- United States

- /

- Pharma

- /

- NasdaqGS:XERS

Why Xeris Biopharma Holdings (XERS) Is Up 12.3% After Raising 2025 Revenue Guidance and Narrowing Losses

Reviewed by Simply Wall St

- Earlier this month, Xeris Biopharma Holdings reported second quarter 2025 revenue of US$71.54 million, up from US$48.07 million a year earlier, with net losses narrowing sharply and basic loss per share from continuing operations at US$0.01 versus US$0.10 in the prior period.

- The company also raised its full-year 2025 total revenue guidance to US$280–290 million, reflecting significant management confidence following substantial top-line growth and improved operational performance.

- We'll look at how the upgraded 2025 revenue outlook strengthens Xeris Biopharma's long-term investment case and industry positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Xeris Biopharma Holdings Investment Narrative Recap

To be a shareholder in Xeris Biopharma Holdings right now, you have to believe in the company’s ability to grow its core products, Recorlev, Gvoke, and Keveyis, while managing risks that come from its narrow portfolio and high spending on expansion. This quarter’s double-digit revenue growth and improved loss per share are positive, and raising full-year revenue guidance supports the short-term catalyst of expanding commercial reach. However, it does not eliminate the main risk of heavy reliance on only a few products for growth and profitability.

Among the recent news, the completion of the Phase 2 study for XP-8121, Xeris’s once-weekly hypothyroidism injection, stands out in context. Success with XP-8121 addresses the catalyst of pursuing new revenue streams outside its core franchise, partially balancing concerns about dependency on existing products. But scaling a new therapy still requires significant investment, adding to the company’s cost pressures over time.

But even with these positive indicators, investors should also keep in mind the possibility that if a competitor outpaces Xeris or if any of its lead products loses market momentum, then...

Read the full narrative on Xeris Biopharma Holdings (it's free!)

Xeris Biopharma Holdings' narrative projects $429.4 million revenue and $77.3 million earnings by 2028. This requires 20.4% yearly revenue growth and a $109.3 million increase in earnings from the current $-32.0 million.

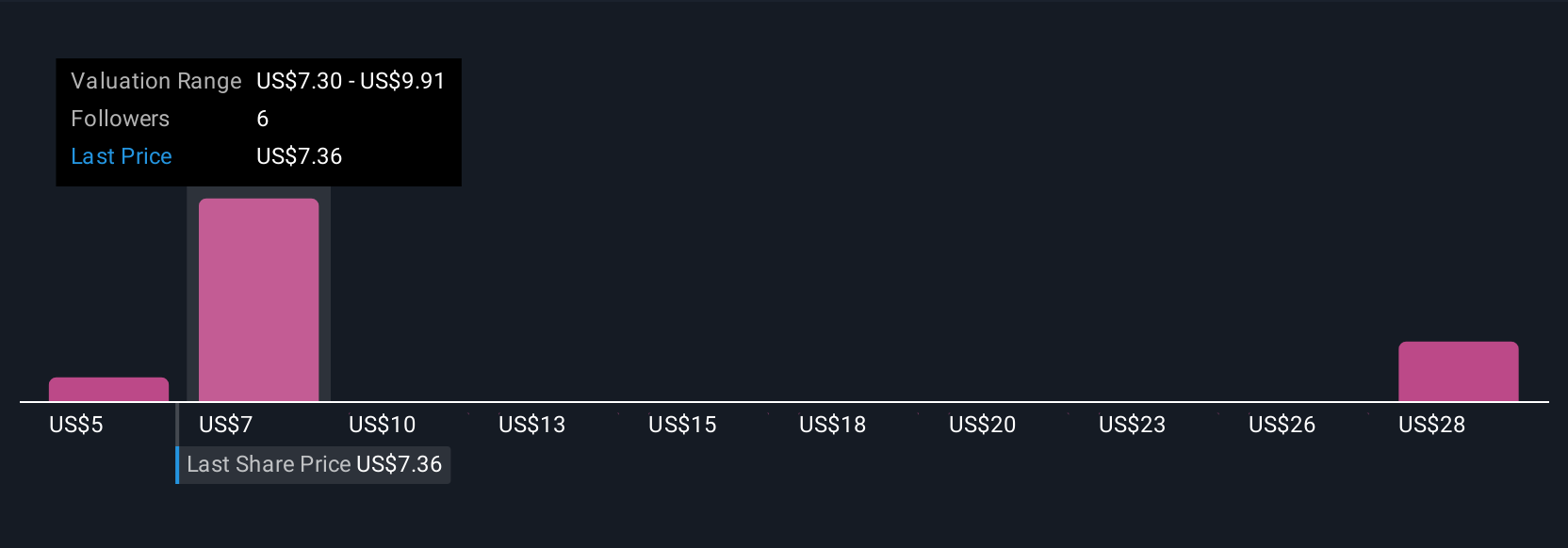

Uncover how Xeris Biopharma Holdings' forecasts yield a $8.17 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Xeris Biopharma range widely from US$4.69 to over US$30.78 per share. Strong recent sales gains may support optimism, but key risks around portfolio concentration remain, explore multiple viewpoints to see what other investors think.

Explore 3 other fair value estimates on Xeris Biopharma Holdings - why the stock might be worth 39% less than the current price!

Build Your Own Xeris Biopharma Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xeris Biopharma Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Xeris Biopharma Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xeris Biopharma Holdings' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XERS

Xeris Biopharma Holdings

A commercial-stage biopharmaceutical company, engages in developing and commercializing therapies for chronic endocrine and neurological diseases in Illinois.

Reasonable growth potential and fair value.

Market Insights

Community Narratives