- United States

- /

- Biotech

- /

- NasdaqGM:XGN

Exagen Inc.'s (NASDAQ:XGN) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

Despite an already strong run, Exagen Inc. (NASDAQ:XGN) shares have been powering on, with a gain of 26% in the last thirty days. The annual gain comes to 269% following the latest surge, making investors sit up and take notice.

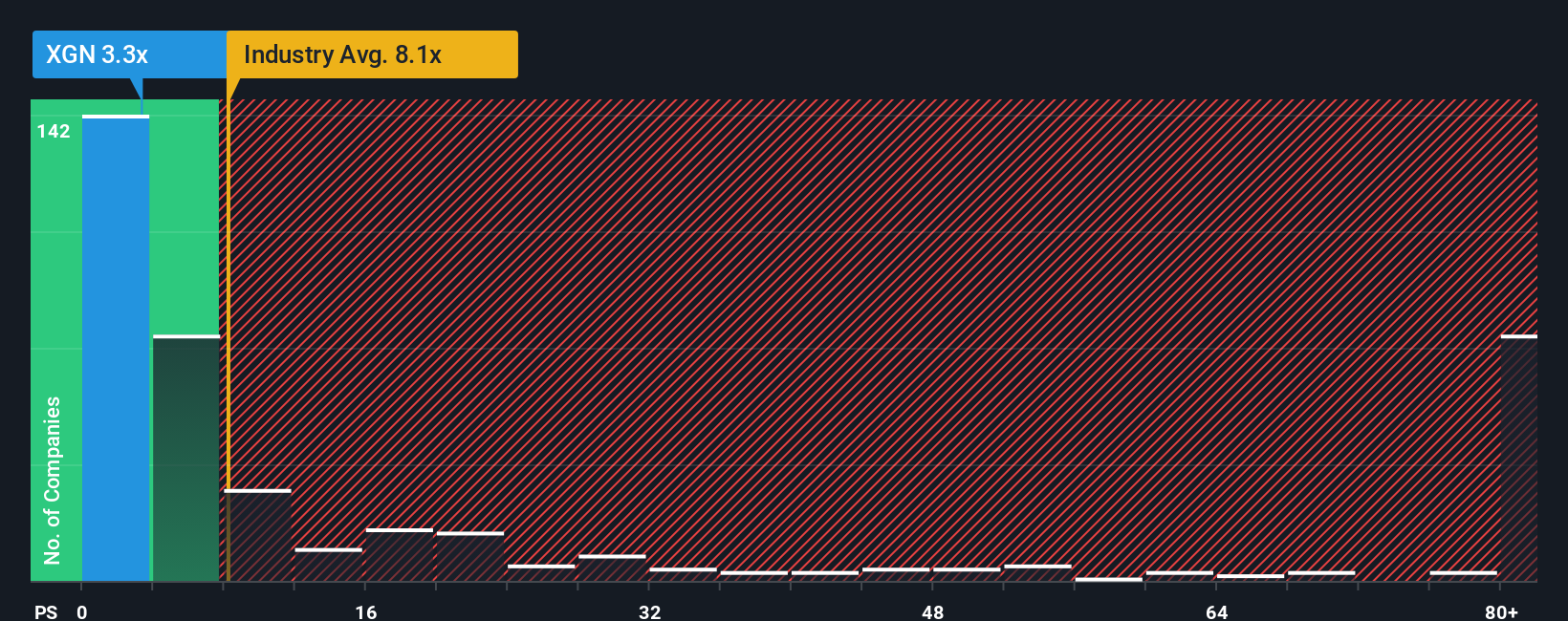

Even after such a large jump in price, Exagen may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 8.1x and even P/S higher than 56x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Exagen

What Does Exagen's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Exagen has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Exagen's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Exagen's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. This was backed up an excellent period prior to see revenue up by 37% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 90% per year, which is noticeably more attractive.

With this information, we can see why Exagen is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Exagen's P/S?

Shares in Exagen have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Exagen maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Exagen you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Exagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:XGN

Exagen

Designs, develops, and commercializes various testing products under the AVISE brand in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.