- United States

- /

- Biotech

- /

- NasdaqGS:ZBIO

Why Zenas BioPharma (ZBIO) Jumped 17.1% After Announcing $200M Shelf Filing and Major License Talks

Reviewed by Sasha Jovanovic

- On October 8, 2025, Zenas BioPharma, Inc. filed a US$200 million shelf registration covering common stock, preferred stock, warrants, and debt securities, and scheduled a special call to discuss a major license agreement and provide a business strategy update.

- This combination of capital-raising flexibility and plans for a transformational license agreement signals moves aimed at business expansion and increased financial resources.

- We'll explore how the shelf registration, enabling diverse financing options, could influence Zenas BioPharma's investment narrative and forward outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Zenas BioPharma's Investment Narrative?

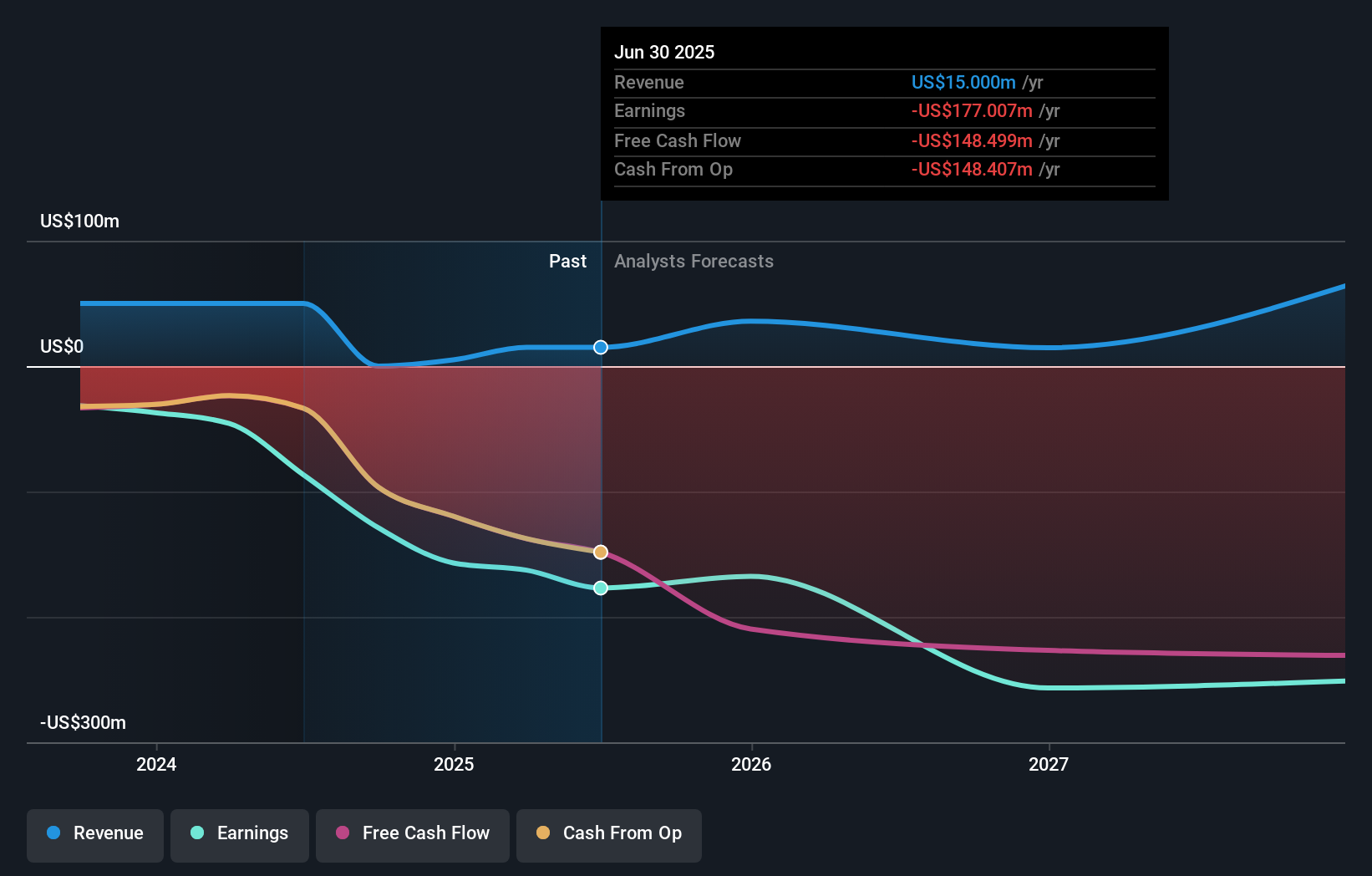

For anyone considering Zenas BioPharma, the big picture for shareholders often centers on faith in the company's ability to turn innovative research and licensing agreements, like the one just teased on October 8, into tangible growth. The recently filed US$200 million shelf registration has real potential to reshape short-term catalysts: it arms Zenas with capital-raising flexibility right as management signals a pivotal licensing deal and outlines an updated strategy. This could address the company’s persistent need for new funding, something highlighted by continued net losses and earlier reliance on external capital like the Royalty Pharma arrangement. At the same time, while anticipated revenue growth remains strong, the biggest risk continues to be profitability: Zenas remains unprofitable, faces volatility, and new leadership still hasn’t weathered a market cycle. The news doesn’t erase these risks, but it could give the company more breathing room to execute its plans if executed thoughtfully.

But, as always, the risk of ongoing losses is something investors should pay close attention to. Insights from our recent valuation report point to the potential overvaluation of Zenas BioPharma shares in the market.Exploring Other Perspectives

Explore another fair value estimate on Zenas BioPharma - why the stock might be worth just $32.43!

Build Your Own Zenas BioPharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zenas BioPharma research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Zenas BioPharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zenas BioPharma's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenas BioPharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBIO

Zenas BioPharma

A clinical-stage biopharmaceutical company, engages in the development and commercialization of transformative immunology-based therapies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives