- United States

- /

- Biotech

- /

- NasdaqGM:ZLAB

Shareholders May Not Be So Generous With Zai Lab Limited's (NASDAQ:ZLAB) CEO Compensation And Here's Why

Key Insights

- Zai Lab will host its Annual General Meeting on 18th of June

- Salary of US$868.5k is part of CEO Samantha Du's total remuneration

- The overall pay is 68% above the industry average

- Zai Lab's EPS grew by 23% over the past three years while total shareholder loss over the past three years was 88%

In the past three years, the share price of Zai Lab Limited (NASDAQ:ZLAB) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 18th of June could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Zai Lab

Comparing Zai Lab Limited's CEO Compensation With The Industry

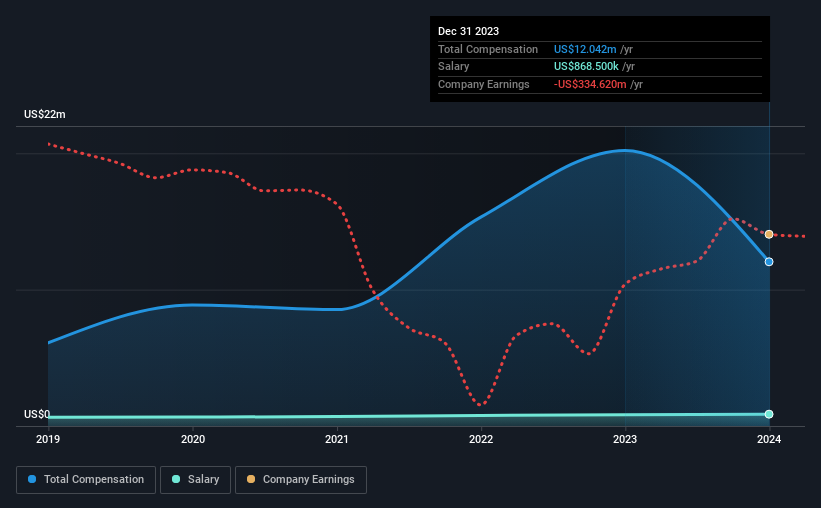

At the time of writing, our data shows that Zai Lab Limited has a market capitalization of US$2.0b, and reported total annual CEO compensation of US$12m for the year to December 2023. We note that's a decrease of 40% compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$869k.

On comparing similar companies from the American Biotechs industry with market caps ranging from US$1.0b to US$3.2b, we found that the median CEO total compensation was US$7.2m. Accordingly, our analysis reveals that Zai Lab Limited pays Samantha Du north of the industry median. Moreover, Samantha Du also holds US$22m worth of Zai Lab stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$869k | US$830k | 7% |

| Other | US$11m | US$19m | 93% |

| Total Compensation | US$12m | US$20m | 100% |

Speaking on an industry level, nearly 23% of total compensation represents salary, while the remainder of 77% is other remuneration. Zai Lab pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Zai Lab Limited's Growth

Over the past three years, Zai Lab Limited has seen its earnings per share (EPS) grow by 23% per year. It achieved revenue growth of 26% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Zai Lab Limited Been A Good Investment?

Few Zai Lab Limited shareholders would feel satisfied with the return of -88% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Zai Lab that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Zai Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ZLAB

Zai Lab

A biopharmaceutical company, focuses on discovering, developing, and commercializing products that address medical conditions in the areas of oncology, immunology, neuroscience, and infectious diseases.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026