- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

This Just In: Analysts Are Boosting Their Zevra Therapeutics, Inc. (NASDAQ:ZVRA) Outlook for This Year

Zevra Therapeutics, Inc. (NASDAQ:ZVRA) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals.

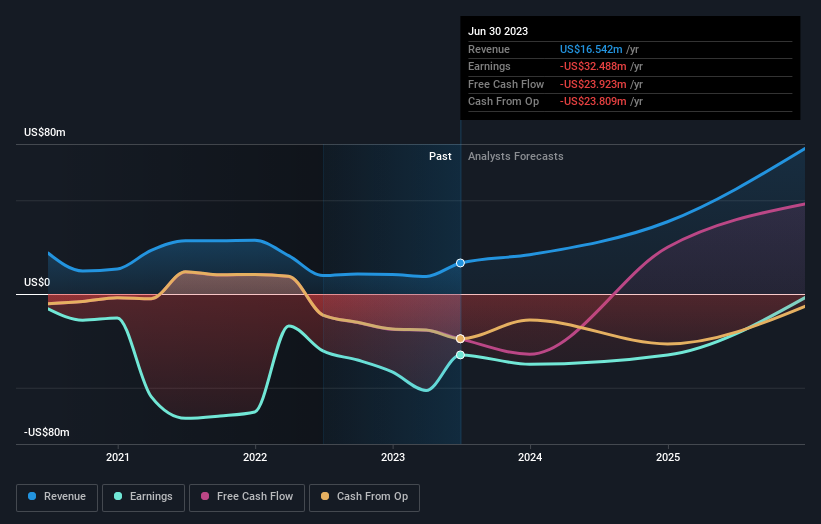

After the upgrade, the four analysts covering Zevra Therapeutics are now predicting revenues of US$21m in 2023. If met, this would reflect a major 27% improvement in sales compared to the last 12 months. Per-share losses are expected to see a sharp uptick, reaching US$1.06. However, before this estimates update, the consensus had been expecting revenues of US$17m and US$1.26 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for Zevra Therapeutics

There was no major change to the consensus price target of US$18.75, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Zevra Therapeutics' rate of growth is expected to accelerate meaningfully, with the forecast 61% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 26% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.4% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Zevra Therapeutics is expected to grow much faster than its industry.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for this year, reflecting increased optimism around Zevra Therapeutics' prospects. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. The lack of change in the price target is puzzling, but with a serious upgrade to this year's earnings expectations, it might be time to take another look at Zevra Therapeutics.

Better yet, Zevra Therapeutics is expected to break-even soon - within the next few years - according to analyst forecasts, which would be a momentous event for shareholders. For more information, you can click through to our free platform to learn more about these forecasts.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives