- United States

- /

- Pharma

- /

- NYSE:BHC

Why Bausch Health (BHC) Is Up 9.1% After John Paulson Deepens His Stake – And What's Next

Reviewed by Sasha Jovanovic

- In late November 2025, investor John Paulson increased his holdings in Bausch Health Companies by 2,500,000 shares, bringing his total stake to 73,255,869 shares and making the position a major portion of his portfolio.

- This sizeable commitment from a high-profile merger-arbitrage investor has drawn fresh attention to Bausch Health’s balance-sheet repair efforts and late-stage pipeline in gastroenterology, hepatology, and aesthetics.

- Next, we’ll examine how Paulson’s larger ownership stake may influence Bausch Health’s investment narrative, particularly its debt reduction and pipeline execution.

Find companies with promising cash flow potential yet trading below their fair value.

Bausch Health Companies Investment Narrative Recap

To own Bausch Health today, you have to believe the company can keep repairing its balance sheet while converting its late stage GI and hepatology pipeline into sustainable cash flow before Xifaxan pricing pressure bites. John Paulson’s larger stake does not change the core near term story, where the key catalyst remains execution on debt reduction and pipeline milestones, and the biggest risk is still potential U.S. Medicare price cuts for Xifaxan.

Among recent announcements, the planned US$7.0 billion refinancing package of new notes and a term loan stands out, because it goes straight to the heart of Bausch Health’s leverage problem. For shareholders watching Paulson’s investment, this refinancing effort is a practical test of management’s ability to lower interest expense and free up more cash for product development and possible future acquisitions.

Yet against this improving balance sheet picture, the unresolved Medicare pricing threat to Xifaxan is something investors should be aware of...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies' narrative projects $10.1 billion revenue and $264.4 million earnings by 2028. This requires a 0.9% yearly revenue decline and an earnings increase of about $166 million from $98.0 million today.

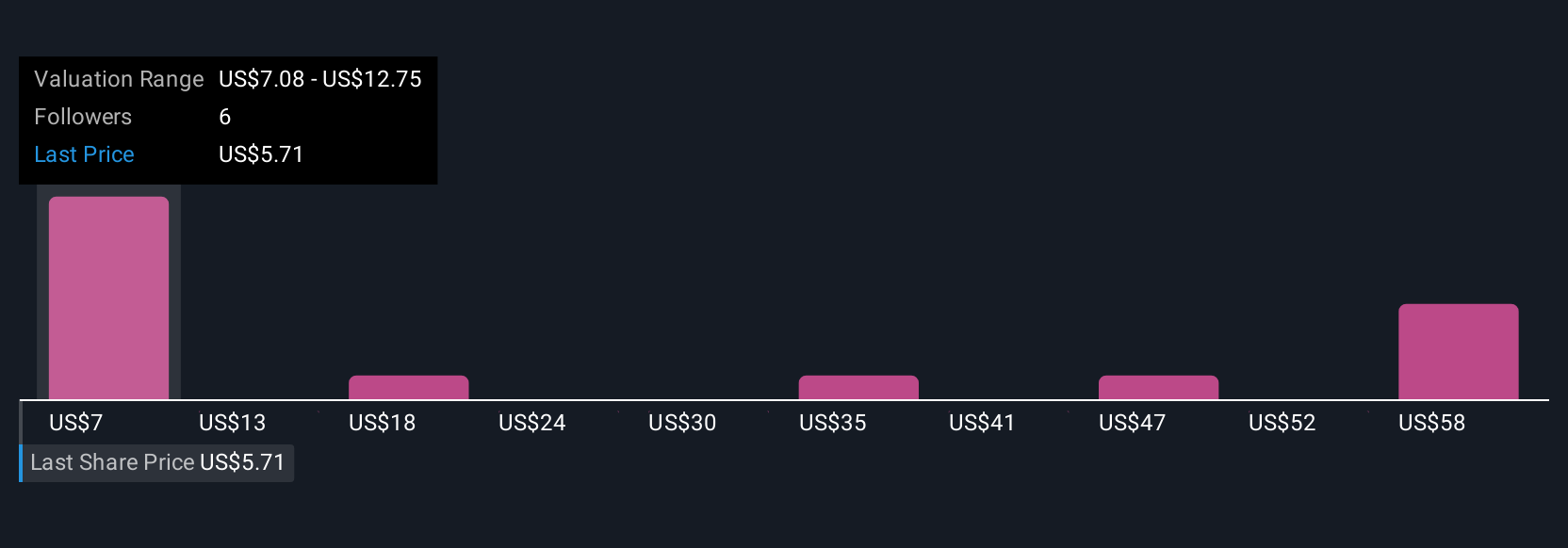

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Bausch Health between about US$7 and US$69 per share, reflecting very different views on the company’s future. As you weigh those opinions, remember that Bausch Health’s heavy reliance on Xifaxan and the Salix segment concentrates revenue risk in a small group of products.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth over 9x more than the current price!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026