- United States

- /

- Biotech

- /

- NYSE:ABBV

AbbVie (NYSE:ABBV) Partners On siRNA Therapies And Earns Accelerated FDA Approval

Reviewed by Simply Wall St

AbbVie (NYSE:ABBV) has recently announced a significant collaboration with ADARx Pharmaceuticals, aiming to develop innovative siRNA therapeutics, and received accelerated FDA approval for EMRELIS, a treatment for non-small cell lung cancer. Despite these promising developments, AbbVie's stock price remained flat over the past month, contrasting with the broader market, which witnessed notable gains. This apparent stability in the company's share price could be seen both as a reflection of the balance between positive advancements in its pharmaceutical pipeline and broader market dynamics that might have tempered investor reactions.

Outshine the giants: these 29 early-stage AI stocks could fund your retirement.

The recent developments involving AbbVie, including its collaboration with ADARx Pharmaceuticals and FDA approval for EMRELIS, could significantly enhance its revenue potential, especially as the company seeks to expand its portfolio in the promising fields of siRNA therapeutics and lung cancer treatment. As such, these advancements might positively impact AbbVie's projected revenue and earnings, aligning with its strategy to strengthen its pipeline and enter growth markets like obesity and oncology.

Over the past five years, AbbVie's total return, including both share price appreciation and dividends, reached a substantial 138.81%, reflecting a broad period of solid performance. However, in the past year, AbbVie's earnings have experienced a 30.2% decline, contrasting with the US Biotechs industry, which grew by 21.7%. This dynamic illustrates the company's recent challenges in maintaining the growth momentum that characterized its longer-term achievements.

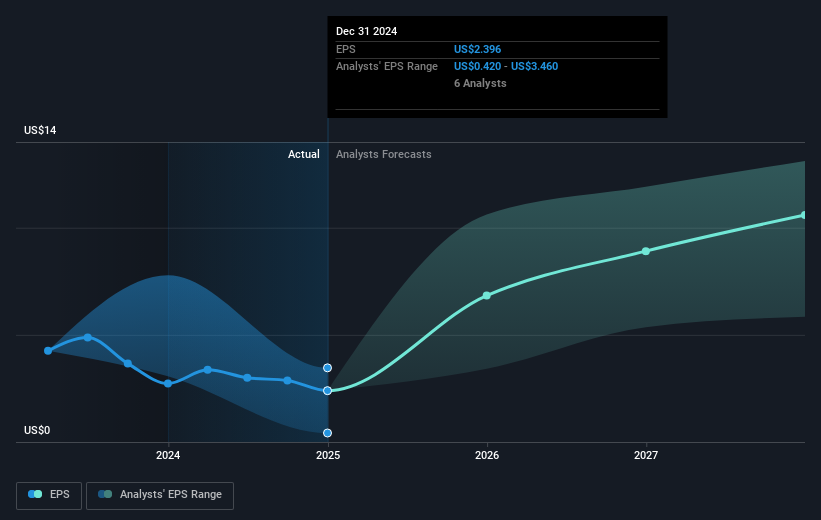

Currently trading at US$187.15, AbbVie's share price is about 11.2% below the consensus price target of US$210.68. With analysts projecting earnings to climb towards US$19.0 billion by 2028, driven by advancements in its drug pipeline and strategic acquisitions, the company's near-term price stability presents a notable context to consider relative to its longer-term valuation prospects. As investors weigh these elements, ongoing biosimilar competition and external economic factors remain critical risks to monitor in shaping AbbVie's future financial trajectory.

Gain insights into AbbVie's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives