- United States

- /

- Biotech

- /

- NYSE:ABBV

Is It Too Late to Consider AbbVie After the Gilgamesh Acquisition Talks?

Reviewed by Bailey Pemberton

If you are wondering what to do with AbbVie stock right now, you are far from alone. This year, AbbVie has quietly been one of the top performers, up a staggering 28.3% since January and clocking in a strong 8.3% gain over the last month alone. Even over the past week, the stock managed a 3.2% bump. For a pharmaceutical giant that is well past its initial growth phase, those are definitely not the returns you would expect from a so-called “mature” company.

Much of Wall Street’s new optimism appears to trace back to several deal headlines fueling speculation about growth potential. Most recently, AbbVie made waves by entering discussions to acquire Gilgamesh Pharmaceuticals, a mental health therapeutics company, in a deal valued near $1B. Analysts have also highlighted AbbVie’s looming acquisition of Bretisilocin, a promising neuro pipeline asset, further strengthening the story that management is not resting on its laurels. With AbbVie participating in a pharma consortium pushing the limits of AI in drug discovery, investors are sensing that AbbVie is trying to shape the future of medicine rather than just keep pace with it.

But all this buzz does beg the question: has AbbVie’s share price already run too far ahead of reality, or are we still looking at a stock that is fairly valued, or even undervalued? According to our valuation scorecard, AbbVie is currently undervalued in just 2 out of 6 major checks, giving it a value score of 2. That hints at a nuanced story, and one that’s perfect to dig into by breaking down what these valuation measures really tell us. We will walk through those approaches next, and stick around, at the end, we will consider a smarter way to think about valuation altogether.

AbbVie scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. For AbbVie, this approach uses recent cash flow results as a baseline, then factors in growth expectations and risk to determine what the business is really worth right now.

AbbVie's latest trailing twelve months Free Cash Flow stands at $18.37 billion. Analyst forecasts have the company's annual Free Cash Flow climbing steadily, reaching $32.33 billion by the end of 2029. For the years beyond, Simply Wall St extends these projections using reasonable assumptions with Free Cash Flow expected to rise to over $40.77 billion by 2035.

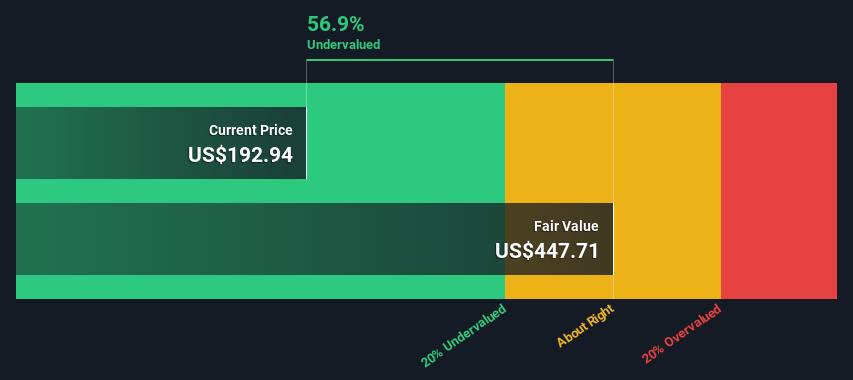

According to this two-stage DCF model, AbbVie's intrinsic value is $434.25 per share. This figure is 47.0% higher than the current share price, implying the stock is significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 47.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AbbVie Price vs Earnings

The price-to-earnings (PE) ratio is widely considered the gold standard for valuing established, profitable companies like AbbVie. It shows how much investors are willing to pay for each dollar of earnings and offers a direct link between a company’s market price and its underlying performance. In theory, higher growth and lower risk deserve a higher PE ratio, while slower growth or higher risk might justify a lower one.

