- United States

- /

- Biotech

- /

- NasdaqGS:ZYME

Zymeworks (ZYME): Assessing Valuation Following Recent Momentum in Biopharma

Reviewed by Kshitija Bhandaru

See our latest analysis for Zymeworks.

Momentum appears to be building for Zymeworks, with a healthy 30-day share price return of 20.6% and an even stronger 90-day move as buyers look for signs of growth potential in the company’s pipeline. Looking at the broader picture, Zymeworks' 1-year total shareholder return of 38.6% stands out against past volatility and suggests renewed confidence in the story ahead.

If the renewed buzz around Zymeworks has you curious about other innovators in biotech and pharma, take the next step and discover See the full list for free.

With the stock up sharply in recent months, the big question is whether Zymeworks is still trading below its true value or if the latest rally means that all future growth is already reflected in the price. Is this a real buying opportunity, or has the market already priced in what lies ahead?

Most Popular Narrative: 15.7% Undervalued

With Zymeworks closing at $16.90 and the most widely followed narrative assigning fair value at $20.06, the valuation signals further upside potential based on long-term milestones and industry trends.

Zymeworks' strategic partnership and out-licensing approach with large pharmaceutical companies (e.g., Jazz, BeiGene, BMS, J&J) is generating significant near-term and long-term non-dilutive cash inflows. This diversifies revenue streams and reduces the R&D burn rate, supporting better EBITDA margins and enhanced cash flow stability as the partnered assets advance.

Want to know what drives that number? The most popular narrative hinges on powerful financial projections and bold assumptions around future margins, new milestones, and deal momentum. Which key breakthrough supports this surprising upside? Don’t miss the details fueling this bullish valuation.

Result: Fair Value of $20.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trials or delayed milestone payments could quickly shift sentiment, which may undercut current projections and impact Zymeworks' valuation outlook.

Find out about the key risks to this Zymeworks narrative.

Another View: Shares Appear Pricey on Sales Ratio

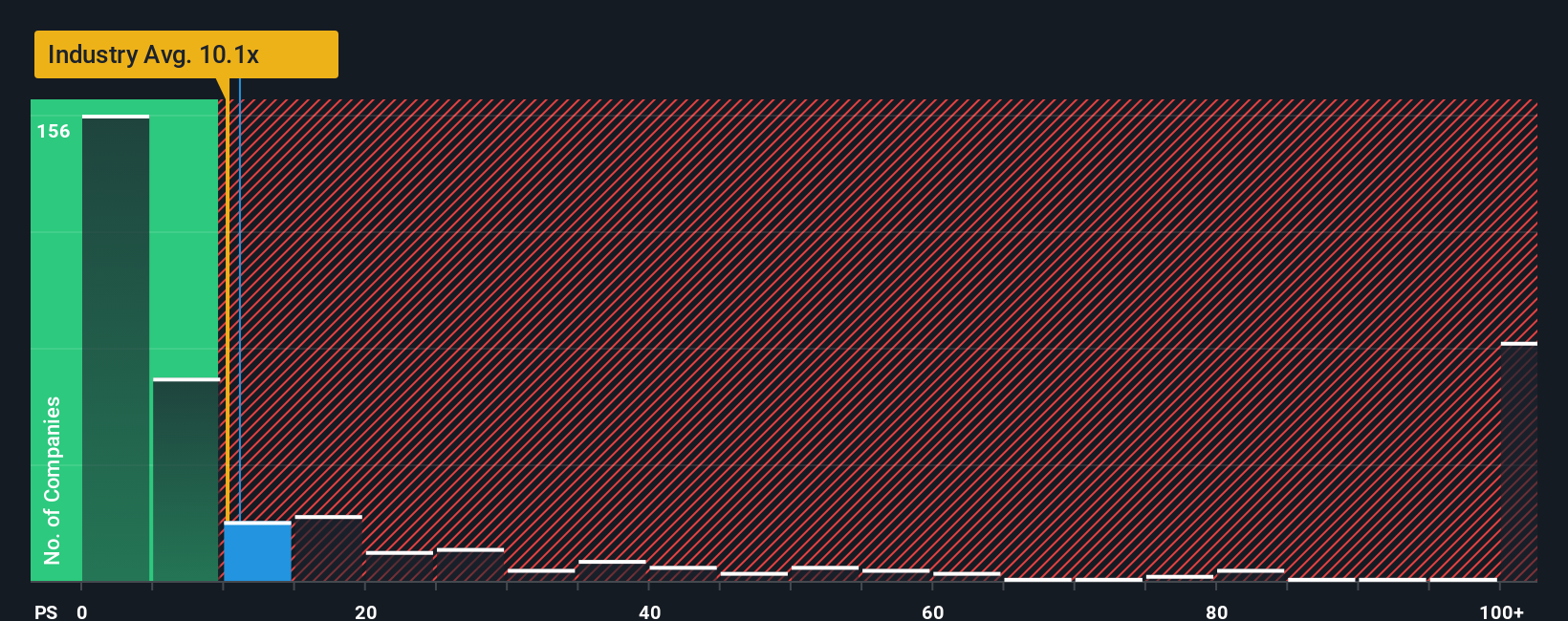

While fair value estimates suggest Zymeworks is trading below its true worth, looking at price-to-sales paints a less optimistic picture. Zymeworks trades at 10.3 times sales, which is more expensive than both its peer average of 7 times and the US Biotechs industry average of 9.7. The market could, over time, move closer to its fair ratio of 1.2 times sales. Does this premium really reflect genuine long-term prospects, or could it leave investors exposed if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zymeworks Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own outlook in just a few minutes. Do it your way

A great starting point for your Zymeworks research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why limit your opportunities? Get ahead of market moves and position yourself for tomorrow's winners by checking out other stock ideas you can act on now.

- Uncover hidden bargains by checking out these 909 undervalued stocks based on cash flows. These stocks are trading below their intrinsic worth, giving you the inside track on value investing.

- Pursue cutting-edge breakthroughs by accessing these 26 quantum computing stocks. Here, companies are at the forefront of quantum technology and reshaping tomorrow’s industries.

- Boost your portfolio’s income potential with these 19 dividend stocks with yields > 3%. This list features stocks with yields above 3% for consistent returns backed by financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zymeworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZYME

Zymeworks

A clinical-stage biotechnology company, discovers, develops, and commercializes biotherapeutics for the treatment of cancer, and autoimmune and inflammatory diseases (AIID).

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives