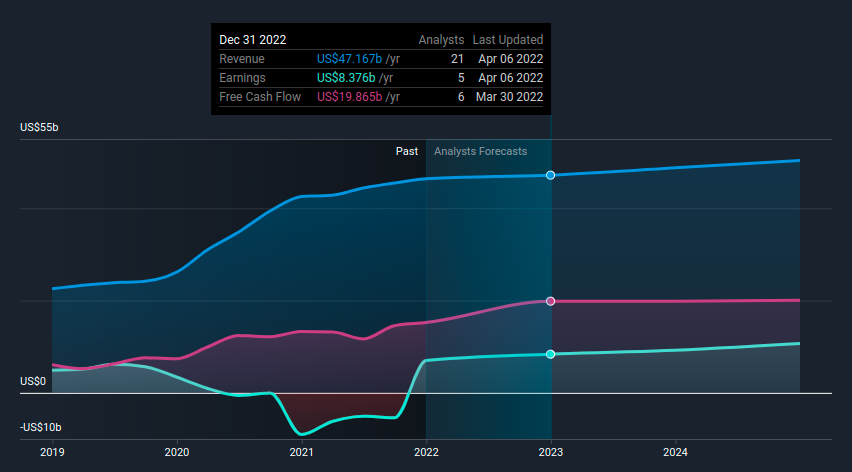

While earnings are around US$7b for BMY, the cash flows paint a different picture.

It seems that BMY has more free cash flows than earnings and both are projected to slightly increase in 2023 but keep stable after that.

Valuation

Considering that the intrinsic value of a company is the present value of future cash flows, we can use a simple stable state model to estimate the intrinsic value of BMY.

Given that there is little future growth implied, the calculation is pretty straightforward:

Next year's free cash flows * discount rate, or US$19.865b / 0.0475 = US$418b.

We can also opt to trust earnings as our base, and instead of free cash flows use future earnings:

US$8.376 / 0.0475 = US$176b this is close to the current US$165.3b market cap.

Our estimates for next year's earnings and cash flows are based on the average analysts' forecasts for these values as seen in the chart below:

You can also look at our full intrinsic valuation model for Bristol-Meyers Squibb in order to get a better perspective on the stock potential. While both models indicate that BMY is undervalued.

Besides the valuation, supply chain risk reductions, investors also like BMY because of the quality of its dividends. We will present the dividend analysis in the next segment.

Dividend Analysis

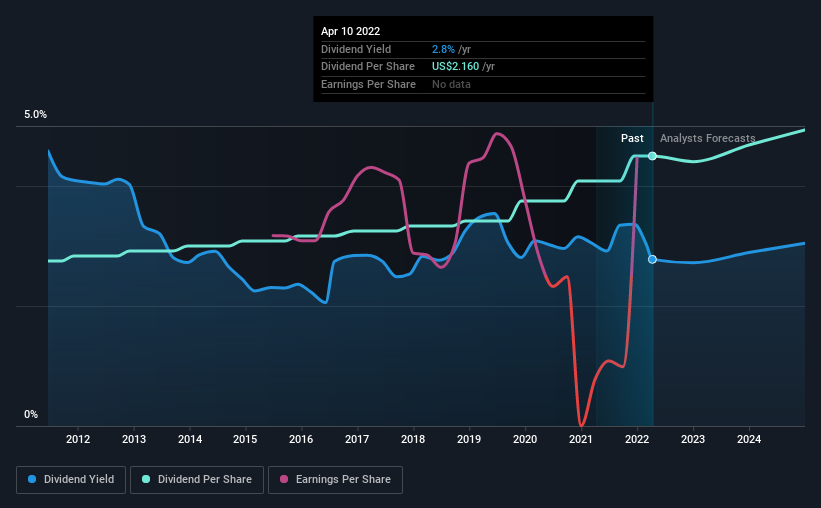

The stock pays a medium 2.8% yield, but investors probably think the long payment history suggests Bristol-Myers Squibb has some staying power.

The company also returned around 3.8% of its market capitalization to shareholders in the form of stock buybacks over the past year.

There are a few simple ways to reduce the risks of buying Bristol-Myers Squibb for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut.

In the last year, Bristol-Myers Squibb paid out 64% of its profit as dividends. This is a fairly normal payout ratio among most businesses.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Of the free cash flow it generated last year, Bristol-Myers Squibb paid out 29% as dividends, suggesting the company generates more cash than is shown by earnings.

Remember, you can always get a snapshot of Bristol-Myers Squibb's latest financial position, by checking our visualisation of its financial health.

Dividend Growth

During the past 10-year period, the first annual payment was US$1.3 in 2012, compared to US$2.2 last year. This works out to be a compound annual growth rate (CAGR) of approximately 5.0% a year over that time.

This closely follows the annual earnings growth of around 4.3% a year for the past five years, which means that the company is paying out a fair share to investors.

Conclusion

Bristol-Myers Squibb is becoming more attractive to investors because it is not as exposed to global supply chain risks, has predictable earnings, and may be somewhat undervalued.

The company may also be considered a good dividend stock, on account of its medium 2.8% yield and stable payout history.

Investors that believe in the future product pipeline of BMY may want to explore the stock's financial profile in order to get a full picture of its investment potential (or lack of).

Taking the analysis a bit further, we've identified 3 warning signs for Bristol-Myers Squibb that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives