- United States

- /

- Biotech

- /

- NYSE:ABBV

Assessing AbbVie’s (ABBV) Valuation After New Cancer Data, EPKINLY Approval, and Dividend Hike

Reviewed by Simply Wall St

AbbVie (ABBV) has packed several catalysts into a few weeks, including fresh blood cancer data heading to ASH 2025, an FDA green light for EPKINLY in follicular lymphoma, and a dividend hike.

See our latest analysis for AbbVie.

Those oncology and neuroscience wins are landing against a strong tape, with AbbVie’s latest share price at $230.24 and a roughly 28 percent year to date share price return, while its five year total shareholder return of about 157 percent signals durable momentum rather than a short term pop.

If AbbVie’s mix of growth and income appeals, it is also worth exploring pharma stocks with solid dividends as another way to find established drug makers pairing pipelines with sizable payouts.

Yet with shares already up more than 28 percent this year and trading only modestly below Wall Street targets, is AbbVie still flying under the radar as a value and growth play, or has the market already priced in its next leg higher?

Most Popular Narrative: 5.5% Undervalued

With AbbVie last changing hands at $230.24, the most followed narrative points to a modest upside from an estimated fair value around the mid $240s, hinging on a sharp profitability reset.

Analysts expect earnings to reach $20.8 billion (and earnings per share of $11.87) by about September 2028, up from $3.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $15.9 billion.

Want to see what justifies such a steep earnings ramp and a richer future profit multiple, even as revenue growth cools compared to the market and margins widen dramatically? The narrative breaks down how these moving parts combine into its fair value call.

Result: Fair Value of $243.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure or setbacks in key immunology and neuroscience assets could quickly challenge those optimistic earnings and valuation assumptions.

Find out about the key risks to this AbbVie narrative.

Another Angle on Valuation

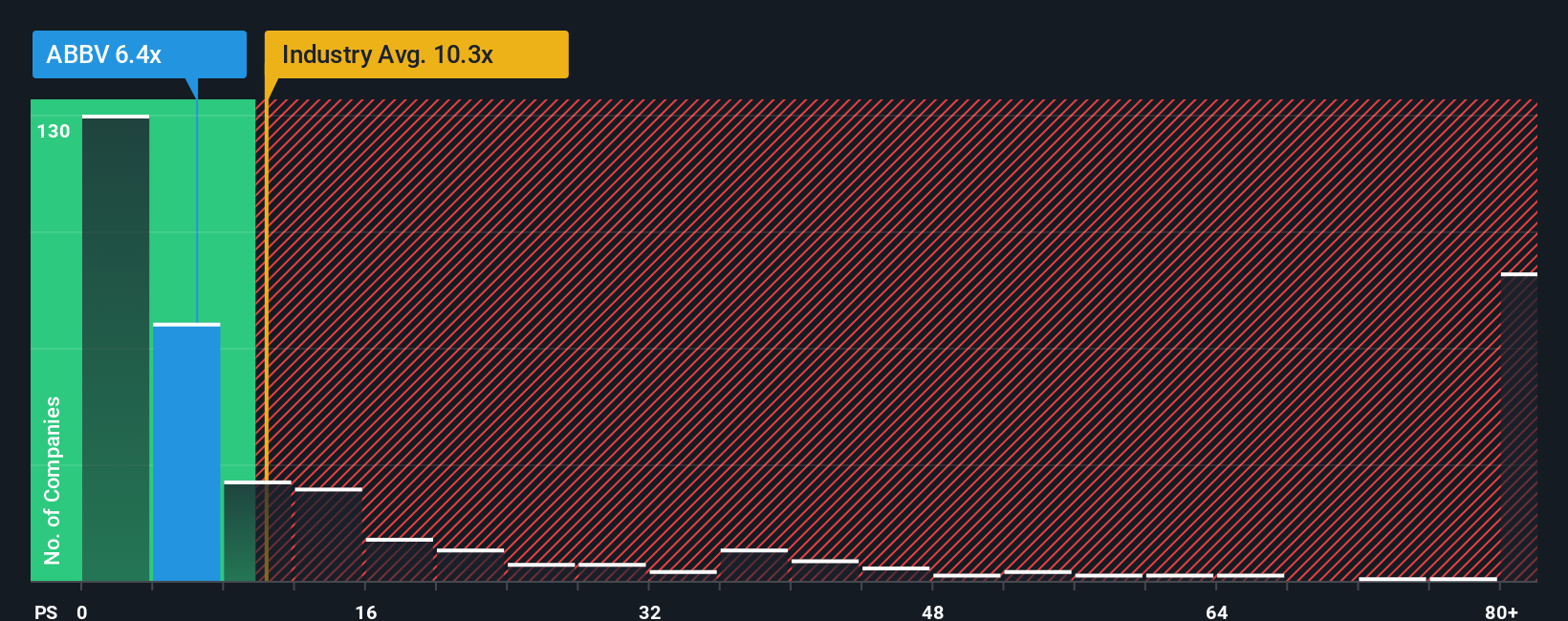

While the narrative view sees AbbVie only modestly undervalued, a closer look at its price to sales ratio tells a sharper story. AbbVie trades at 6.8 times sales, slightly richer than peers at 6.4 times, but below its 11.2 times fair ratio, suggesting potential for the market to re rate the stock if execution holds up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AbbVie Narrative

If you are skeptical of this view or simply prefer your own deep dive, you can build a personalized AbbVie thesis in under three minutes using Do it your way.

A great starting point for your AbbVie research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to explore targeted stock ideas on Simply Wall Street that could help sharpen and diversify your portfolio.

- Capture emerging tech potential by reviewing these 25 AI penny stocks that are reshaping industries with real world artificial intelligence applications.

- Strengthen your income stream by evaluating these 14 dividend stocks with yields > 3% offering yields supported by underlying fundamentals.

- Consider opportunities in these 81 cryptocurrency and blockchain stocks that focus on the infrastructure and services behind digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026