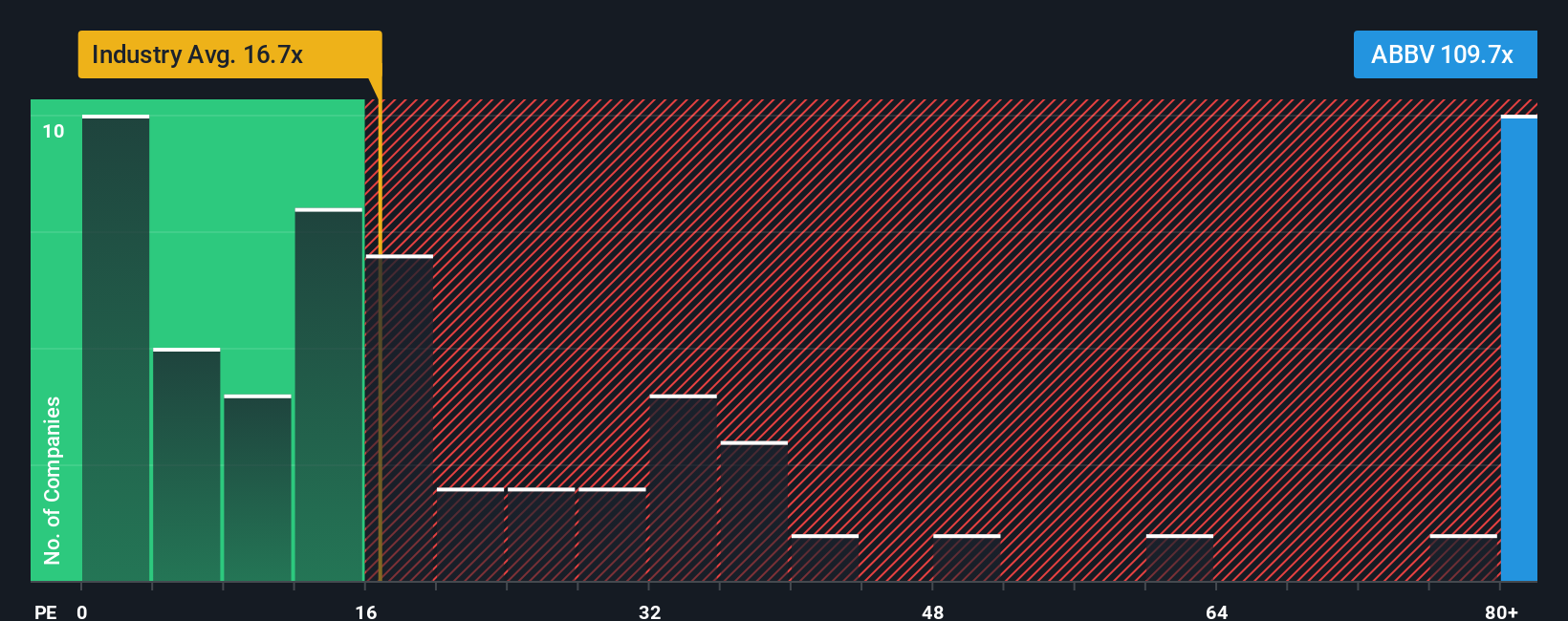

Currently, AbbVie trades at a PE ratio of 109.2x. To put this figure in context, the biotech industry average is just 16.5x, while AbbVie’s key peers sit around 22.1x. That is a massive premium, and it raises questions about how much growth or earnings stability the market is expecting from AbbVie compared to the average biotech stock.

This is where the Simply Wall St "Fair Ratio" enters the picture. Unlike broad industry or peer averages, the Fair Ratio is a proprietary benchmark that weighs multiple factors unique to AbbVie, such as growth forecasts, risk profile, profit margins, market capitalization, and the specifics of the biotech space. For AbbVie, the Fair Ratio is calculated at 36.4x. This suggests that, even after accounting for the company’s strengths, AbbVie’s current valuation significantly overshoots what would be considered fair on a balanced, data-driven basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

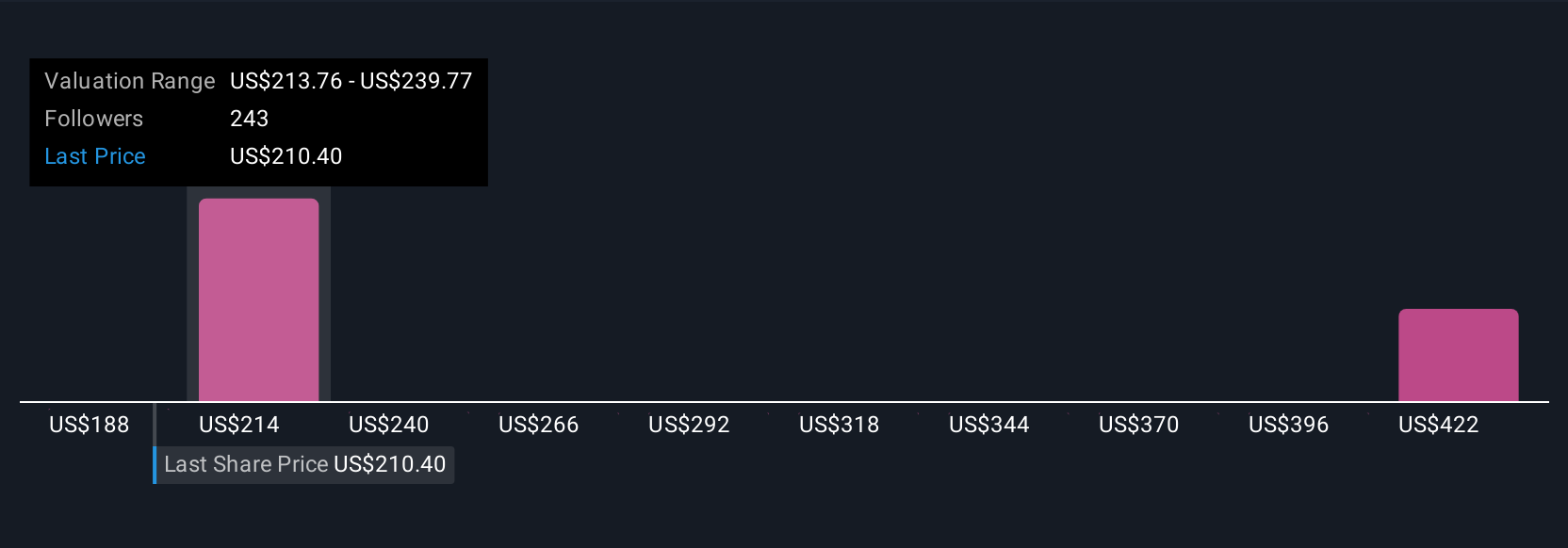

Earlier, we mentioned a better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about what you believe is driving AbbVie’s future. It connects the company’s strategy, pipeline, and risks to your own best estimate for its future revenue, earnings, and margins, then translates these beliefs into a fair value for the share price. Narratives help make investing personal and powerful, since you can openly attach your rationale to your numbers and keep track as new information arrives.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors, making it easy to see and compare different viewpoints. Each Narrative links its fair value directly to a financial forecast, so you can see when your story indicates it is time to buy or sell by comparing your fair value to the current market price. As news, earnings releases, or analyst updates land, Narratives dynamically update, helping you stay in sync with the real world.

For example, some investors have built bullish narratives on AbbVie with fair values as high as $255, banking on robust immunology innovation. Others are more cautious with estimates as low as $170, citing competition and margin pressures, and both are just a click away for you to review.

Do you think there's more to the story for AbbVie? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Medium-low risk with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives