- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Xeris Biopharma's Path Toward Profitability Might Change The Case For Investing In XERS

Reviewed by Sasha Jovanovic

- In recent weeks, Xeris Biopharma Holdings reached a new 52-week high as it maintained a consistent record of outperforming earnings expectations and received further upward earnings estimate revisions from analysts.

- Analyst sentiment has grown more optimistic as the company moves closer to breakeven, with forecasts pointing toward a final annual loss in 2025 before achieving profitability in 2026, despite current concerns regarding negative equity on the balance sheet.

- We'll examine how growing confidence in Xeris Biopharma's path to breakeven could impact its long-term investment narrative and risk profile.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Xeris Biopharma Holdings Investment Narrative Recap

To invest in Xeris Biopharma Holdings, investors must have conviction in the company's ability to sustain growth momentum from its core products while executing on its path toward breakeven. While the latest 52-week high and optimism around earnings suggest strengthening prospects, these developments do not materially diminish the biggest near-term risk: Xeris's concentrated portfolio increases vulnerability to any disruption or competitive threat affecting Recorlev, Gvoke, or Keveyis.

The raised 2025 revenue guidance in August stands out as especially relevant, reinforcing the view that growing demand for existing therapies is supporting the company's transition toward profitability. This development also aligns closely with analyst catalysts such as broader commercial uptake and expanding market share, both crucial as Xeris pushes to offset ongoing expenses and edge closer to its breakeven milestone.

Yet, in contrast to the upbeat earnings momentum, investors should be aware that a high reliance on just a few marketed treatments means a single setback could...

Read the full narrative on Xeris Biopharma Holdings (it's free!)

Xeris Biopharma Holdings' narrative projects $440.9 million revenue and $84.8 million earnings by 2028. This requires 21.5% yearly revenue growth and a $116.8 million increase in earnings from -$32.0 million currently.

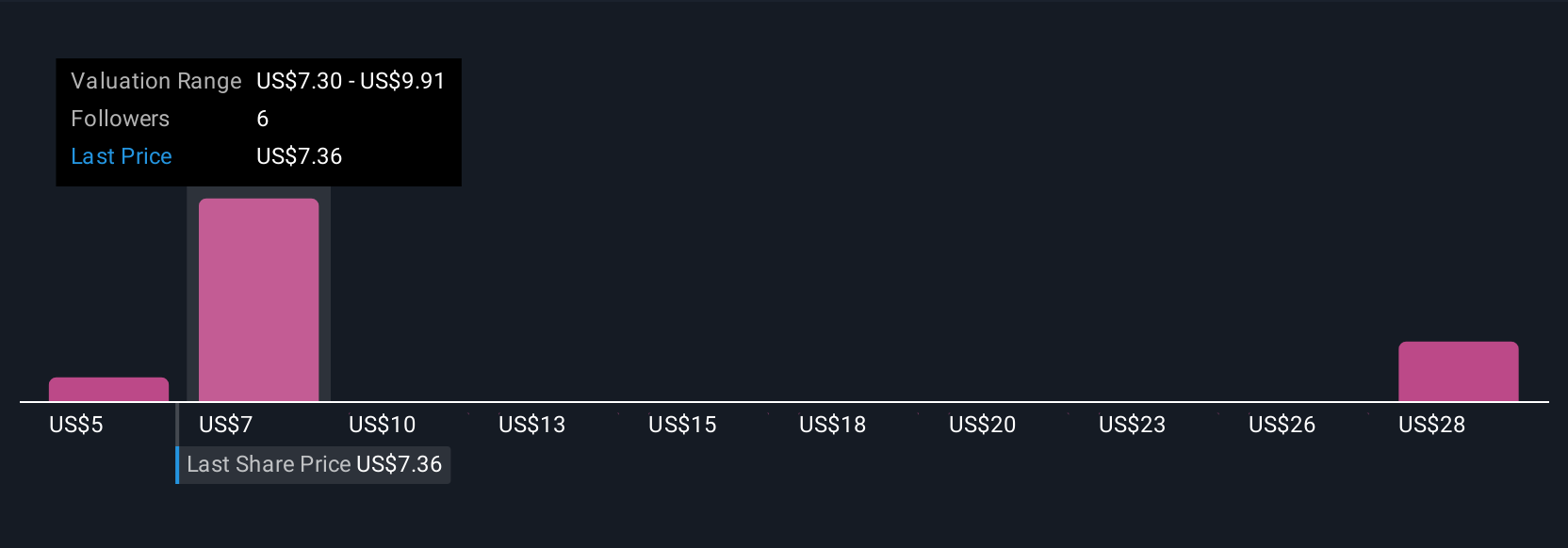

Uncover how Xeris Biopharma Holdings' forecasts yield a $9.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Four private investors in the Simply Wall St Community estimate Xeris’s fair value anywhere from US$4.69 to US$30.79 per share. While the range is wide, ongoing high reliance on Recorlev, Gvoke, and Keveyis remains a key focus and could shape the long-term outlook discussed by many participants.

Explore 4 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

No Opportunity In Xeris Biopharma Holdings?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives