- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Zai Lab (NasdaqGM:ZLAB): Does Slower Growth Justify Its Current Valuation Multiples Compared to Biotech Peers?

Reviewed by Kshitija Bhandaru

Recent analysis shows that Zai Lab (NasdaqGM:ZLAB) is projected to grow revenue more slowly than the overall biotech sector in the coming years. However, its valuation still aligns closely with industry averages.

See our latest analysis for Zai Lab.

Zai Lab’s share price has delivered a 35.8% return year-to-date, while the 1-year total shareholder return stands at 36.7%, a solid rebound that suggests momentum is building again after a challenging stretch. Investors appear to be weighing the company’s growth potential and industry position alongside recent fundamentals and valuation shifts.

If you're searching for your next compelling opportunity, now’s a great time to expand your view and discover fast growing stocks with high insider ownership

This sets up the key question for investors: Is Zai Lab’s current market price a fair reflection of its outlook, or is there still a genuine buying opportunity if future growth has not yet been fully priced in?

Most Popular Narrative: 39.2% Undervalued

Zai Lab’s most closely watched narrative calculates a fair value that is significantly higher than the last close price of $33.69. This puts the current price at a steep discount by narrative standards. The gap between these values reflects optimism about future revenue and earnings, as well as confidence that upcoming catalysts have not yet been fully priced in by the market.

Multiple high-potential product launches and label expansions over the next 12-18 months (including VYVGART, bemarituzumab, KarXT, TIVDAK, Tumor Treating Fields), combined with a deep pipeline in oncology and immunology, are expected to significantly increase Zai Lab's addressable market and diversify revenue streams. This supports both top-line growth and future earnings.

Curious why this narrative sets such a bold fair value? Hint: It’s about blockbuster growth, profit turnaround, and a future profit multiple rarely seen outside of high-flyers. Want to see the assumptions driving that jaw-dropping estimate? Find out what makes Zai Lab stand out.

Result: Fair Value of $55.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as fierce competition in oncology and unpredictable regulatory delays in China could still affect Zai Lab's future trajectory.

Find out about the key risks to this Zai Lab narrative.

Another View: Could Multiples Tell a Different Story?

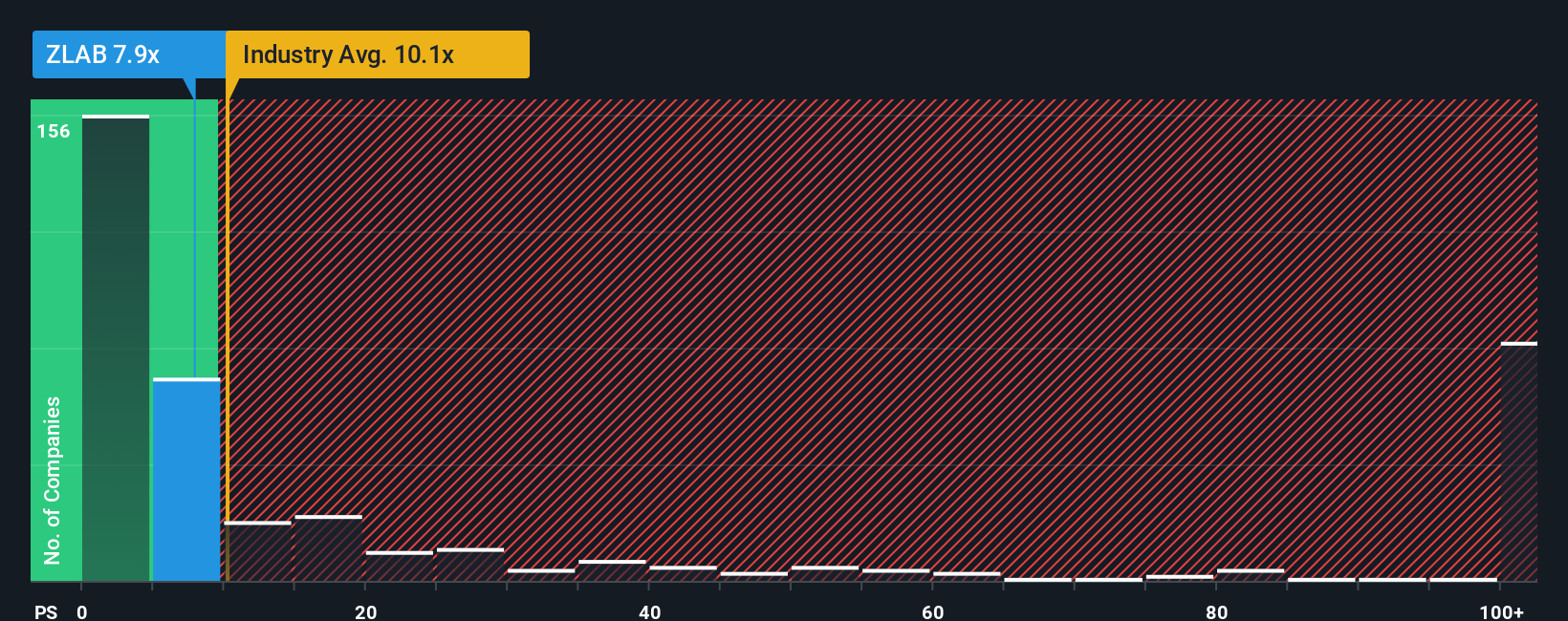

While the SWS DCF model sees Zai Lab trading at a steep discount to its estimated fair value, the price-to-sales ratio paints a more cautious picture. Zai Lab’s ratio is 8.8x, which is well above the fair ratio of 4.5x and higher than its peer average of 4.7x, but still below the US Biotechs industry average of 10.2x. This gap might signal that the market has already priced in considerable future optimism, leaving less room for error if high growth expectations change. Which side of the debate do you lean toward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zai Lab Narrative

If you have a different perspective or want to dig into the numbers yourself, it's easy to build your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Zai Lab.

Looking for More Investment Ideas?

Don’t wait and risk missing the next breakout. The best investors always keep their options open, so make your next smart move now.

- Tap into real yield potential by checking out these 19 dividend stocks with yields > 3%, which offers reliable returns with yields above 3%.

- Ride the AI innovation wave and seize emerging opportunities by starting with these 25 AI penny stocks, which are shaping tomorrow’s technology landscape.

- Get ahead of the crowd by uncovering hidden gems trading below their true worth inside these 892 undervalued stocks based on cash flows, based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives