- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (NYSE:A) Updates 2025 Guidance and Reports Q1 Sales of US$1,681 Million

Reviewed by Simply Wall St

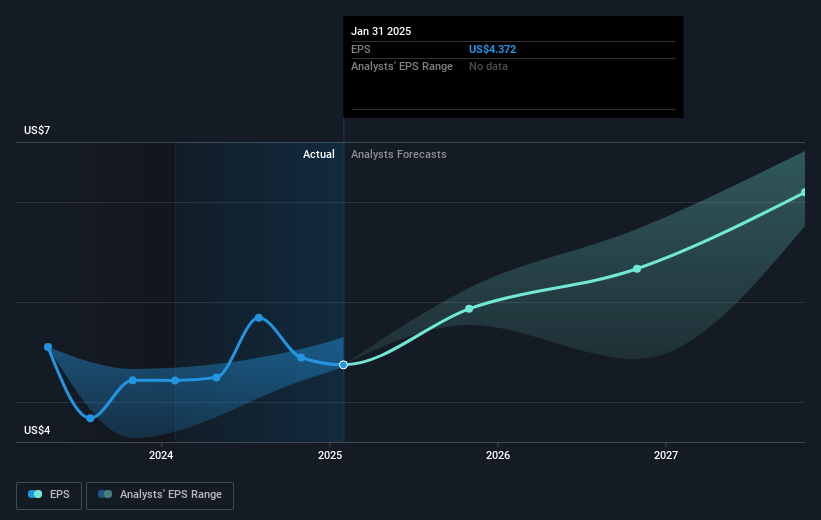

Agilent Technologies (NYSE:A) recently announced Q1 2025 earnings, showing sales growth to $1,681 million from $1,658 million the previous year, alongside a decline in net income and EPS. The company released its revenue outlook for Q2 and the full year, with growth projections between 2.4% and 4.9%. Despite these mixed signals, Agilent's share price dropped 1.95% over the last week amidst overall market turbulence. Broad market concerns, particularly regarding tariff developments announced by President Trump and economic health indicators, contributed to a mixed trading environment. The technology sector faced additional pressures as Nvidia shares declined post-earnings, affecting tech stocks broadly. Concurrently, the U.S. stock indexes displayed volatility, with the S&P 500 down 0.1% and major semiconductor stocks experiencing declines. These factors likely influenced Agilent's recent price movement within the context of a 3.6% decrease in the broader market over the same period.

See the full analysis report here for a deeper understanding of Agilent Technologies.

Agilent Technologies' total shareholder return over the past five years was a robust 64.96%, reflecting a mix of share price appreciation and dividends. This performance was shaped by several key developments and strategic decisions. The company achieved consistent earnings growth, averaging 11.3% per year, despite some challenges in recent quarters. Agilent also maintained a high Return on Equity at 21.9%, aligning with strong operational efficiency, while managing to trade at a price slightly below its estimated fair value.

Within the last year, Agilent faced a more challenging market environment and underperformed the US market, which returned 16.7%. However, it surpassed the US Life Sciences industry return of 15.6%. Notable business moves included a significant share buyback in late 2024 and the introduction of the new InfinityLab LC Series, enhancing its product line. Additionally, increases in quarterly dividends were part of Agilent’s strategy to deliver value to shareholders, further driving total returns over this period.

- Understand the fair market value of Agilent Technologies with insights from our valuation analysis—click here to learn more.

- Uncover the uncertainties that could impact Agilent Technologies' future growth—read our risk evaluation here.

- Is Agilent Technologies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives