- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

Does Zevra Therapeutics’ (ZVRA) Board Turnover Subtly Recast Its Leadership and Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- In early December 2025, Zevra Therapeutics announced that industry veteran Alicia Secor joined its Board of Directors, replacing retiring director Wendy Dixon, PhD, while the company also prepared for the year-end departure of long-serving CFO and Treasurer R. LaDuane Clifton.

- Secor’s appointment to both the Audit and Compensation Committees brings deep rare-disease and commercial leadership experience at a time when Zevra is managing board turnover and an upcoming chief financial officer transition.

- We’ll now examine how Secor’s addition to the board, alongside the pending CFO departure, could influence Zevra’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Zevra Therapeutics Investment Narrative Recap

To own Zevra today, you have to believe its rare‑disease portfolio, led by MIPLYFFA and supported by OLPRUVA and pipeline assets, can offset product concentration and commercialization risks. The board refresh with Alicia Secor and the coming CFO change do not appear to materially alter the near term focus on MIPLYFFA execution and European reimbursement progress, but they do add another layer of governance and leadership transition risk to monitor.

The most relevant recent development alongside these board changes is the planned year end departure of long serving CFO and Treasurer R. LaDuane Clifton, who has been central to Zevra’s shift into a commercial stage rare disease company. With a search for his successor underway, investors may watch how financial leadership continuity supports funding decisions, commercial investment behind MIPLYFFA, and the pacing of Europe focused initiatives that underpin key revenue catalysts.

Yet investors should also be aware that heavy reliance on a single ultra orphan asset like MIPLYFFA means...

Read the full narrative on Zevra Therapeutics (it's free!)

Zevra Therapeutics' narrative projects $296.5 million revenue and $151.4 million earnings by 2028.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 184% upside to its current price.

Exploring Other Perspectives

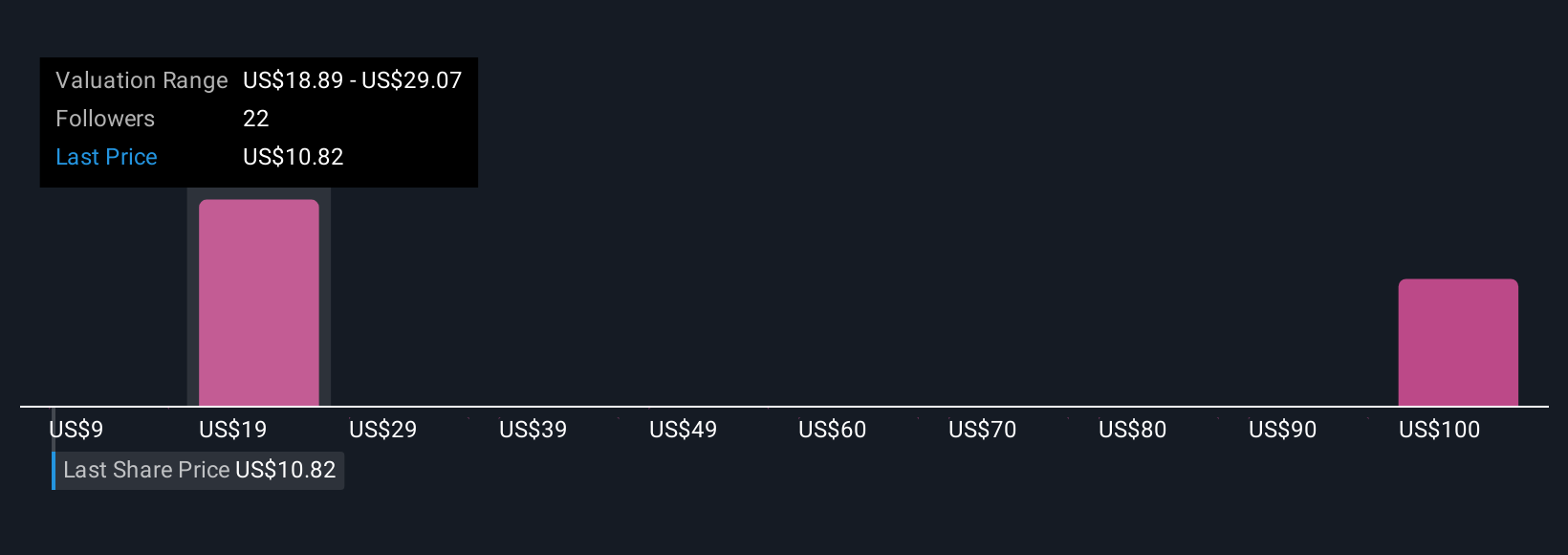

Ten members of the Simply Wall St Community see Zevra’s fair value anywhere between US$18 and about US$104 per share, underlining very different expectations. Set against this spread, the concentration risk in MIPLYFFA and the slow OLPRUVA uptake may help explain why opinions on the company’s longer term performance diverge so sharply.

Explore 10 other fair value estimates on Zevra Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026